For the second day in a row, the USD / JPY pair is trying to recover its recent losses, which reached 107.20 support, its lowest level for almost a month, settling around 108.05 at the time of writing. The pair is trying to keep away from moving below 108.00 psychological support to avoid further downward pressure and testing stronger support levels. The US dollar still faces firm expectations that the US Federal Reserve is ready to cut US interest rates when it meets next week to determine its monetary policy. Those expectations will be supported by a slowdown in US GDP growth, which will be announced by the end of this week. Expectations are that the United States' gross domestic product (GDP) is to start to slowdown after its recent record numbers, as the fierce trade dispute with China, which has slowed the world's second-largest economy to its lowest level in 26 years, continues. The US economy is not too far being affected by this conflict either.

As the global trade war continues and increasing geopolitical tensions, led by the situation in the Arab Gulf region continues, the Japanese yen will continue to drive safe haven gains for investors, which will depend on the Yen in times of uncertainty. Expectations among economists about the extent and duration of the reduction are variant, with expectations that support the possibility of a quarter-point cut only, and monitoring economic developments, and expectations suggest a half-point rate cut to meet the strongest risks to the US economy, especially as the trade conflict with China continues.

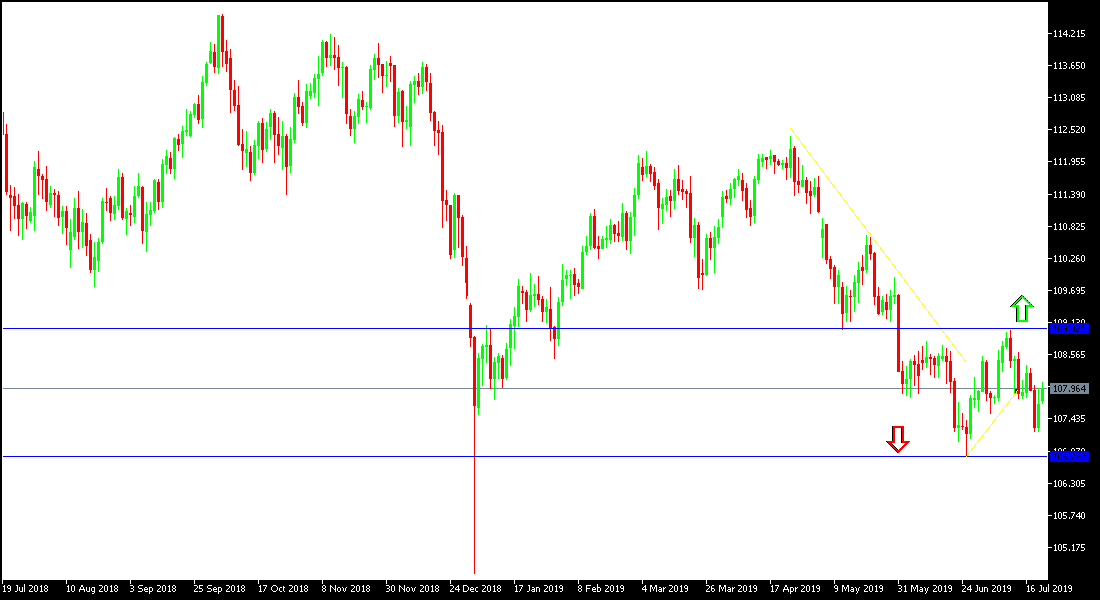

Technically: The general trend of the USD / JPY is still closer to the continuation of the decline as long as its stabilized below the 110.00 psychological resistance level, and therefore the nearest support levels for the pair are currently 107.20, 106.70 and 106.00 respectively, levels are supporting the continuation of the strength of the current trend. On the upside, the nearest resistance levels are currently 108.30, 109.00 and 109.85, respectively. Technical indicators confirm that the price reached oversold areas and that it is ready for correction but there are currently no incentives to do so.

On the economic data front today: The economic calendar today has no important and influential data from Japan or the United States of America. The pair will react to renewed global geopolitical concerns as the Japanese yen is one of the most important safe haven.