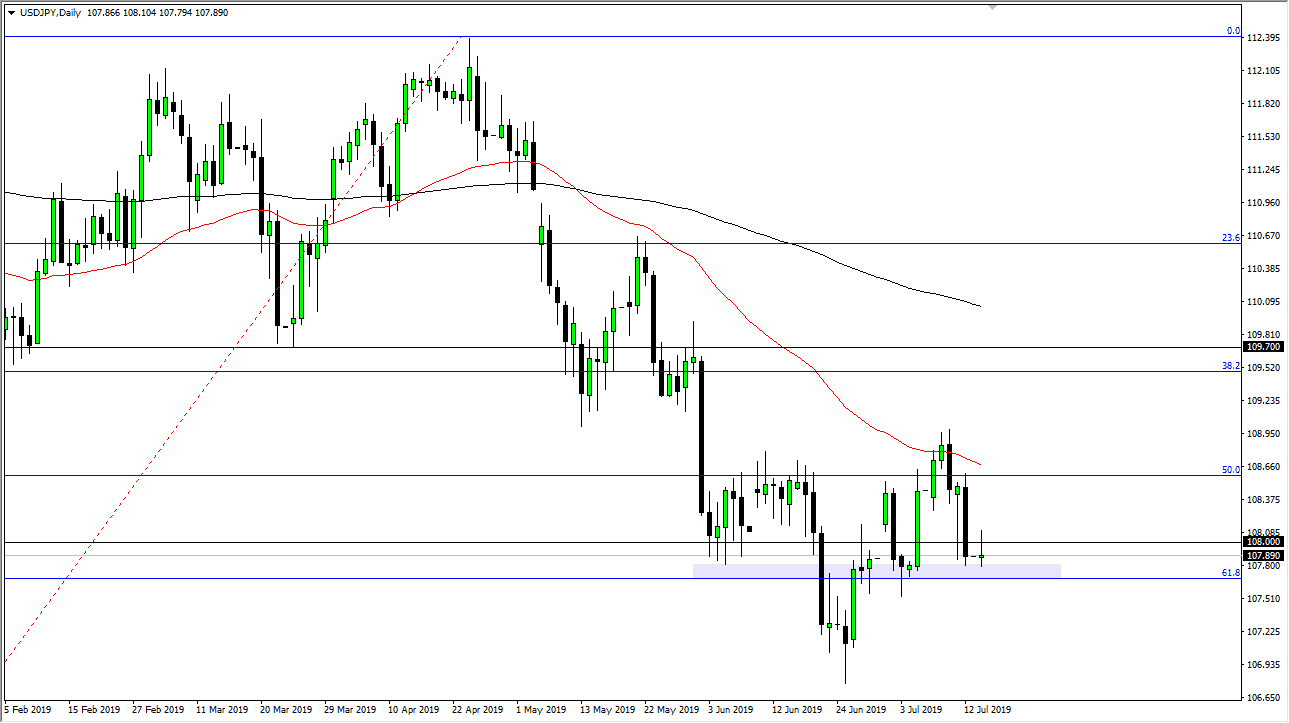

The US dollar has rallied a bit during the Monday session against the Japanese yen but gave back the gains to form a rather lackluster looking candle stick. Because of this, the market looks very likely to continue to struggle in this area, and at this point the 61.8% Fibonacci retracement level underneath should offer an interesting place to observe the market.

The US dollar did manage to break above ¥108 during the day, but as you can see we ended up falling significantly from there. By doing so, it looks as if we may challenge those candlesticks from the last couple of weeks that had formed hammers in this general vicinity. If we were to break down below those hammers, then obviously the US dollar should continue to go much lower against the Japanese yen, at least in the most recent lows near the ¥106.70 level.

At this point, it’s very likely that if we break down below here the market could go down to the ¥105 level as it would wipe out the entire move to the upside. The move would reach towards the 100% Fibonacci retracement level, which typically will happen once the 61.8% level gets crushed to the downside. Having said all of that, the Japanese yen is a safety currency so I find it interesting that we could favor the Japanese yen even though the S&P 500 has been rising and showing signs of longer-term strength. Overall, this is a bit of a divergence from what we are used to seeing so pay attention to this.

All things being equal though, if we were to turn around and break above the top of the candle stick for the trading session on Monday that would be a good sign that we could go reaching towards the 50 day EMA. That means we could be looking at ¥108.50, possibly even higher than that. All things being equal it’s very likely that the market will continue to be very choppy, and of course influenced by risk appetite overall. Keep in mind that the Federal Reserve is looking to cut interest rates and, so that of course is weighing upon the US dollar. That’s not only happening here, but it is also happening against other currencies around the world. However, at this point in time it seems like there’s more confusion than anything else.