The US dollar rallied significantly during the trading session on Friday after the jobs number came out much stronger than anticipated. This of course is good for the US dollar in the sense that people began to price in the idea of the Federal Reserve not making interest rate cuts. That being said, later on the market got a bit of relief due to Jerome Powell suggesting that the Federal Reserve was also going to do whatever it takes to keep the economy going, and other words keeping interest rates low.

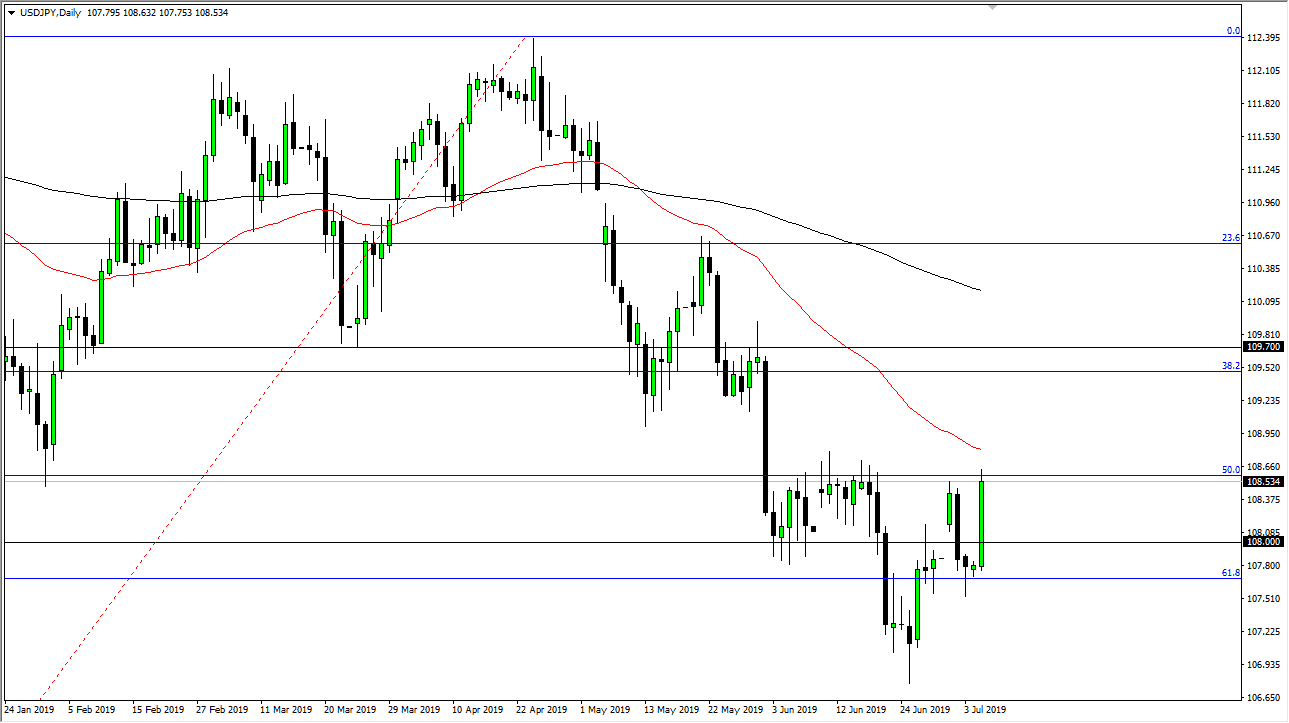

While this could be negative for the US dollar in general, it will be different in this pair because the USD/JPY pair tends to move with risk appetite overall, and that of course is what we saw during the trading session on Friday: a little of both. We are reaching towards the ¥108.60 level, an area that is massive resistance, and as a result it’s an area that should attract a lot of attention. The fact that we couldn’t close above it tells me that there are still sellers in this area. Beyond that, we have the 50 day EMA above also offer resistance.

Ultimately, this very bullish candle stick does in fact suggest that we are going to go higher eventually, but we may need to pullback a bit in order to build up the necessary momentum. Remember that this pair does tend to fall right in line with the S&P 500, and if it can break above the 3000 level that will probably send this market towards the upside again, and that should of course send this market much higher as well. At this point it’s very likely that the market is going to continue to go higher, reaching towards the ¥109.60 level which was the beginning of a significant break down.

A break above there could then send this market even higher, but in the short term I think we are simply trying to build up a base so don’t be surprised at all to see if we get some type of short-term pullback. That pullback should be a buying opportunity as long as we can stay above the ¥107.50 level underneath, where the hammer formed just a couple of days ago which was the beginning of a sign of positive momentum. Overall, this is a market that looks like it is trying to carve out a bottom.