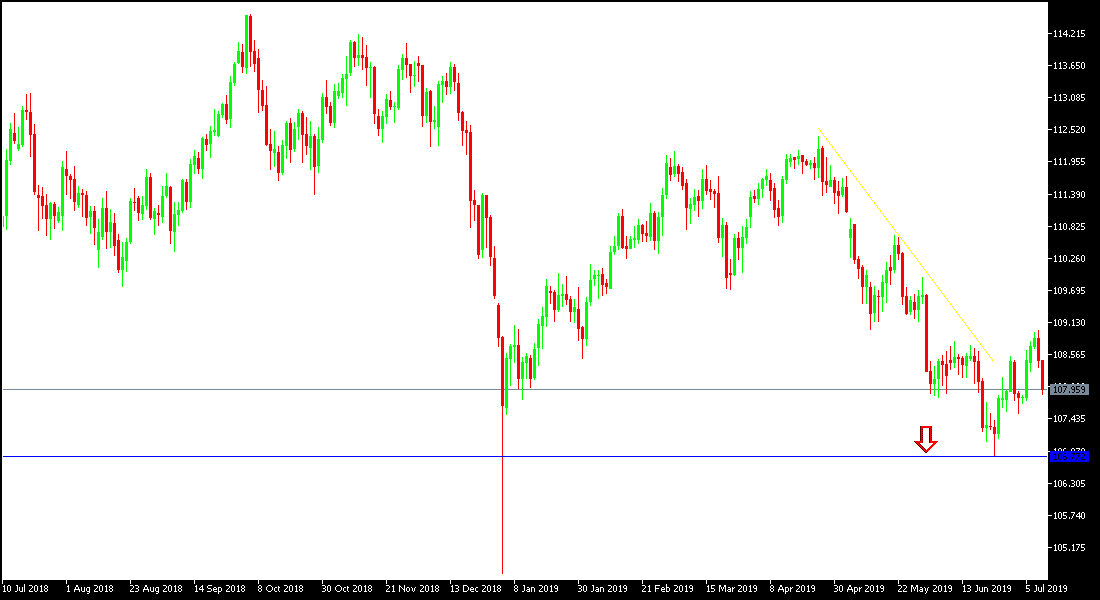

Strong signs from the US central bank of a near US interest rate cut contributed to stronger losses for the US dollar against other major currencies. The USD / JPY pair fell back to the support level 107.85 at the time of writing, after its recent gains, which lasted for four straight sessions, reaching to the resistance level of 108.96. If US CPI figures fall short of expectations, financial markets may confirm Fed fears of a slowdown in the world's largest economy. Jerome Powell, according to his testimony before the US Congress Committee, and what was later stated in the content of the minutes of the Fed’s last meeting, confirms to the markets by 100% that the bank will soon reduce US interest rates, and the current month maybe more appropriate to do so.

From a technical perspective, if the pair moves around and below the 107.00 support level, the bearish trend will strengthen and the bullish hopes will evaporate.

The JPY is leading safe haven for investors as global trade and political tensions continues, supported by the global trade war between the US and China. Powell's testimony and the minutes of the bank's last meeting in June, ended the recent optimism from the positive US job numbers in June, which boosted recent gains in the US dollar.

The Japanese yen will see more purchase appeal if Trump levies tariffs on all US imports from China. On the other hand, if the two sides reach a long-term trade agreement, the Japanese yen may lose a lot, as that will increase risk appetite.

Technically: Despite the recent rebound, the bearish trend remains intact with the USD / JPY stabilizing below the 110.00 level. The pair reached the levels we expected in the previous technical analysis and is currently near the levels of 108.35, 107.75 and 106.60 respectively, which confirm the strength of the trend downward. On the upside, the nearest resistance levels are 108.85, 109.55 and 110.20 respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar today will focus on the announcement of the US consumer price index and the weekly unemployed claims, and what will appear in the second testimony of Jerome Powell before the Congress. The pair will be watching with caution and interest for renewed global geopolitical concerns, and all about Trump's internal and external policy.