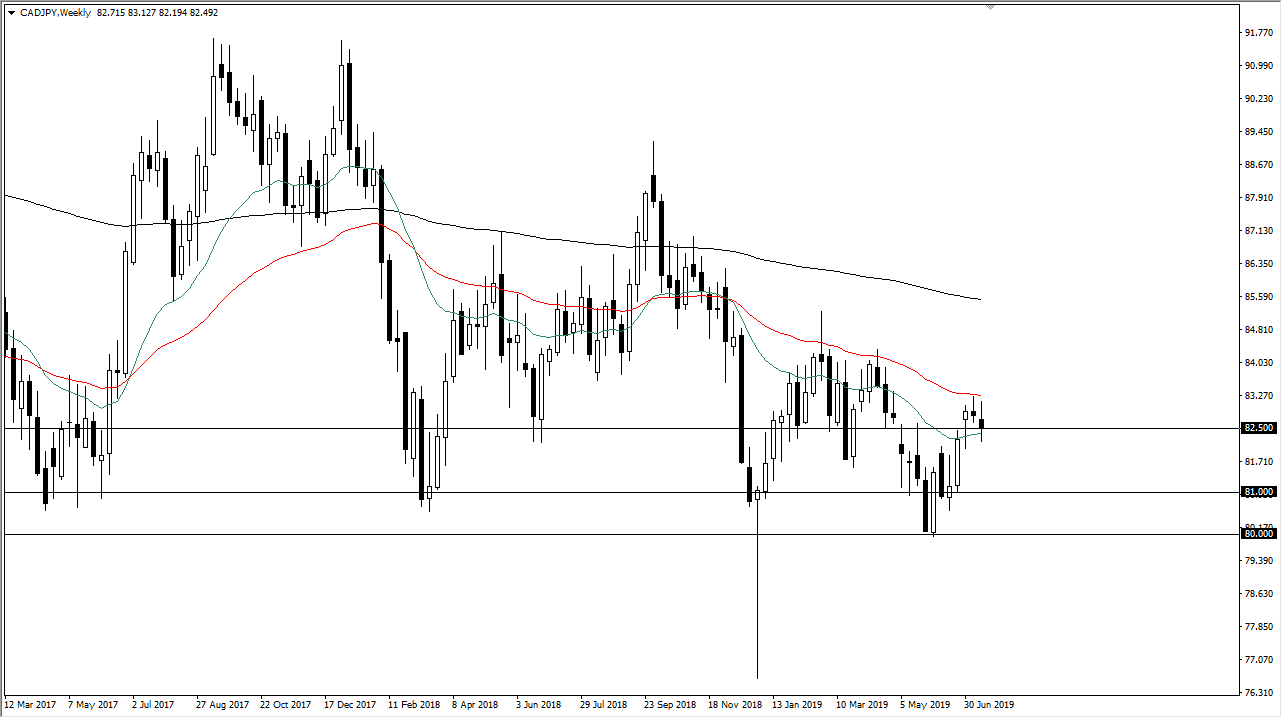

CAD/JPY

The Canadian dollar has gone back and forth during the course of the week, showing significant volatility against the Japanese yen. However, I find this area interesting considering that there was a gap year, and now we are seen a lot of confliction between the last three candlesticks. Simply put, if we can break above the previous week’s close, then I think we are free to go towards the ¥85 level. If we break down below the clothes from two candles before this one, then we break down to the 81 young level.

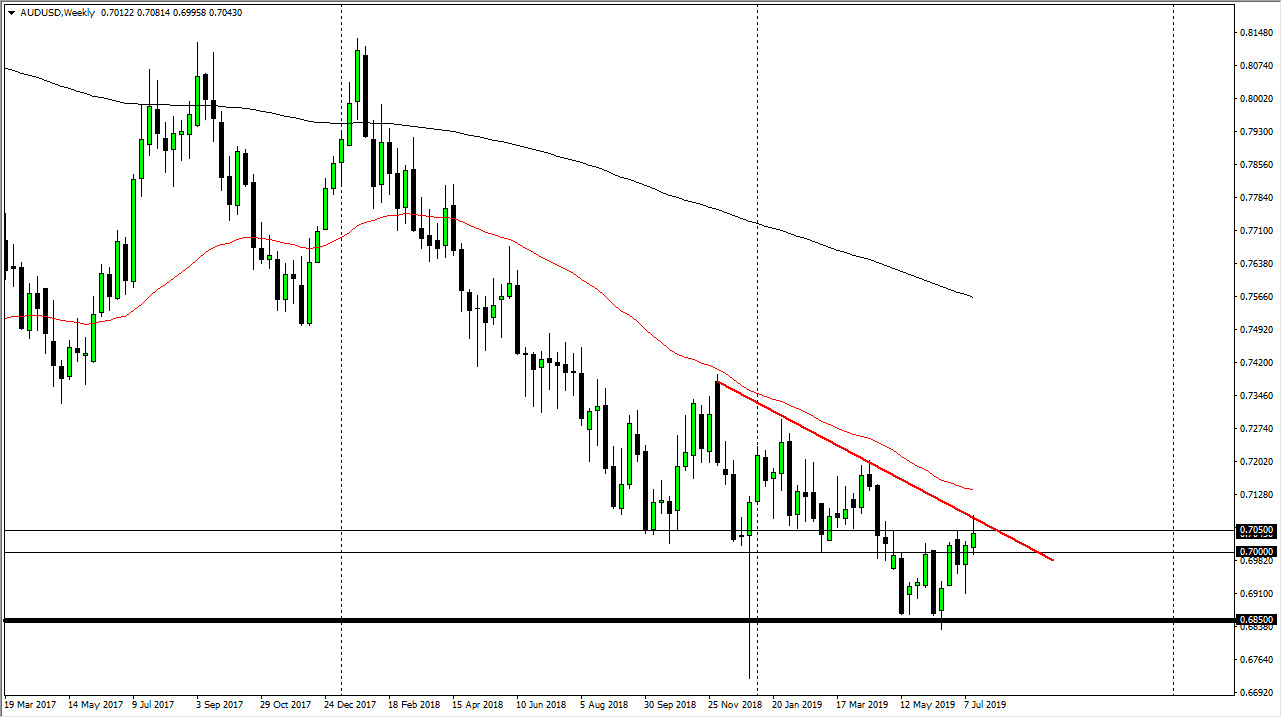

AUD/USD

If there is anywhere we are going to see a major change of attitude and pace, it’s probably going to be in the Australian dollar. If we can break back above the range for the week, this market is likely to continue going higher. That being said, if we break down below the 0.70 level that would be a very negative turn of events. Quite frankly, it’s going to come down to whether or not we are focusing on the Federal Reserve. The Federal Reserve is likely to cut interest rates, and that of course will put pressure on the greenback. I like buying a breakout for a longer-term move to at least the 0.72 handle if not further.

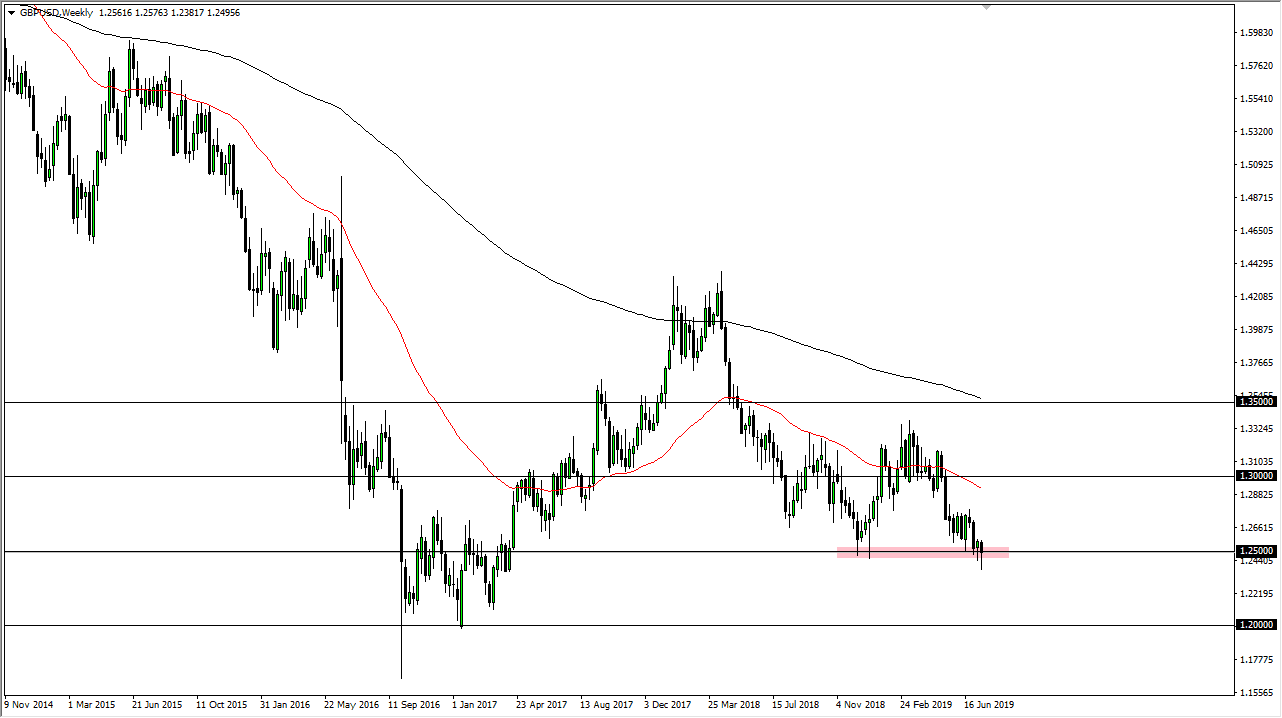

GBP/USD

The British pound has broken down significantly during the week, slicing through the 1.25 handle. By breaking through there, we have tested significant support, and have found it. Having done that, we have formed a massive hammer as we did the previous week, so I think a bounce from here probably sends the market to the 1.2750 level. Alternately, if we break down through the candle of the week, then the market could go down to the 1.2250 level, possibly even the 1.20 level after that.

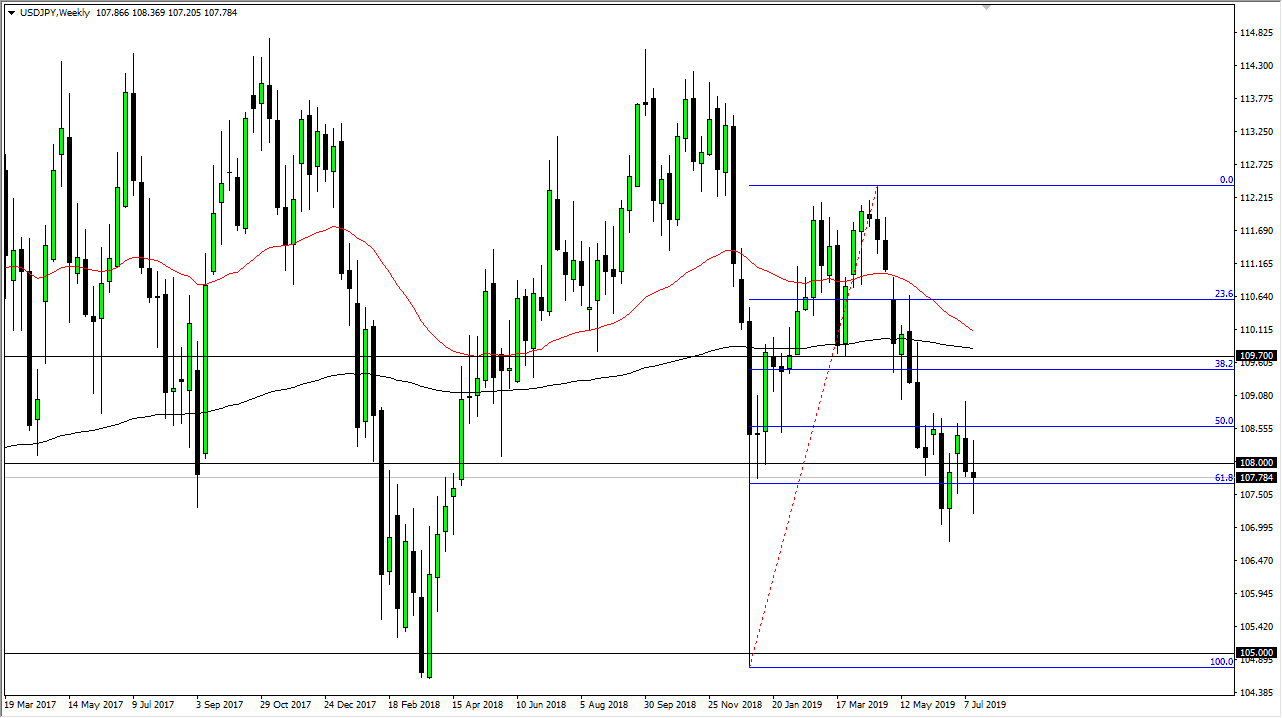

USD/JPY

The US dollar has gone back and forth during the week to form a relatively neutral candle stick against the Japanese yen, and I think this is indicative of what we can expect. I think we will simply go back and forth in the short term, so if you are a range bound trader you may find this an interesting market. Otherwise, you are probably better off leaving this one alone as there is no true directionality over the last month or more. That being the case, I think we need to wait for some type of impulsive candle stick on the weekly timeframe to be a bit more sure about putting significant money forward.