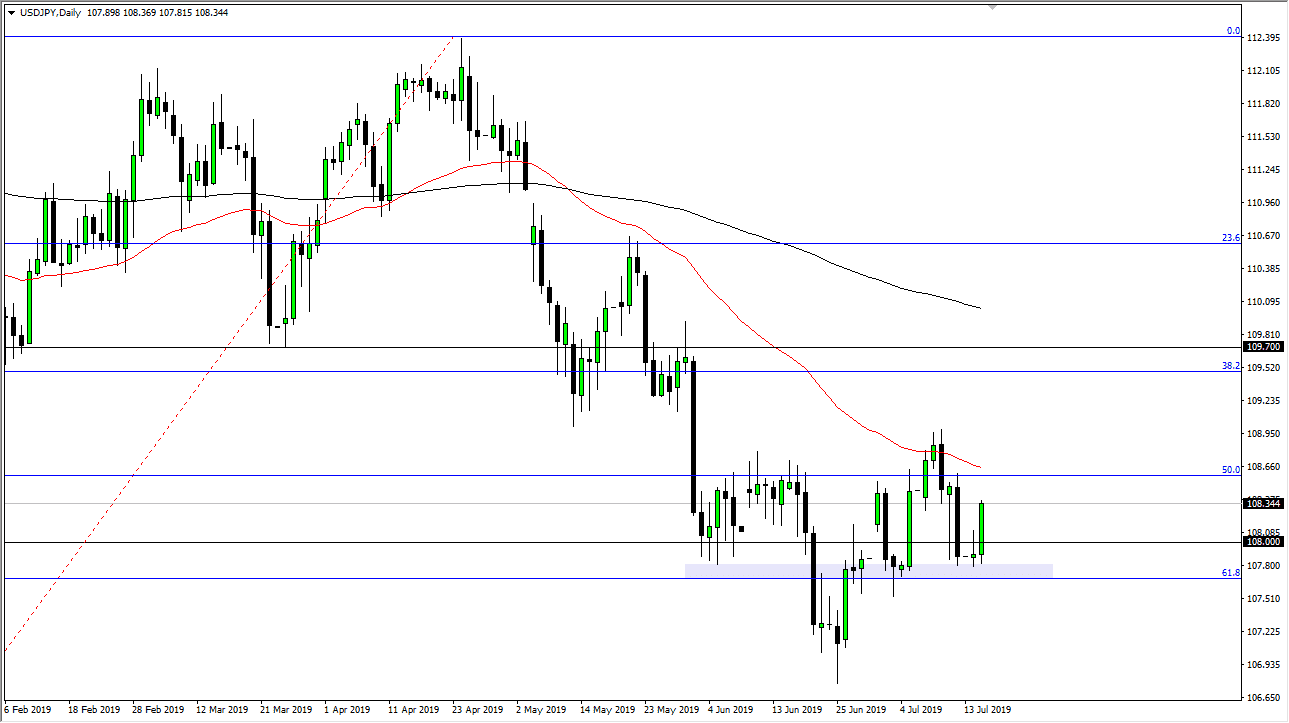

The US dollar has broken higher after initially dropping against the Japanese yen during the day on Tuesday, breaking above the top of the inverted hammer that formed for the Monday session. By doing so, we have broken through a bit of resistance for the previous session, and the fact that we have broken through there suggests to me that a lot of sellers are now on the wrong side of the trade. This will lead the market towards the 50 day EMA eventually, which is pictured in red on the chart. I think that this market will continue to be very noisy, and I don’t necessarily think that we are going to explode to the upside but I also recognize that there is a lot of noise above.

Looking at this pair, I also see the ¥107.50 level as massive support. It not only features a couple of hammers, but the 61.8% Fibonacci retracement level also is in the same area, so I think that it’s only a matter of time before buyers would come in if we went back down to that level.

Looking at this chart, I think that we are trying to build up enough momentum to finally break to the upside, but keep in mind that this pair is highly sensitive to risk appetite. If we were to break above the ¥109 level, then this market will probably go looking towards the ¥109.70 level, and then even higher than that. I do think that short-term pullbacks could cause a bit of support underneath, but you have to keep open the idea of a break down. If we get a break down it will probably coincide with a lot of negativity around the world, so keep that in mind. In other words, if the stock markets break down, then we will probably see this pair break down simultaneously. However, if we continue to get signs of strength in the overall stock market attitude, then that should push us to the upside. I believe at this point you will continue to see a lot of volatility and choppiness, so what I like doing is looking for short-term pullbacks to take advantage of. That being said, I wouldn’t put too much money into this market at this point as we continue to see so much noise. This market is going to continue to be difficult to say the least.