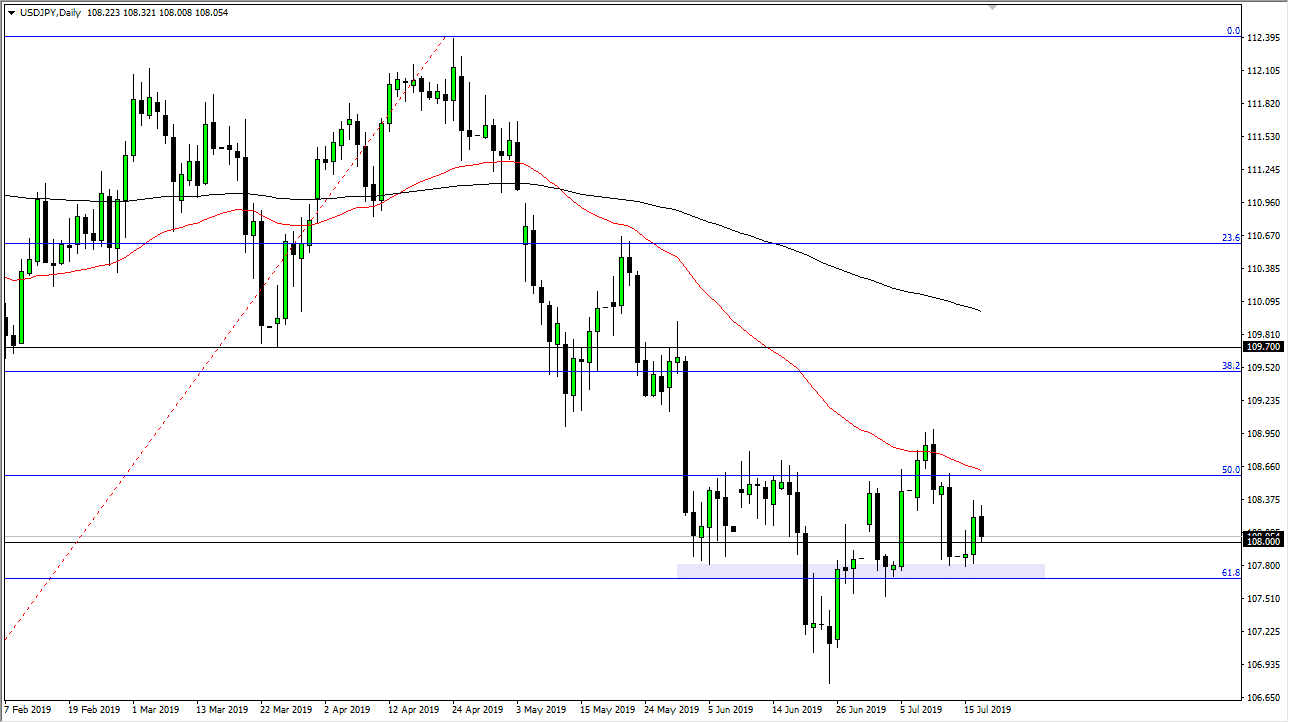

The US dollar initially tried to rally during the Wednesday trading session against the Japanese yen but has pulled back towards the ¥108 level. There is a significant support level underneath, near the 61.8% Fibonacci retracement level, which is closer to the ¥107.75 level. Ultimately, this is a market that is very sensitive to risk appetite around the world, so keep in mind that you need to pay attention other markets as well.

While the Federal Reserve is likely to cut interest rates this month, and perhaps even in September, that doesn’t necessarily mean that the US dollar will fall against everything. In fact, if stock markets get a boost from that, and they very well could, that probably sends this market higher. I believe that the purple box on the chart which coincides with the 61.8% Fibonacci retracement level should be massive support. If we were to break down significantly below there, that could change everything but right now it does look as if it’s at least trying to hold.

The 50 day EMA is grinding a bit lower from here, so I do think that it’s going to come into play rather soon. If we can break above the 50 day EMA, at least on a daily close, it’s likely that we could continue to go towards the ¥109.70 level. I don’t have any interest in shorting this market but do recognize there is a bit of danger to the downside as there are a lot of geopolitical issues out there. That being the case, the occasional headline could come out to send money flowing towards the Japanese yen, but right now it looks as if we are trying to form some type a bottom.

To the upside, I think it is going to be very choppy and difficult. Quite frankly if this pair starts to rally, I would be interested in going long NZD/JPY, AUD/JPY, or even CAD/JPY instead of this pair, because the US dollar of course has the stigma of having rate cuts coming. It isn’t that this pair can’t rally, it’s just that it will probably lag a lot of those other currency pairs as far as momentum is concerned, because there are a lot of issues that will continue to weigh upon the greenback. All things being equal though, I do prefer going to the upside given enough time.