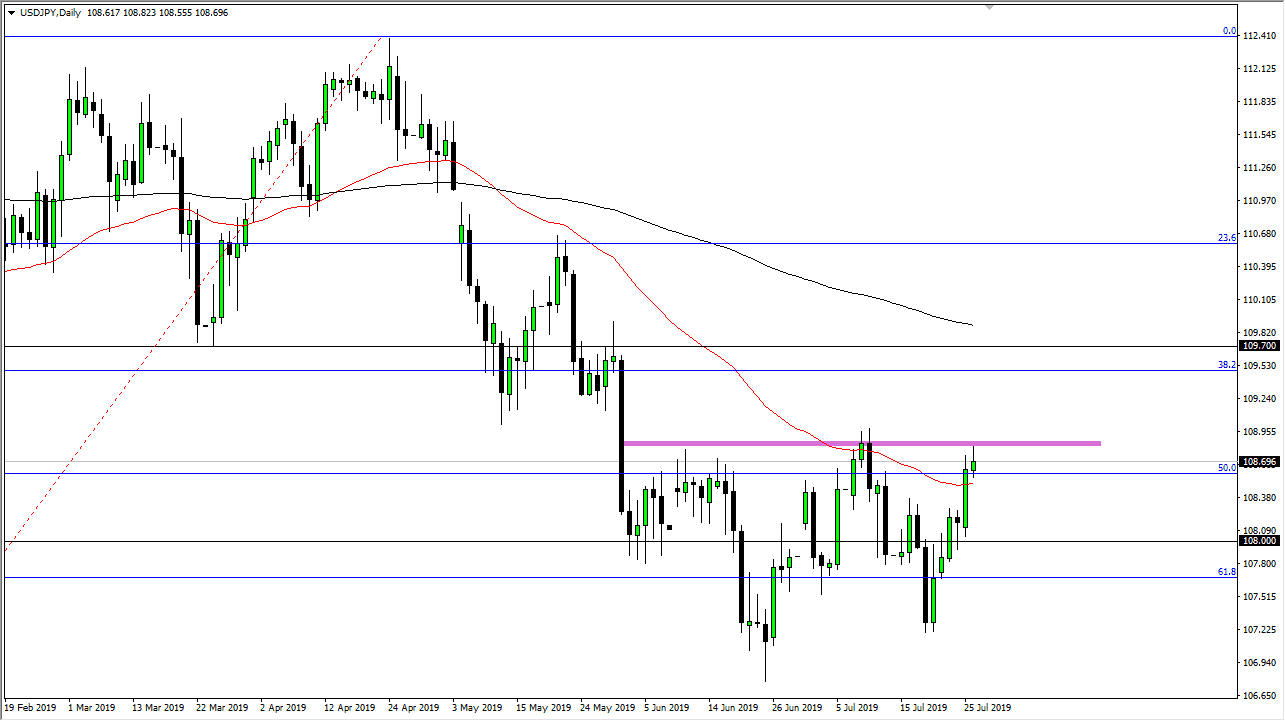

The US dollar has been bullish against the Japanese yen over the last several sessions, and on Friday it was no different. Having said that, the market has reached towards the ¥109 level, that’s an area that of course causes a certain amount of resistance. It’s a large, round, psychologically significant handle, and the scene of the most recent high. At this point, if we were to break above the ¥109 level it would of course be very strong, not only because of the round figure but also because we would be breaking above that most recent high.

Keep in mind that this pair is highly sensitive to the risk appetite around the world, which can be seen around the world and global indices, most specifically the S&P 500. At this point, I do like the idea of buying pullbacks and I do expect one to happen. This is because the markets are probably a bit exhausted in the S&P 500, and we most certainly are running into an area where we could find a bit of trouble here. That being said, expected to be short-term at best as stock markets look ready to go higher based upon the stock market showing positive momentum due to the Federal Reserve looking likely to cut interest rates.

Ultimately, this is a bit counterintuitive, but if the Fed cuts rates, that could be bullish for this market. While it will work against the value of the US dollar against many other currencies, the Japanese yen is a bit different mainly because it is a “safety currency”, which of course will be abandoned if we continue to see bullish attitudes when it comes to risk appetite. That being said, if we get the exact opposite happening, that could send this pair lower. I suspect in the short term we are probably going to see this market pull back towards the ¥180 level before we turn around as we base in general.

The alternate scenario of course is that if we were to break down below the ¥107 level, we would slice through this consolidation area and perhaps go lower. If that happens, we could be targeting the ¥105 level which would be the 100% Fibonacci retracement level. Overall though, I do favor the upside and I think that the 50 day EMA underneath starting to curl higher is a good sign.