The price of the USD/JPY pair appears to be silent for four sessions in a row moving in a limited range awaiting the breaking point as the Federal Reserve announces its monetary policy. Before that, the pair is stabilizing around the 108.50 level at the time of writing. Expectations strongly suggest that the US central bank will cut the US interest rate from 2.50% to 2.25%. The biggest focus will be on the announcement of the bank's monetary policy statement following the decision, along that, there will be important comments from Governor Jerome Powell. Any signs to continuing the easing policy course would lead to further losses to the US dollar against other major currencies. If he pointed out that the bank has cut rates today to secure the economy and that it will monitor economic performance after today's decision, the dollar losses will be limited.

The pair did not react very much by data suggesting a slight rise in China's Industrial Purchasing Managers Index, which is still below the 50 level that separates deflation from growth in the important sector. This week, the Japanese central bank kept its ultra-easy stimulus policy in place to support Japan's economy with negative interest rates and stimulus plans to counter the consequences of the US-China global trade war, which in turn directly affect Japan's economy, which relies directly on exports and on US and Chinese markets.

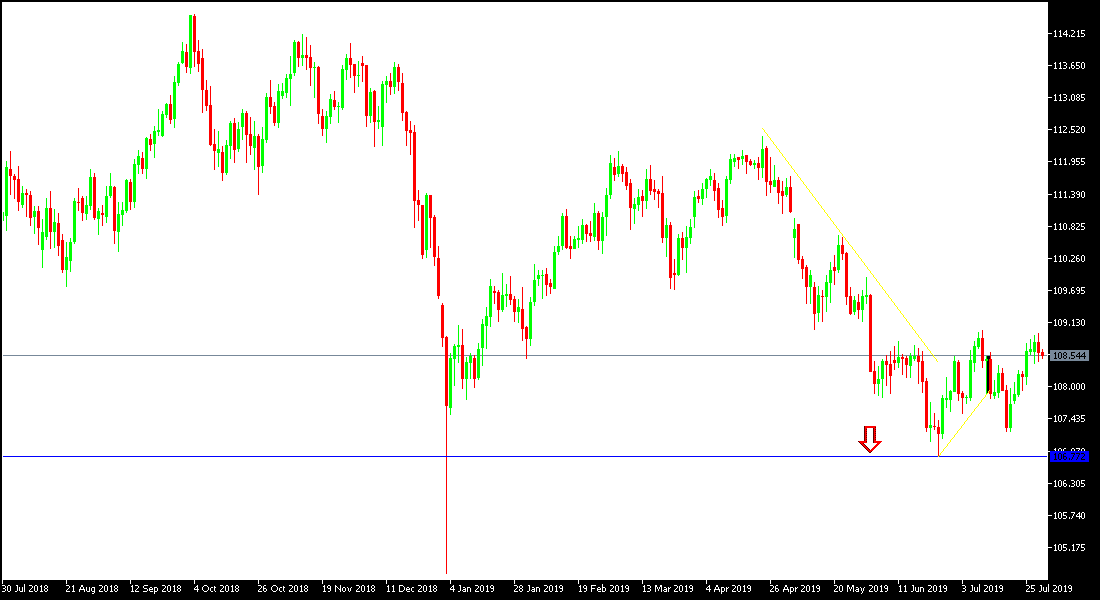

Technically: The general trend of the USD / JPY price will be negatively affected if it moves towards and below the 108.00 support level which will support the move towards the 107.55, 106.90 and 106.00 support levels and will consolidate the strength of the bearish trend. On the upside, its success in moving above 110.00 psychological resistance will open the way for the pair to test higher resistance levels that could reach 110.75 and 111.30 respectively. Standby and caution mode controls the performance of the pair.

On the economic data front today: After the release of Chinese and Japanese data in morning trading, the pair will be affected by the announcement of US ADP data for non-farm employment change, Chicago Purchasing Managers' Index, Federal Reserve monetary policy decisions and Governor Jerome Powell's press conference.