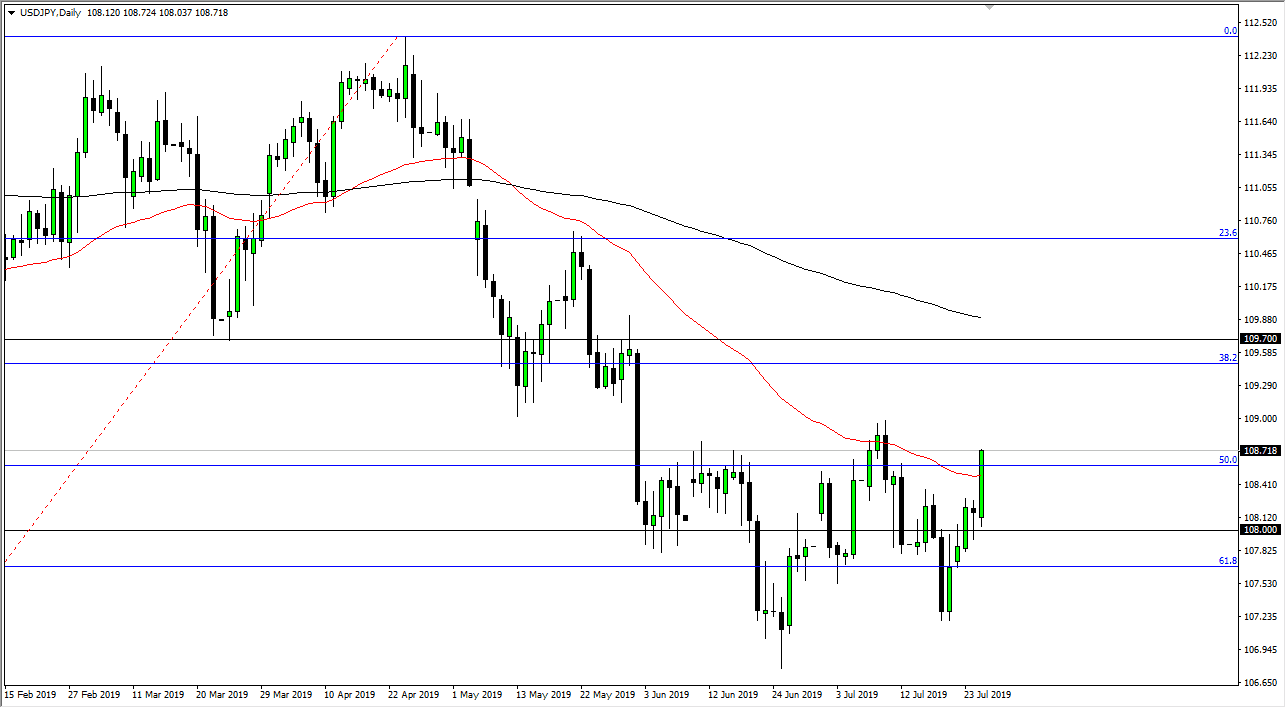

The US dollar has broken to the upside during the trading session on Thursday, clearing the 50 day EMA which of course is a very bullish sign. Quite frankly, this has been a very explosive move and it looks like we are going to try to take out the ¥109 level. That’s an area that of course will cause a certain amount of attention, but if we can break above there it’s likely that the market then goes to the ¥109.70 level next.

To the downside, I suspect that the ¥107 level should continue to be rather supportive. The ¥108 level is of course the middle of the range so therefore it makes for “fair value.” This is a long and strong candle, so ultimately it’s likely that the market should find some follow-through. That being said though, I need to see the market break up above the ¥109 level for at least one hour to be a buyer though because we have seen so much in the way of noise lately. Ultimately, if we were to break higher then we could be looking at the 200 day EMA which is close to the ¥109.70 level.

Short-term pullbacks could be thought of as potential buying opportunities but only for longer-term traders. Quite frankly, this is the wrong time of year for explosive moves, as many large traders are thinking more about holiday than anything else. With that in mind, I suspect that we will probably pull back but quite frankly there is enough here to get me excited about shorting inlets of course I were a short-term scalper.

Looking at this chart, there is still plenty of volatility, so I would also suspect that a lot of trading should be done with smaller positions than usual, as the danger is probably going to increase. Longer-term traders though may be looking to build some type of longer-term shot higher, as the market continues to see a lot of questions out there when it comes to the stock market, Federal Reserve, and of course risk appetite. That being said, if we do break down below the ¥107 level, the market probably goes down to the ¥105 level next which is even more support. Either way, it is going to be very choppy and there isn’t a whole lot you can do about that other than mitigate risk.