The US dollar/Japanese yen pair is extraordinarily sensitive to the Federal Reserve and of course interest rate announcement, just as any other major pair will be that features the US dollar, but in this case it has a bit of an inverse relationship at times. For example, one thing that you should pay attention to is that the Federal Reserve cutting interest rates should fuel the stock market higher, and that could very easily send this pair higher as well as this market is highly sensitive to the S&P 500. Low rates and cheap money sent stock markets to the upside.

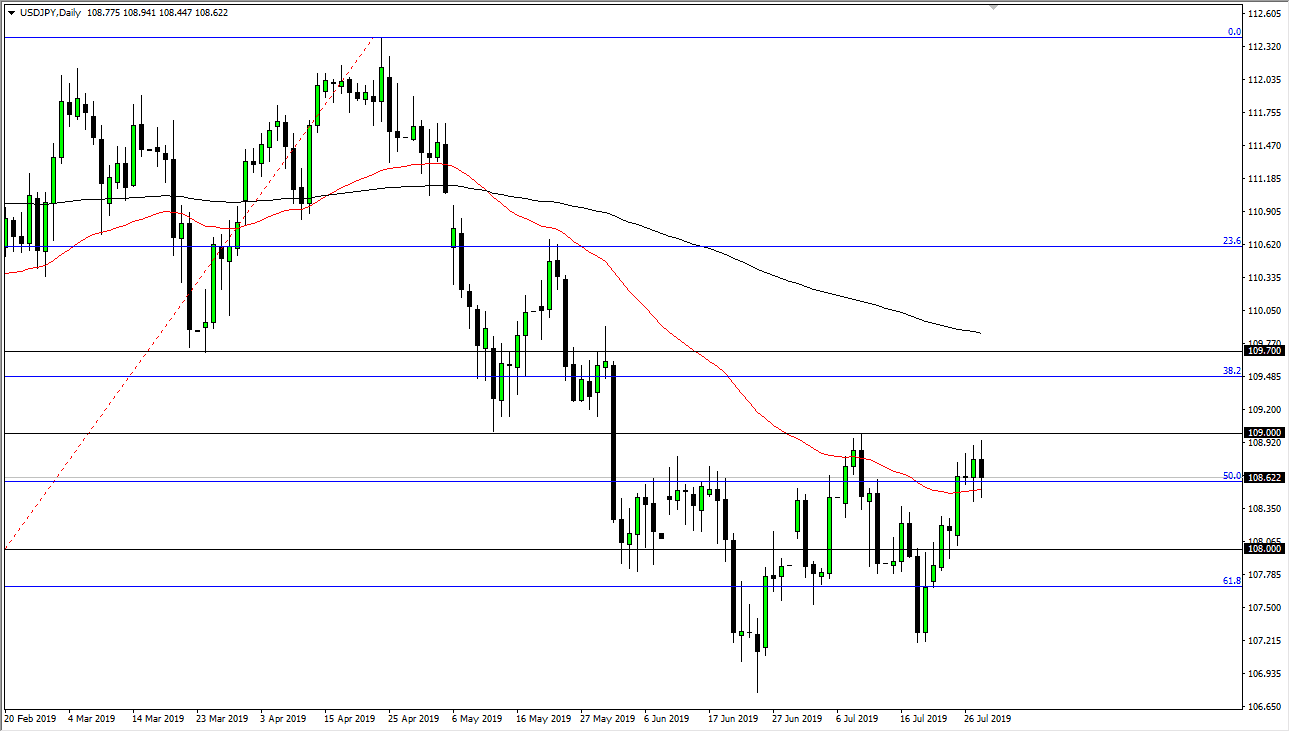

Looking at this chart, I think there is plenty of reason to think that we will eventually break to the upside, mainly because we have been grinding to the upside for some time now anyway and have seen the 50 day EMA offer a bit of support. We have bounced nicely from that moving average, and also seem to be paying attention to the ¥108.50 level, as it has been important as well. To the upside, we have the ¥109 level that has offered a bit of resistance, but if we were to break above there, it allows the market reaching towards the ¥109.70 level above.

Ultimately, if the Federal Reserve does in fact cut rates and suggest that they are going to continue to be extraordinarily dovish, that should send stock markets into a frenzied to the upside, thereby dragging this market higher. The 200 day EMA, which is pictured in black on this chart is currently reaching towards the ¥109.70 level, so if we can break above there it’s a complete trend change from the longer-term traders frame of mind.

All things being equal though, there is the possibility of a shock to the market and if we get that this pair could reach towards the ¥170 level. That level being broken to the downside would be an extraordinarily negative sign, perhaps leading toward a huge selloff as we will then be below the 61.8% Fibonacci retracement level. Once we break down through there, it’s quite common to reach towards the 100% Fibonacci retracement level, which at this point is roughly the ¥105 level. All things being equal, I expect a lot of volatility but I do think that the buyers will jump in and push to the upside, there just waiting for the Federal Reserve given the green light.