The Japanese yen is still stronger and the USD bullish correction attempts didn’t pass the 108.63 resistance, and the USD/JPY settled again around 108.30 at the time of writing. The pair didn’t benefit much from the US employment numbers, which came better than expected, especially in terms of new jobs in the non-farm sector, but we have seen a rise in the unemployment level against expectations of a stable level. At the same time, the average hourly wages remained as is with expectations of it were for an increase. Generally speaking, the report results support the USD against other majors, as markets ruled out the Fed Reserve rate cut this current month.

The JPY will continue gaining from the global political and trade tensions, as it is one of the most important safe heaves for investors’ hedging from the consequences of such tensions. The general trend of the USD/JPY will remain bearish as long as it established below the 110 psychological resistance. The investors resumed their purchase of the JPY with a renewed fears of Tramp imposing stronger tariffs on China at the end, even after the truce announced between the two countries at the end of the G20 summit in Japan at the end of the last month. Investors have lack of trust in Trump and his policies, as they have often negotiated and he still went ahead and imposed more tariffs.

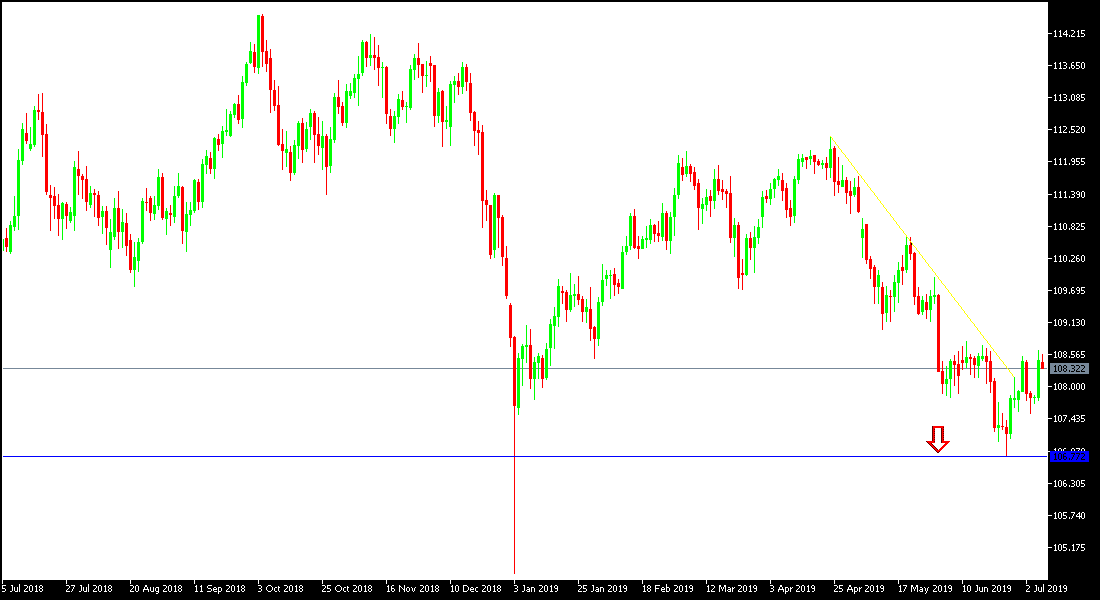

Technically: As we had previously predicted, the stability of the USD / JPY below the 110.00 level will increase the bearish momentum of the pair, and the pair has reached the levels we expected in the previous technical analysis which is closest to the next support at 107.65 and then the following support levels will be 106.45 and 105.80 respectively. These levels confirm the strength of the downward trend. On the upside, the nearest resistance levels are 108.60 and 109.55, respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar has no important data from Japan or the U.S. The pair will monitor with caution and interest the renewed global geopolitical concerns, and all about Trump's internal and external policy.