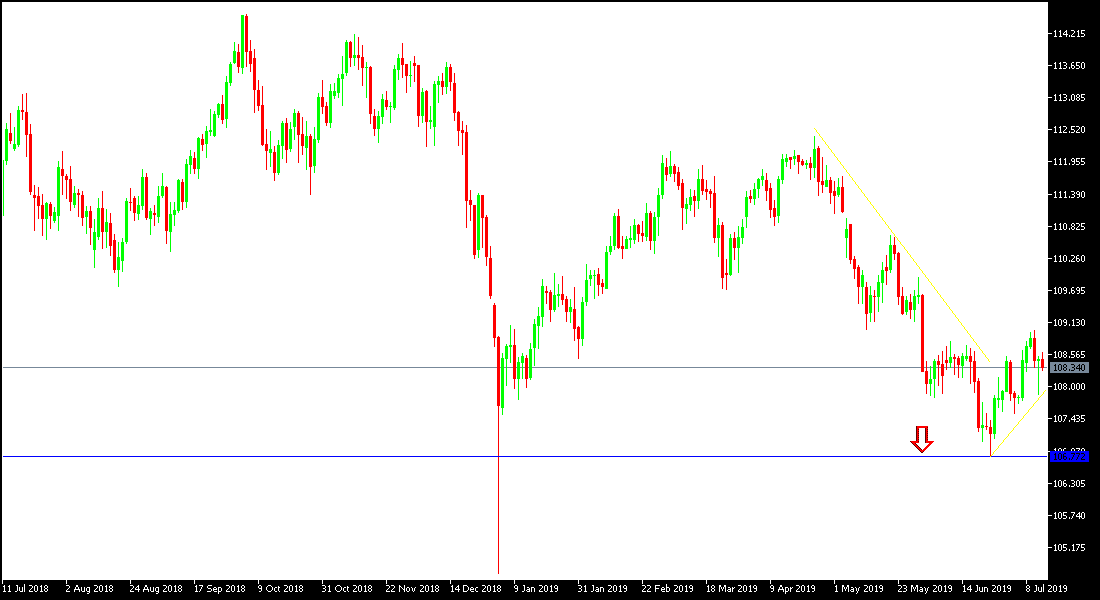

With the beginning of this week’s trading, the USD / JPY pair rebounded to the 108.98 resistance level, but with the US Federal Reserve's signs of nearing the US interest rate cut, the pair fell to the 107.85 level, which it tested during Thursday's session, before settling around 108.35 at the time of writing. The opportunity for the pair to close this week's trades higher will weaken if the pair continues to perform around the 108.00 support. Powell, the Federal Reserve Chair, reiterated in his testimony before the Senate what he said in his testimony before the US Congress, that the US central bank is ready to cut interest rates, as trade tensions continue and concerns about the strength of the global economy directly affect the US economic outlook. Thus, the financial market expectations are 100% that the bank will cut US interest rates at its meeting later this month.

US CPI figures came in higher than expected, but did not affect the market's direction to prepare for a US interest rate cut soon.

From a technical perspective, if the pair moves around and below the 107.00 support level, the bearish trend will strengthen and the upside hopes will evaporate. Japanese yen leads safe havens for investors amid continued global trade and political tensions supported by the US-China global trade war. On the other hand, demand for Japanese yen will increase if Trump levies tariffs on all US imports from China.

Technically: the USD / JPY remains bearish as long as it remains below the 110.00 level. The pair reached levels we expected in the previous technical analysis, and is currently near 108.20, 107.65 and 106.40 respectively, which confirm the strength of the bearish trend. On the upward side, the nearest resistance levels are 108.85, 109.55 and 110.20 respectively. We still prefer to buy the pair from every bearish bounce.

On the economic data front today: the pair will react today with the release of the trade balance data in China and the US producer price index. The pair will watch with caution and interest any renewed global geopolitical concerns as the Japanese Yen is considered one of the most important safe havens.