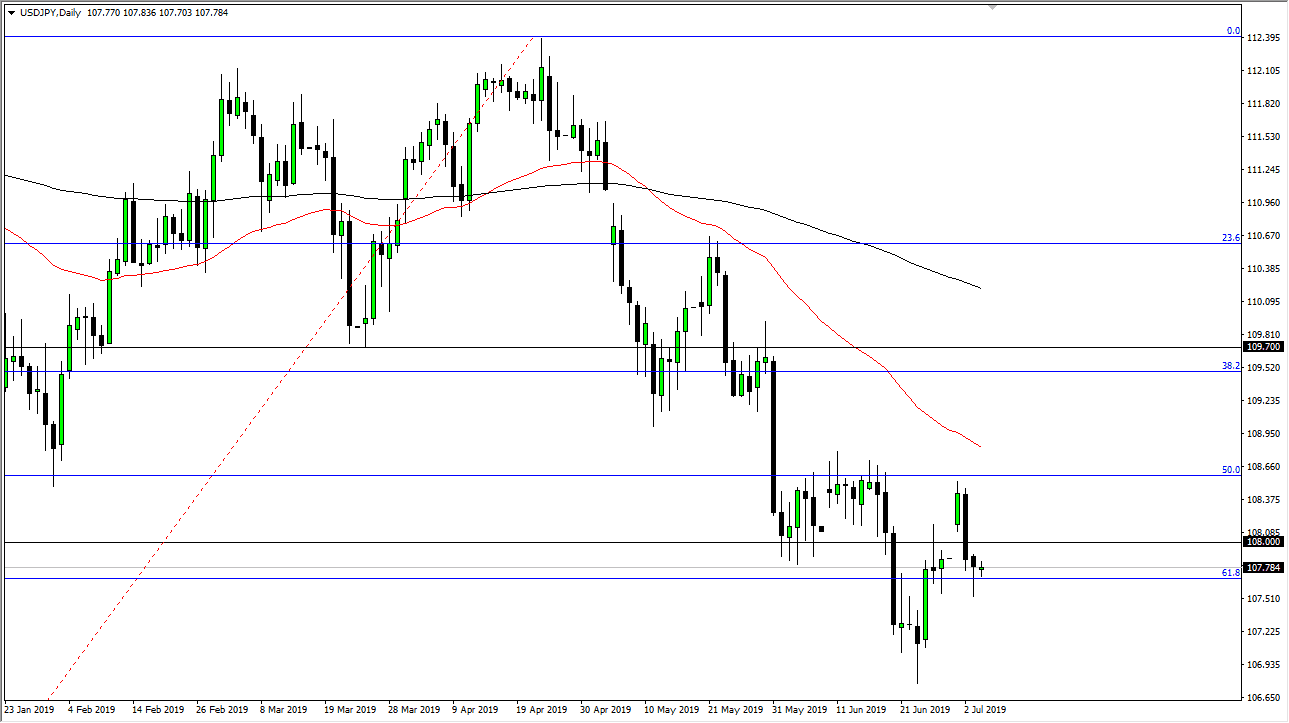

The US dollar has gone back and forth during the trading session on Thursday in a very tight range, but that shouldn’t be much of a surprise as it has been Independence Day in the United States. That being the case, you should look at this as being set up for the jobs figure on Friday. After all, we had dropped significantly to fill the gap, and then turned around to form a hammer with that very same candlestick on Wednesday. If we can break above that candlestick, it’s likely that we go higher as it would of course be a classic technical signal to start buying.

Looking at this chart it looks as if it does want to go higher given enough time, but I don’t know that it will before we get the jobs number on Friday. If we get a bullish number, it’s likely that we will rally. Even if we don’t get a bullish number, it’s very likely that we will turn in rally as the stock markets look as if they are ready to go higher. That being said, if we were to close below the bottom of the hammer from the Thursday session, then it would be very negative sign. That could send the market down to the ¥170 level and breaking down below there opens up the door to the ¥105 level which would be a rather significant move.

All things being equal though, this is a risk sensitive pair so pay attention to the stock markets, and it should be noted that the S&P 500 futures market is hanging about the 3000 handle. If we can break above there, it’s very likely that we continue to go higher. If the market falls significantly, that could be the thing that drives this market lower. Remember that the yen is considered a safety currency, so some kind of major concern would push this market lower. However, on the breakout that I expect we should go looking towards the ¥108.50 level. Moving above there, we could then go to the ¥109.60 level given enough time. Obviously that’s a bigger move than a longer-term move, as it would also slice above the 50 day EMA. Regardless, even if we do go higher - and I think it’s going to happen given enough time - this is going to be a noisy and choppy marketplace. If we did break down and make a fresh new lows it might be a little bit more rapid than the upside.