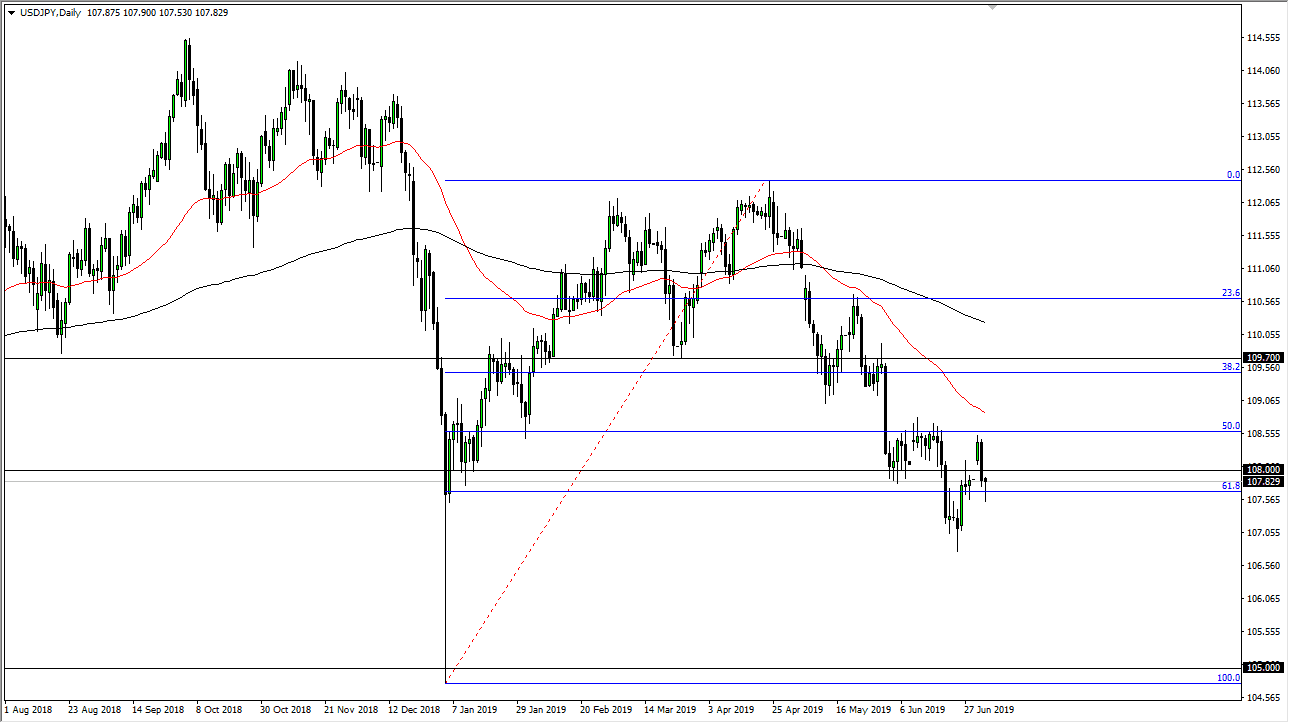

The US dollar initially pulled back a bit against the Japanese yen during the day on Wednesday but then turned around to show signs of life at the ¥107.50 level later in the day. We turned around of form a bit of a hammer as we head into the Independence Day holiday. Ultimately, we have formed a closure of the gap from a couple of days ago. The fact that we have filled the gap and bounced a bit, suggest that perhaps we are getting ready to rally. What’s going to be interesting is that Thursday will be very thin and illiquid, and therefore we could get erratic moves. I think at this point we may be looking ahead to the jobs figure on Friday, so although this analysis is for the thin Thursday session, you could push it forward as well.

Ultimately, the hammer is a sign of extreme support, as sellers are starting to lose money. If we can break above the top of the hammer is very likely that we will go looking towards ¥108.50 level. If we can break above there, then we will try to tackle the 50 day EMA. Breaking above that also allows the market to go to the ¥109.60 level. Ultimately, this would be a reversal of the trouble that we had been in, and this could be in reaction to the S&P 500 finally breaking the 3000 level. A jobs number that is better than anticipated, that could be the reason why we see more of a “risk on” move.

Ultimately though, if we can break down below the hammer from the trading session on Wednesday, it could open up the door to the lows again, near the ¥106.75 level. Ultimately, a breakdown below that level and the hammer that formed in that region would open up the door to wiping out the entire area all the way to the ¥105 level. That would probably follow right along with some type of massive “risk off” move. The market does seem to be trying to form a bottom overall though, so I think it favors a move to the upside, although it won’t necessarily be an easy move to accomplish, and it would be more of a longer-term type of situation. The market has sold off quite drastically and we are hanging about the 61.8% Fibonacci retracement level so there is some precedence to the idea.