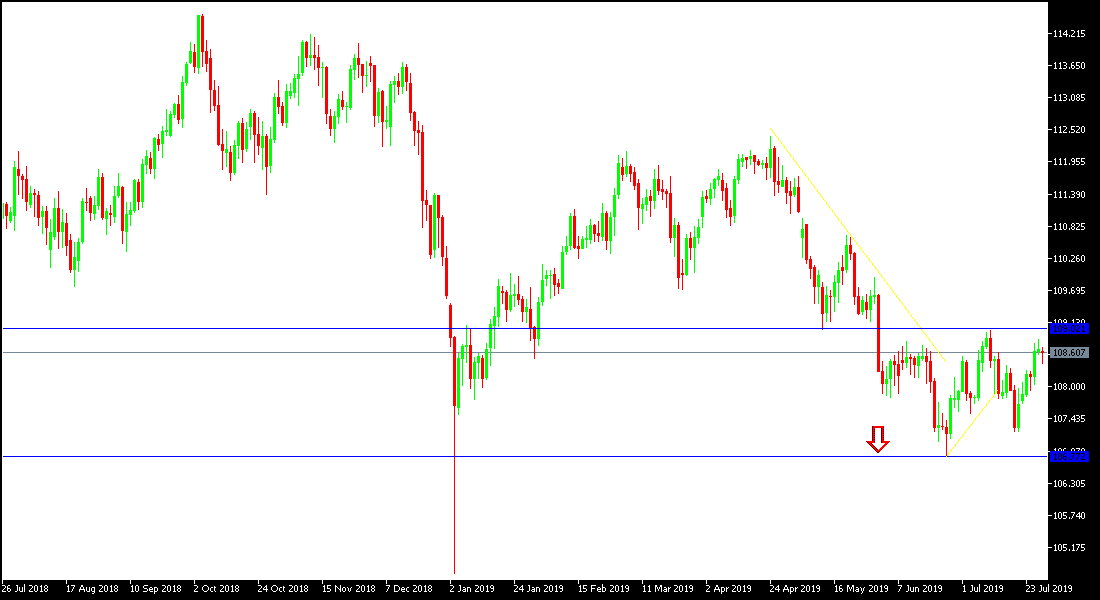

For three consecutive trading sessions, the USD / JPY pair is close to the 108.82 resistance level waiting for stronger catalysts to support the bullish correction which will not work without moving towards the 110.00 psychological resistance level. The pair is stable around 108.55 at the time of writing. The pair's movements are expected to remain stable until the US Federal Reserve announces its interest rate decision later this week amid firm expectations that the bank may accept a quarter-point cut to counter US economic slowdown and then the pair's performance will react with the announcement of US jobs figures amid expectations of an increase in the number of new jobs and the stability of both, the average wage and unemployment rate in the country. At the end of last week, GDP growth slowed by 2.1% from 3.1% in the previous issue and expectations for a stronger slowdown were up to 1.8%, which would support expectations of easing the policy of the US Central Bank, especially as Trump's management is in its global trade wars.

The results of the US economy growth along with the agreement between Trump and the US Congress on a budget to avoid closing the US government's work, together with the recent economic outlook update by the IMF all contributed to stronger gains for the US dollar. It should be beared in mind that the increasing global geopolitical and trade concerns will favor Japanese yen gains as it is one of the most important safe haven for investors in times of uncertainty.

Technically: The general trend of the USD / JPY pair still needs to move towards the 110.00 psychological resistance level to confirm the bullish correction strength which will support the move towards the resistance areas 110.75 and 111.30 respectively. On the downside, any attempt to move below support at 108.00 will support the return to test the strongest bearish levels 107.20, 106.70 and 106.00 respectively, which are levels evaporating the expectations of the upward correction.

In today's economic data: economic calendar today, and after the release of Japanese retail sales, has no important US data. The pair will be affected by continued geopolitical concerns and global trade tensions.