The weakness of the US dollar, investors risk aversion, and the return to safe havens contributed to the evaporation of the USD / JPY gains, and the pair's returned to test stronger support levels, which reached 107.61 support level during Thursday's trading session. Recent skirmishes between the United States and China over the future of their trade have given no optimism to investors that the two parties are on track to resolve the biggest trade dispute threatening the future of global economic growth, and even contributed to the global central bank's policy towards more stimulus and lower interest rates to counter the consequences of that war. We see mixed results in the US economic data, with disappointing figures for the US housing market, met by improved US retail sales figures for June.

JPY is a leading safe haven for investors as global trade and political tensions continue to be supported by the US-China tariff war, which has slowed the GDP growth of the world's second-largest economy to its lowest level in 26 years, and financial markets expect the US central bank to cut the US interest rates when the US Federal Reserve meets at the end of the month.

US inflation figures came in higher than expected, but did not affect the market's direction to prepare for US interest rate cuts soon.

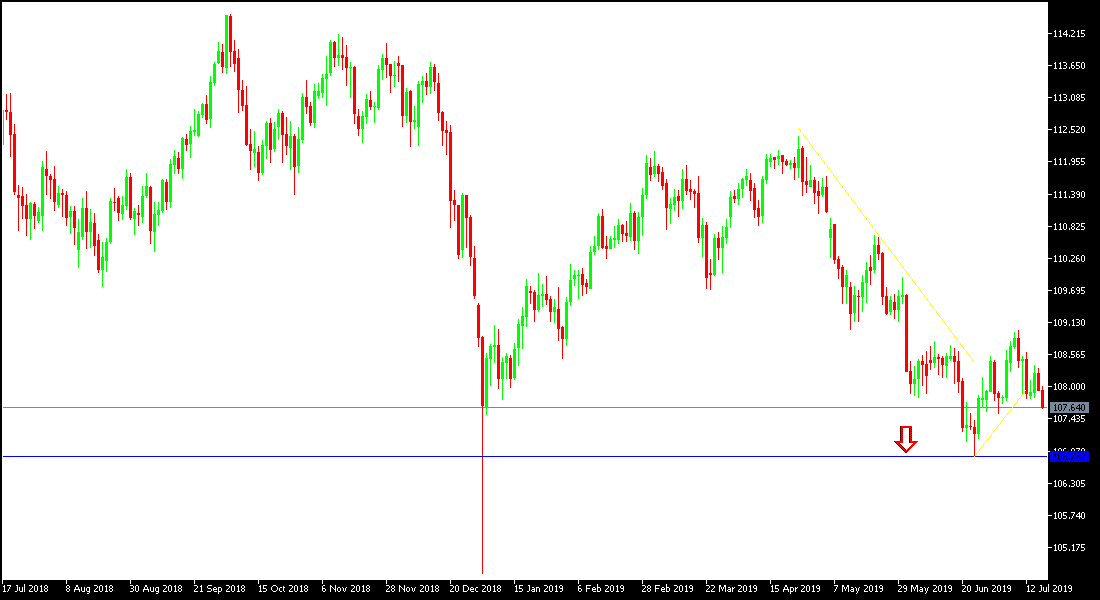

Technically: As we had previously predicted that the general trend of the USD / JPY is still closer to move within its downtrend channel, as long as it remains below the 110.00psychological peak, this performance will support the pair’s move towards the strongest support levels at 107.45, 106.80 and 106.00 respectively, which support the strength of the bearish trend. On the upside, the nearest resistance levels are currently 108.30, 109.00 and 109.85, respectively. Opportunity to trade the pair by buying from levels below 108 support is still the best way now. Technical indicators confirm the pair's reach into oversold areas but still lacks incentives to start a bullish correction strongly.

On the economic data front: The economic calendar will focus on the announcement of the Japanese trade balance, the US unemployment claims and the Philadelphia industrial index. The pair will react with caution and interest with any renewed global geopolitical concerns, as the JPY is among the most important safe haven assets.