The US dollar broke down during the trading session on Thursday against the Japanese yen and what had been massive volatility. Beyond that, we have a situation where the market is trying to figure out what to do next. The US dollar getting hit due to the Federal Reserve cutting interest rates make sense, but what we have also seen is markets running away from the US dollar after the Iranians have offered a significant move in the nuclear talks. There was more or less a “risk on” move in the currency markets, as well as the stock markets. Oddly enough, it did not translate into this pair as it typically does.

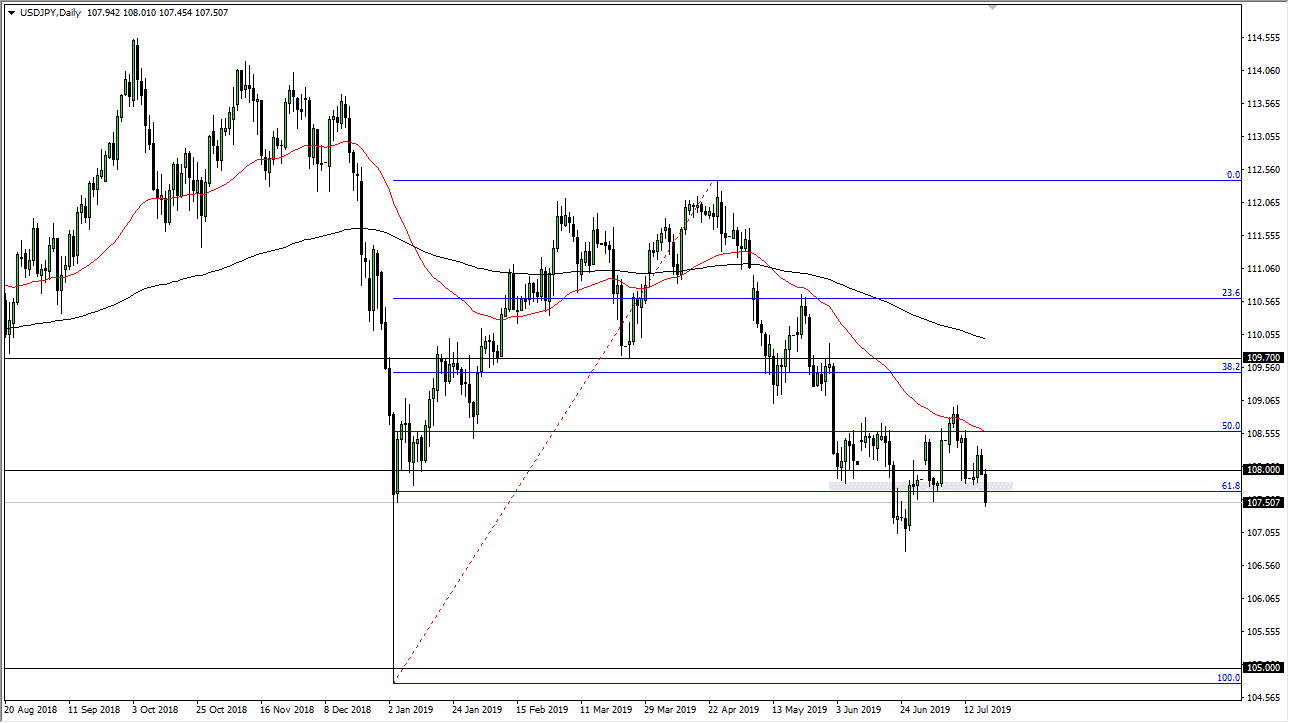

By breaking the way we did to the downside, it looks as if we are going to continue the downtrend, so this is rather peculiar, and all about the US dollar that it is risk appetite at this point. The hammer that extends down to the ¥106.75 region is your last vestiges of support, before we wipe out the overall move, as we are below the 61.8% Fibonacci retracement level again. That could send this market as low as ¥105 given enough time, but obviously that’s a longer-term call.

This market has shown a lot of choppiness and therefore we should be paying attention to that volatility, but with the candle stick that we have formed during the trading session on Thursday, it looks very likely that the market could drop down. Looking at this chart, we are in a downtrend and although it looked like we were going to form some type a bottom. At this point in time, it looks as if the market continues to see a lot of questions, so we need to keep our position size very small if we choose to trade in this market. I think that one of the biggest problems with trying to short this market though is that this is about the US dollar and up the Japanese yen. In other words, if you look in other currency pairs such as the NZD/JPY, they are going higher in a “risk off” move. There might come a time rather quickly and suddenly the people start selling the Japanese yen, even against the US dollar so therefore this is going to continue to be very noisy to say the least. That being said, it certainly looks more bearish than you did just 24 hours ago.