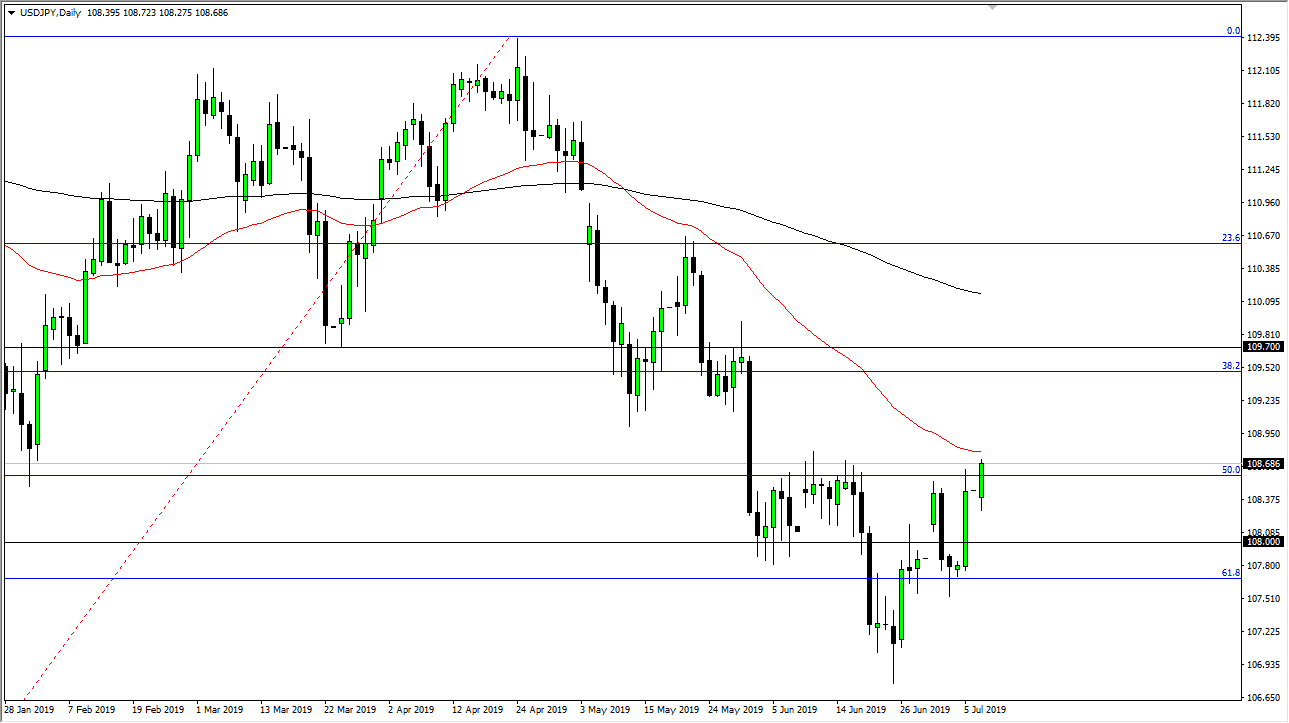

The US dollar initially dropped a bit during the beginning of the week, showing signs of weakness. However, keep in mind that this pair is highly sensitive to risk appetite, and therefore it’s interesting to see that we are pressing the resistance above. The ¥108.75 level seems to be an area that could cause resistance, but the fact that the candlestick is trying to close towards the top of the daily range suggests that we could continue to see this bullish pressure.

Beyond that, the 50 day EMA is just above, flattening out and showing signs of stagnation. However, as the market has broken down significantly and then turned around to rally just as rapidly, showing signs of a potential trend change. If we do get above that 50 day EMA I believe that the market will go looking towards the ¥109.60 level, maybe even higher than that.

The market pulling back from here will more than likely find plenty of buyers though, because even though the market is running into resistance, it has shown a significant amount of resiliency. The fact that we are revisiting this area yet again and showing a tenacity to the upside suggests to me that we will eventually break out to the upside. Even if we do get that pullback, I think that the ¥108 level is rather supportive, just as the 61.8% Fibonacci retracement level. Overall, this is a market that I think is in the midst of trying to change the trend, and that’s always a messy affair. The US dollar rising will be a little counterintuitive to a lot of you as the Federal Reserve is looking to cut interest rates but the reality is that interest rate cuts will fuel more of a “risk on attitude.”

That being said, we will probably see the US dollar fall against most other currencies, but the Japanese yen is a bit of a safety currency, and as a result it makes this pair move differently than many of the others. In a sense, you can measure it against the S&P 500 but this pair doesn’t operate in a vacuum, as there are plenty of other things to pay attention to as well. All things being equal though it does look like the buyers should win out this argument and continue to push this pair much higher. However, if we were to break down below the candle stick from Thursday, that could change things.