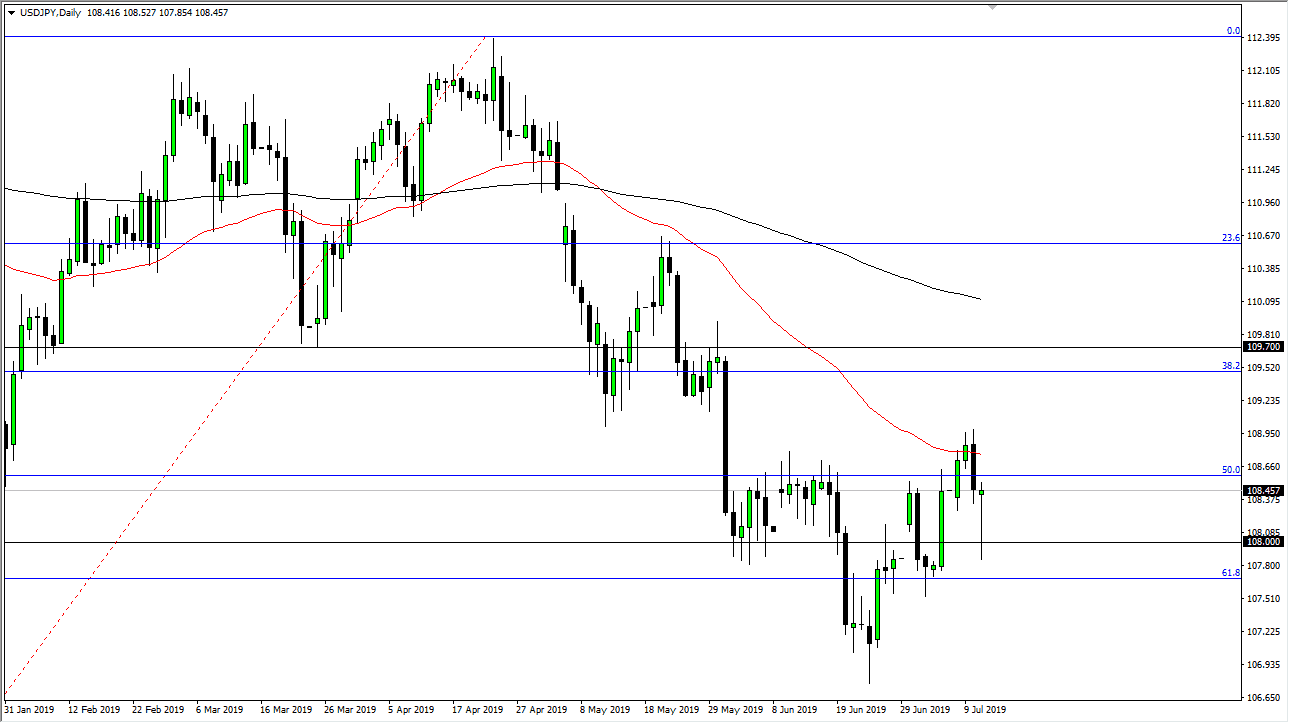

The US dollar initially broke down during the trading session on Thursday but found enough support just below the ¥180 level to turn things around and form a massive hammer. This hammer of course is a good sign for bullish pressure and therefore I think we are going to continue to rally. Keep in mind that this pair is highly sensitive to risk appetite though, so let’s pay attention to the stock markets get a bit of a heads up as to where we are going to go.

Looking at the length of the tail on this candle, it’s obvious that there is a lot of bullish pressure. I think that the market is going to try to break above the 50 day EMA which is drawn in red on the chart. If we can break above the top of the candle stick from the Wednesday session, that could then send this market towards the ¥109.70 level after that. This level of course will be difficult to break above there, but if you can slice through there it’s very likely that we will continue to rally for the longer-term.

I think volatility is going to continue to be an issue but keep in mind that we are also trying to build a bit of a base just above the 61.8% Fibonacci retracement level. That’s an area that attracts a lot of attention as per usual, so by doing so it looks as if the market is trying to turn the overall trend around. That’s always a very busy and noisy affair, so don’t be surprised if it takes a certain amount of effort to do that.

However, a breakdown below that area could send this market much lower, perhaps reaching down towards the ¥106.75 level initially, and then the ¥105 level which would wipe out the entire bullish rally that we had seen previously. Overall though, I do think that we are showing signs of strength and I think that something that should be paid attention to. This will be especially true if the stock markets continue to show bullish pressure, as the correlation between the USD/JPY pair in the S&P 500 is rather well-known. The Japanese yen is the so-called “safety currency”, so because of that we may rise or fall right along with risk appetite. Even though the US dollar is probably going to fall in general, this pair is a bit different because of the Japanese yen.