For three consecutive trading sessions, the USD/JPY pair is trading at the 108.28 resistance level, with little change. This is despite the recent momentum of the US dollar from US President Trump and the US Congress agreeing on a budget to avoid closing the US government's, along with economic growth expectations update by the International Monetary Fund. Which is in favor of a stronger growth for the world's largest economy. It appears that investors are still holding safe havens, led by the Japanese yen, until confidence returns to the markets, with a US-China trade dispute solution approaches.

US dollar gains may be negatively impacted by expectations of US interest rate cuts by the Federal Reserve, which will meet next week to determine its monetary policy track. Investors are seeing growing market expectations for the bank to begin easing its monetary policy to face the risks that will affect the future of US economic growth, which saw the longest growth in the history of U.S economy. Market forecasts may change according to the US GDP figures, which will be announced on Friday. The continuation of a large-scale trade dispute with China has slowed the world's second-largest economy to its lowest level in 26 years. The US economy is not far from being affected by this conflict. According to forecasts, output growth will slow to 1.8 percent after growth of 3.1 percent in the previous quarter.

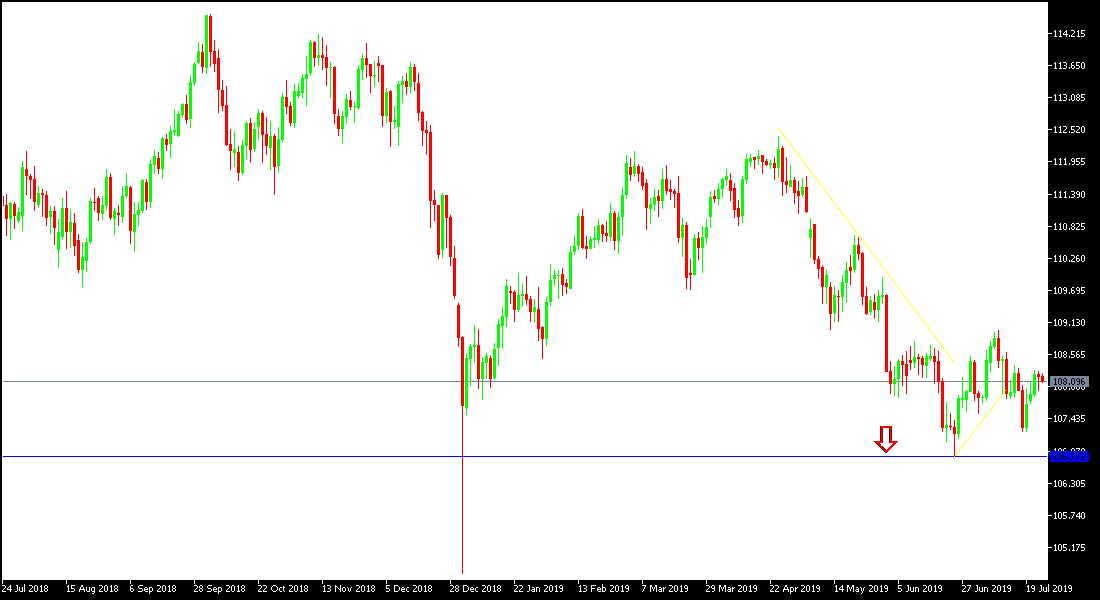

Technically: The general trend of the USD / JPY pair continues to be bearish as long as it remains below the 110.00 psychological resistance level and any move below 108.00 supports will push the market towards the support areas at 107.20, 106.70 and 106.00, respectively. On the daily chart, the MACD and the EMA are not yet ready to move higher. Therefore, the nearest resistance levels will be 108.75, 109.35 and 110.00 respectively.

On the Economic Data Today: The economic calendar today will focus on US durable goods orders, unemployed claims and trade balance of commodities. The pair will be affected by continued geopolitical concerns and global trade tensions.