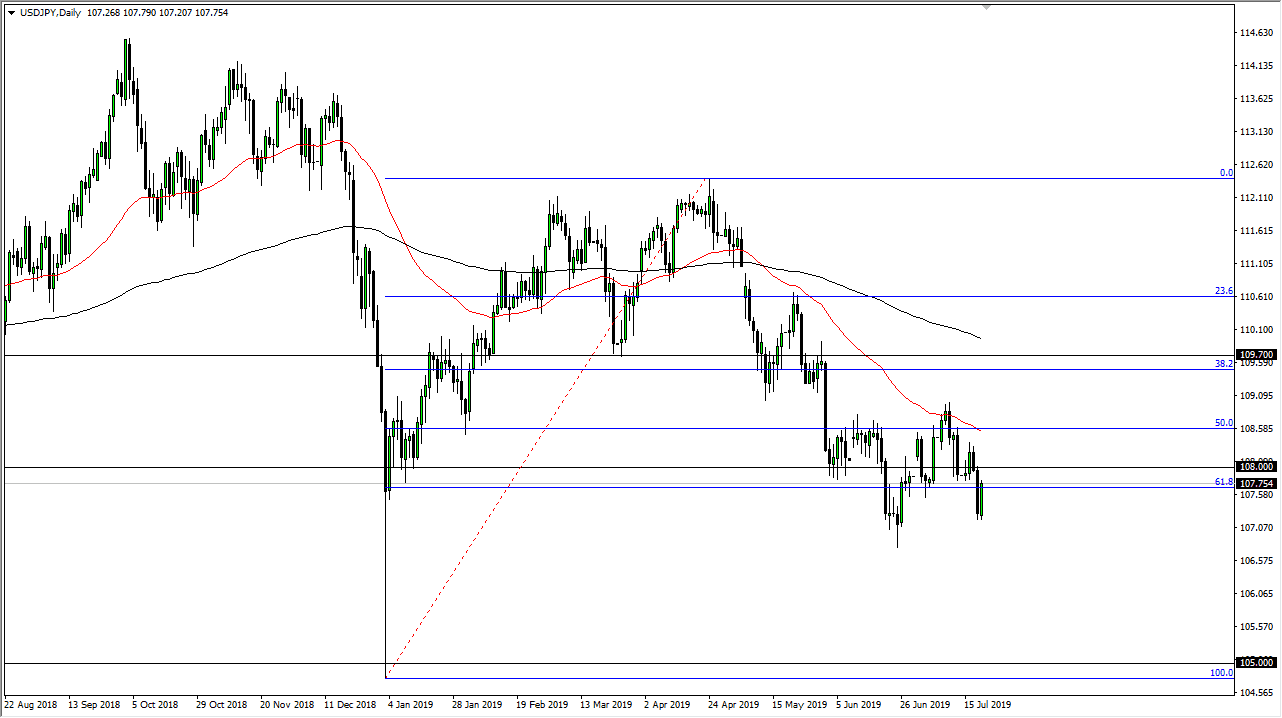

The US dollar bounced a bit during the trading session on Friday to recover against the Japanese yen, showing signs of life again. We had sold off rather drastically during the trading session on Thursday, reaching down towards the ¥107 level before bouncing again. That being the case, it makes sense that the buyers will continue to jump into this area. Overall, this is a market that I think continues to consolidate, based upon the recovery of this market.

If we were to break down below the hammer from a couple of weeks ago, that opens the door to two the bottom, wiping out the entirety of the move and going back to the 100% Fibonacci retracement level. That would be the ¥105 level, but I think it’s going to take something rather drastic to make that happen, at least in the short term. I think we are much more likely to go back and forth, perhaps carving out some type of consolidation range. To the upside, I see the ¥108.70 level as being massive resistance, but I also see the ¥107 level being significant support.

If we can finally break out of this range, then we can simply follow the market overall. In the short term, it does tend to move right along with the risk appetite of the stock markets, but ultimately this is a market that seems to be rather confused, because at this point the Japanese yen is thought of as a safety currency, but it comes down to whether or not we are focusing on the US dollar and the Federal Reserve. In other words, I think you could get a small pop from here, perhaps taking a bit of a small long position, but I wouldn’t put too much into this market at this point. If you wish to short the Japanese yen you can probably do so against more vibrant currency such as the Australian dollar or even the New Zealand dollar. With the Federal Reserve all but assured to cut rates this month, the US dollar might be a bit sluggish against most currencies, and even though it could rally against the Japanese yen it may do so much more slowly than some of the other currencies. After all, it’s about maximizing your trading opportunities, and I just don’t see that here. If you're a range bound trader though, this might be a nice market for you.