The USD/JPY pair's attempts to rebound stopped at the 109.00 resistance level, as the US Federal Reserve began its meeting to determine its monetary policy and will announce tomorrow its latest decision on interest rates and the future of the Bank's policy. Expectations are almost certain that the Bank will cut interest rates by a quarter point to face challenges which are slowing US economic growth. According to US gross domestic product figures announced at the end of last week, the world's largest economy will begin the slowdown journey after the longest economic growth chain in the history of the United States. The bank's move, along with a pessimistic policy statement and cautious remarks by Bank Governor, Jerome Powell, would stop the US dollar gains and prevent the USD/JPY from testing the 110.00 psychological top, which gives it a rebound bullish strength.

The Central Bank of Japan, as widely expected, maintained its super-stimulus monetary policy to support the Japanese economy with negative interest and stimulus plans to counter the consequences of the global trade war led by the United States of America and China, which in turn directly affect Japan's economy that relies directly on exports to the US and Chinese markets. In addition, the rise in global geopolitical tensions and trade concerns will favor Japanese yen gains as one of the most important safe haven assets for investors.

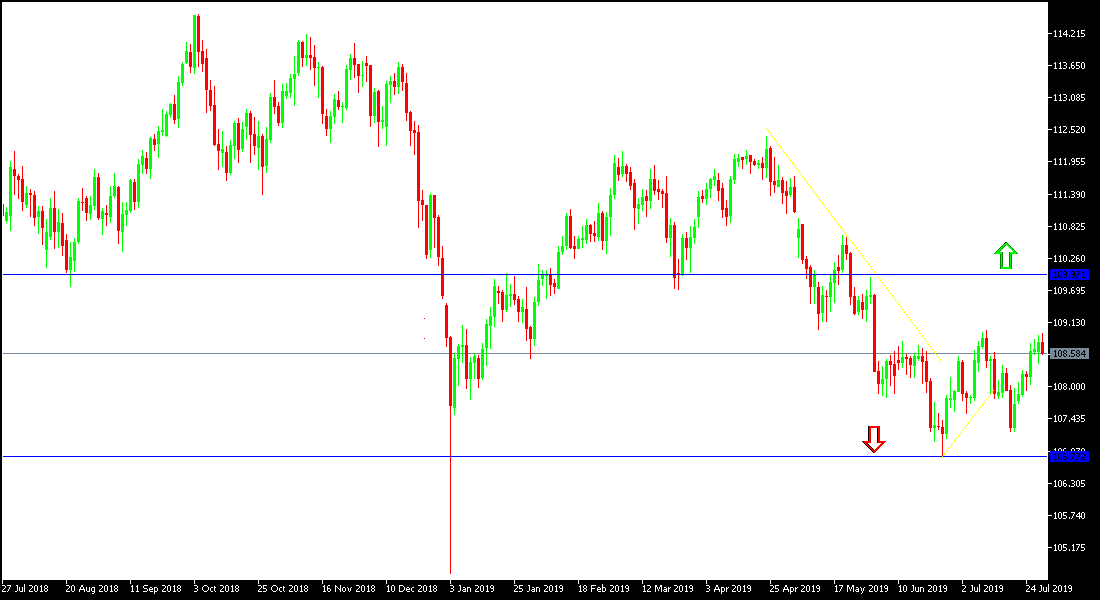

Technically: The overall trend of the USD/JPY pair will strengthen upward if it tests the 110.00 psychological resistance level and stabilizes above it, as it pushes the pair to test higher resistance levels that could reach 110.75 and 111.30 respectively. If the downward pressure comes back, the nearest support levels will be 108.00, 107.25 and 106.70, respectively, which are levels at which the outlook for gains is evaporated. Waiting mode and caution will be dominating the pair's performance.

On the economic data front: The economic agenda today will focus first on the announcement of the monetary policy of the Central Bank of Japan and the statements of Governor Kuroda, and then the US data on the consumer price index, the preferred measure of the bank to measure inflation in the country, as well as the average income, US citizen spending and consumer confidence data from the U.S.