The US dollar gapped higher against the Japanese yen to kick off the trading session on Monday, perhaps in reaction to the bullish attitude after the United States and China agreed to at least continue to talk during their meeting in Osaka. It is a bit perplexing considering not much has changed except for perhaps the Americans easing their rhetoric when it comes to Huawei. However, at this point it’s very likely that people will start to look at the situation as being very little change, and that of course could continue to see more of the same that we have seen as of late.

Looking at this pair, you should always keep in mind that the pair tends to follow right along with the S&P 500 and other major stock indices. You can see that we gapped higher from here on Monday, just as we did the S&P 500. However, the S&P 500 has pulled back and it’s very likely that the USD/JPY pair may struggle a little bit going to the upside until that turned back around.

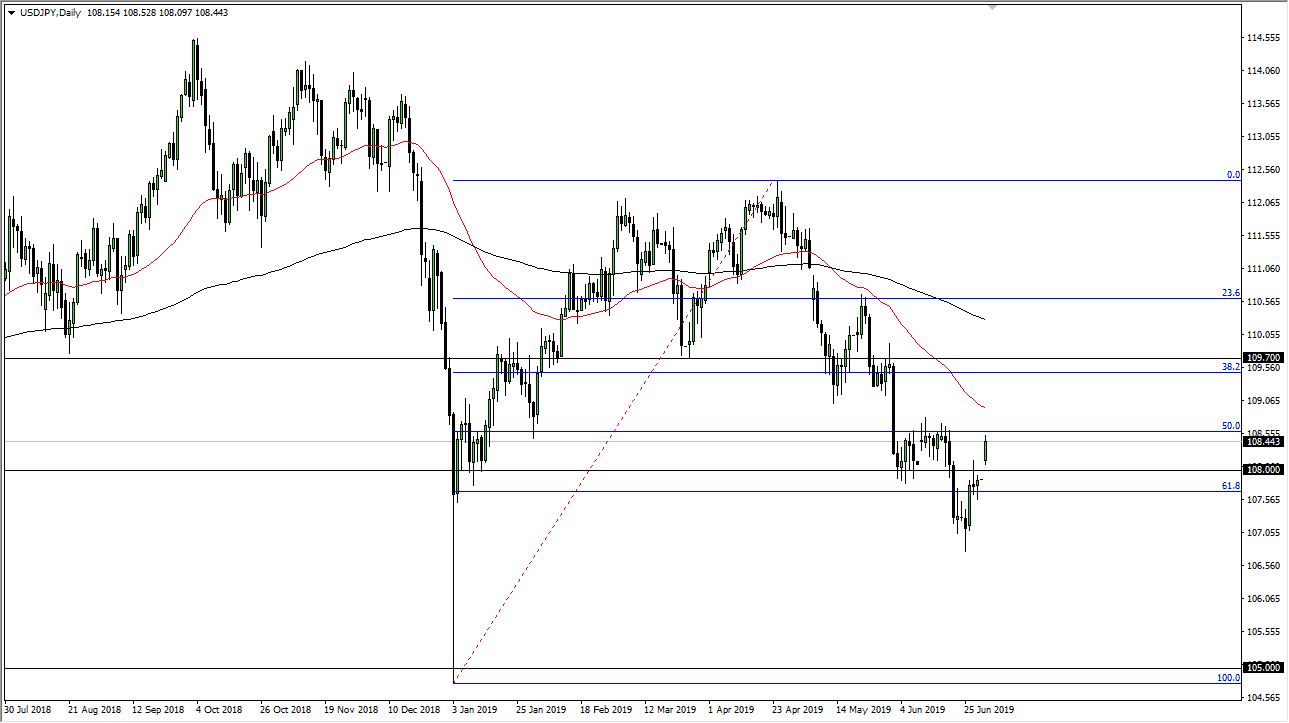

If we were to clear the ¥108.60 level, then I think the market probably builds momentum to go much higher, perhaps looking towards the ¥109.60 level. I do believe this eventually happens, but we may have a couple of pullbacks in the meantime in order to build up the momentum necessary to finally break out. I believe that there is a significant amount of support below, extending all the way down to the bottom of the gap that formed. At this point, the US dollar should continue to be a bit soft in general though, mainly because of the Federal Reserve stepping away from interest rate hikes, and perhaps heading into interest rate cuts. However, the reverse can be true at times as it is a risk barometer, this pair that is.

All things being equal we will have to see whether or not we can break to the upside, as it should send this market another 100 pips higher. On the other hand, if we can break down below the gap underneath, that could open up the door to the ¥107 level. Remember, the Japanese yen is considered to be a bit of a safety currency, even against the US dollar so as long as the markets don’t get too upset, we will eventually see the breakout that the chart is suggesting.