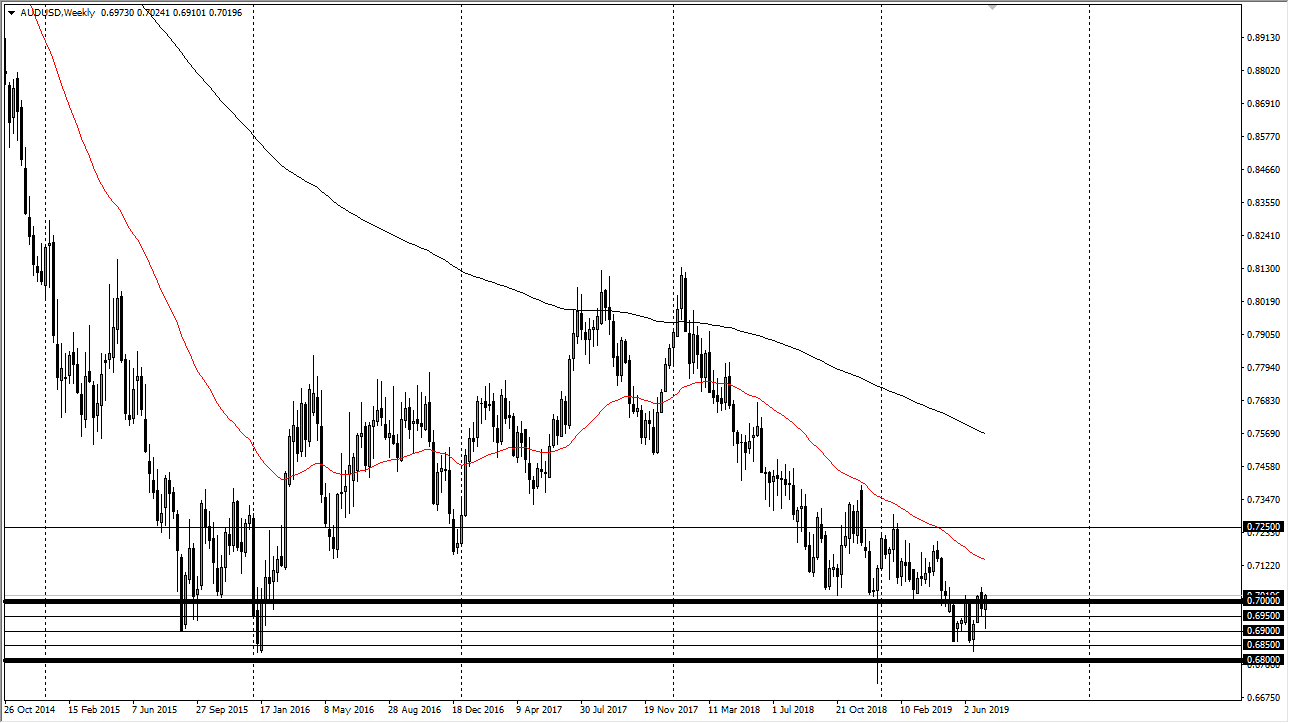

AUD/USD

The Australian dollar has rocketed above the 0.70 level, a very bullish sign indeed. The candle stick for the week is a hammer and that does suggest that we are going to be going higher in the longer-term. The Australian dollar is highly sensitive to the US/China trade situation so that is negative but at the same time we have the Federal Reserve looking to cut interest rates so it is going to continue to favor the upside due to the softening US dollar that we are seeing globally.

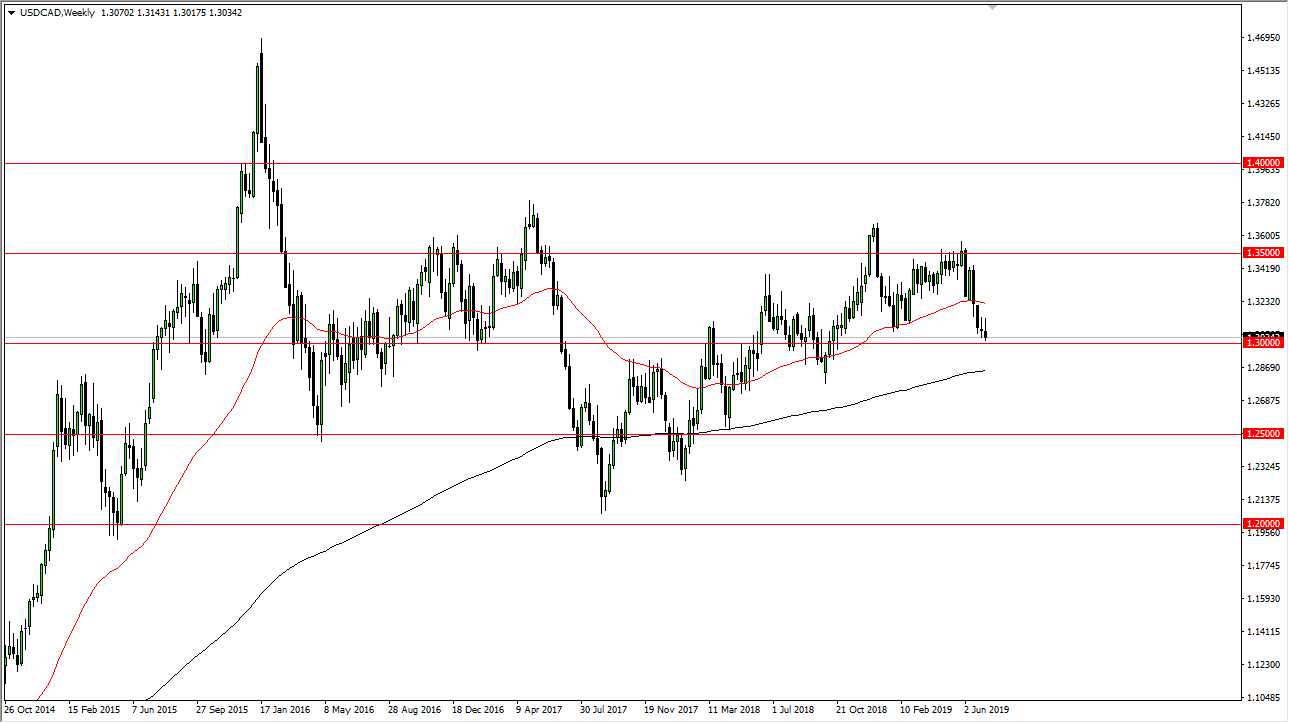

USD/CAD

The US dollar has formed an inverted hammer against the Canadian dollar at the crucial 1.30 level. The fact that we have formed this signal suggests that we are going to see further US dollar weakness here as well, perhaps reaching down towards the 1.28 handle and then eventually the 1.25 level. However, if we do turn around and break above the highs of the week, we could rally towards the 1.35 level above. This market looks very negative to say the least, so that being the case it’s a scenario where we are likely to see much more negativity in the short term.

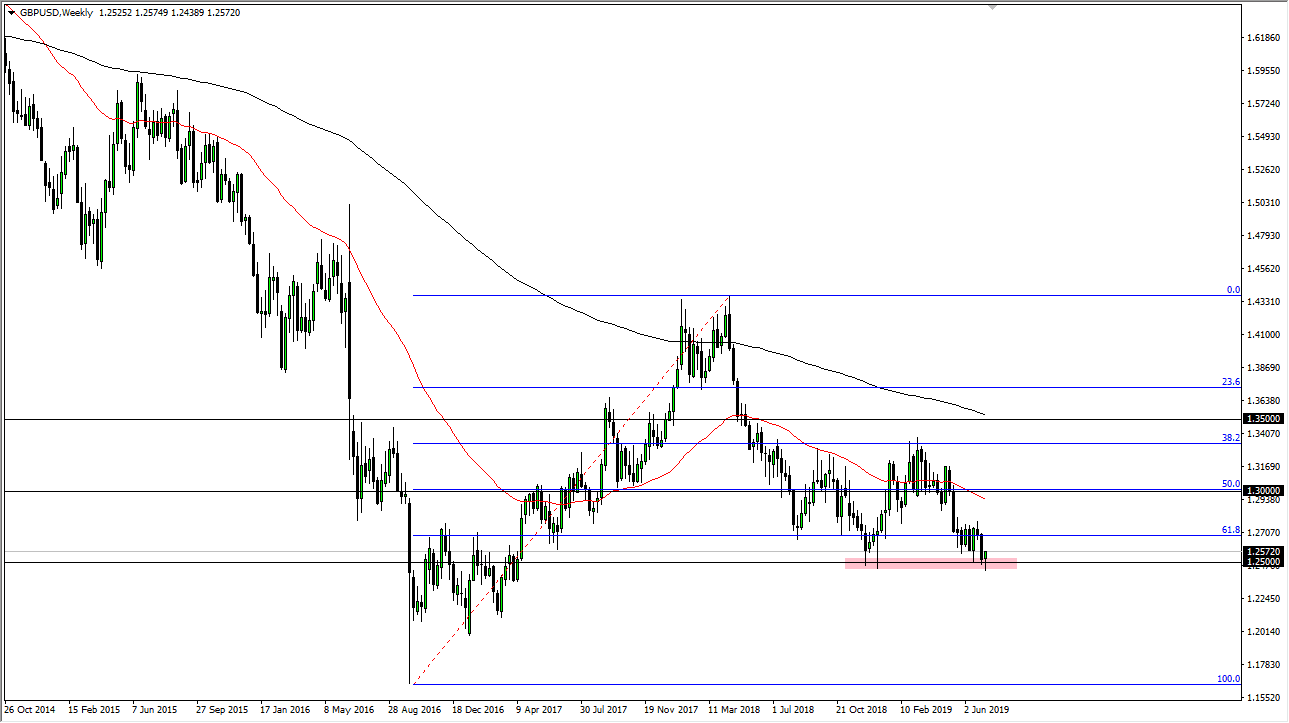

GBP/USD

The British pound has initially fallen below the 1.25 handle, but then turned around of form a nice-looking hammer. This suggests that we are going to see a bounce but what’s even more interesting is the fact that the US dollar is being sold off against most currencies. While the British pound could go as high as the 1.27 level above, quite frankly I think this chart just tells me that I should be short of the US dollar against most currencies and may just pass on this one.

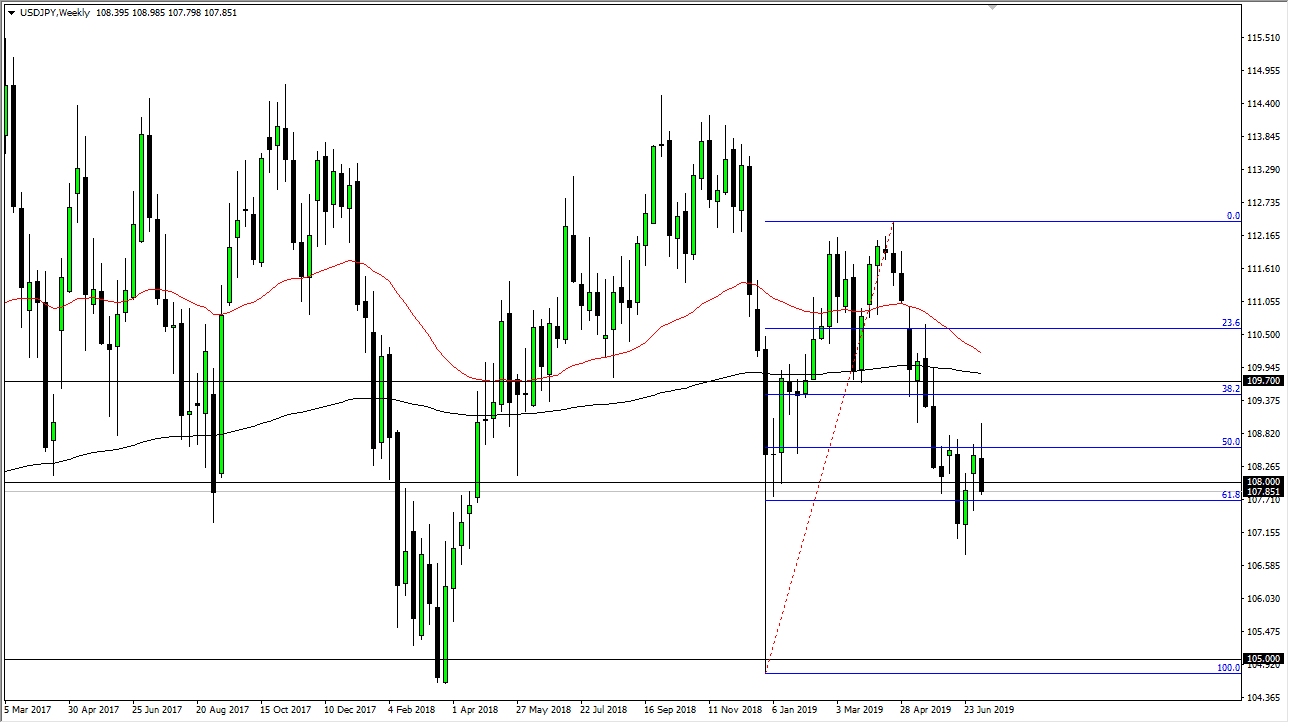

USD/JPY

The US dollar initially tried to rally against the Japanese yen as well but broke through a hammer on the daily chart on Friday. We broke down through the hammer of the Thursday session so that of course is a very negative sign. The hammer from the previous week suggests that there is support below, but if we break down below that level we will probably go down towards the 107 young level, perhaps even the 105 young level after that. Rallies more than likely are to be sold.