For the fourth day in a row, the USD / JPY pair moved up towards the 108.98 resistance level the time of writing, the highest level in one month. Despite the rebound, the pair still needs to move above the 110.00 psychological resistance to confirm the strength of breaking the bearish trend and start a correction in a new direction. The pair will have an important date today with updates on the monetary policy of the US Central Bank, where Jerome Powell will testify before the US Congress Committee to clarify the state of the economy and the bank's plans to promote it. The contents of the minutes of the bank's last meeting for June will also be announced. Any signs of delaying the near date of the US interest rate cut will support further gains for the US dollar and vice versa.

The JPY retains its place among safe havens for investors to hedge from continued global trade and political tensions, led by the US-China global trade war, and the situation in the Gulf region. On the economic front, US job numbers in June supported recent US dollar gains as markets with those results ruled out a chance to cut the US interest rate at the Federal Reserve meeting this month.

Investors will return to buying the Japanese yen again if Trump is imposed tariffs on all imports from China. On the other hand, if the two sides reach a long-term trade agreement, the Japanese yen may lose a lot, as that will increase risk appetite. In general, investors do not trust Trump and his policy. They often negotiate and then imposed more tariffs between the two parties.

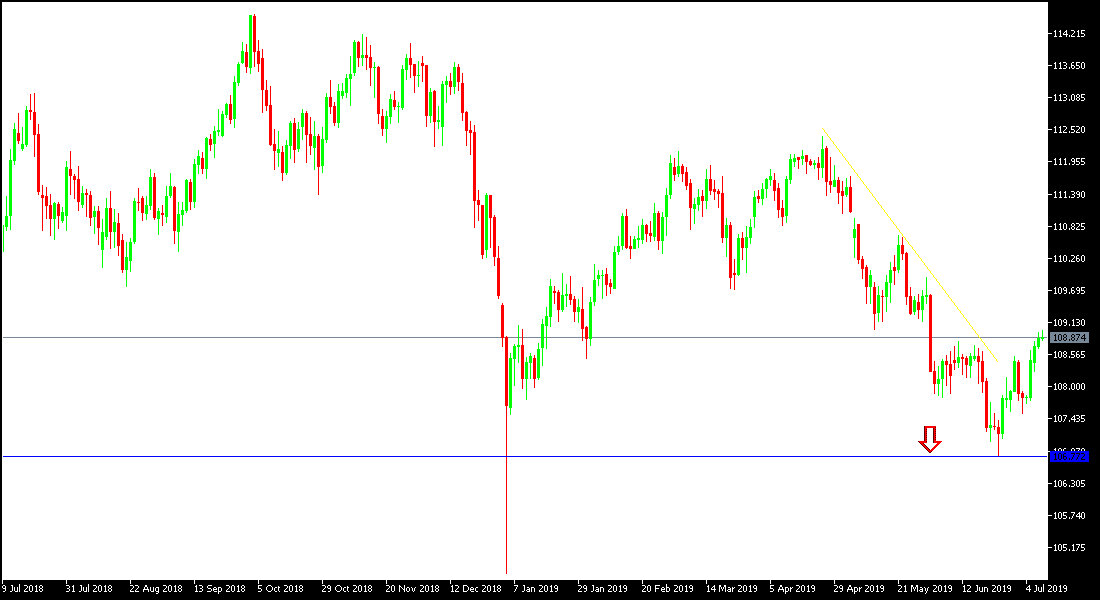

Technically: Despite the recent rebound, the bearish trend remains intact with the USD / JPY stabilizing below the 110.00 level. The pair reached the levels we expected in the previous technical analysis and is currently near the levels of 108.35, 107.75 and 106.60 respectively, which confirm the strength of the bearish trend. On the upside, the nearest resistance levels are 108.85, 109.55 and 110.20 respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar today has no important Japanese data and will focus on Powell’s testimony before the US congress and the minutes of the Fed’s last meeting. The pair will monitor with caution and interest the renewed global geopolitical concerns, and all about Trump's internal and external policy.