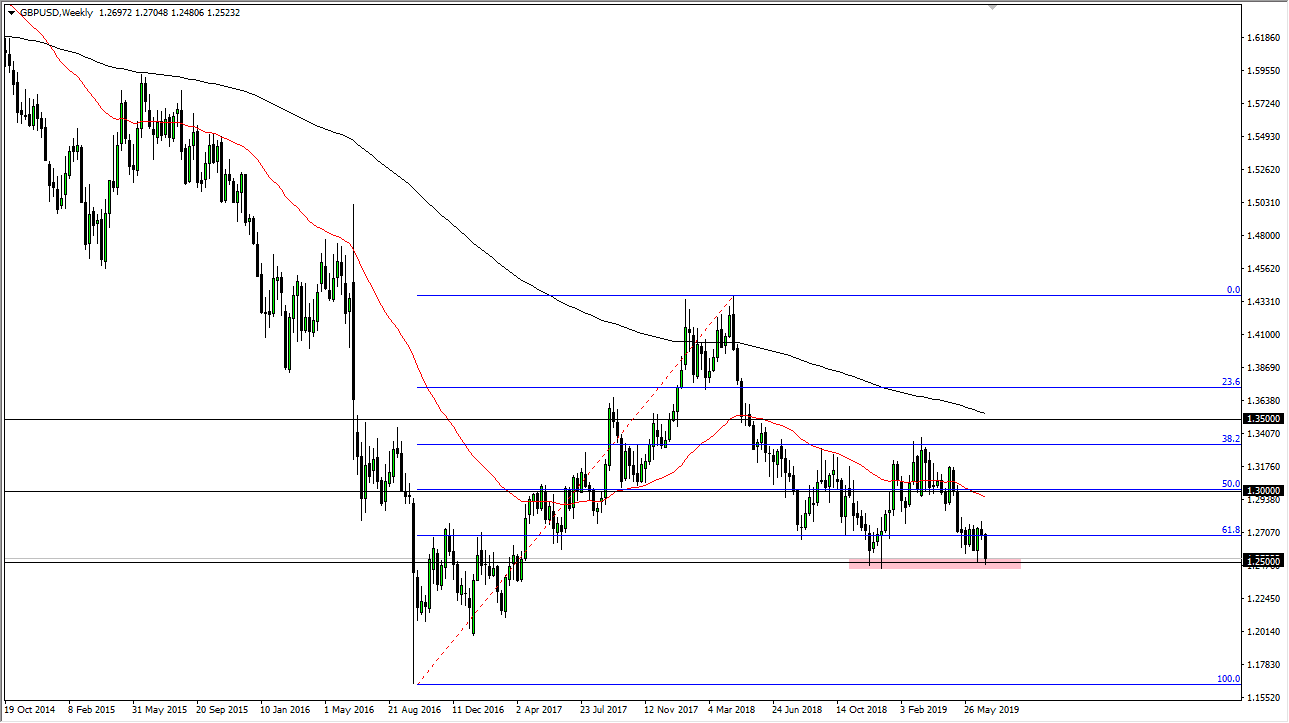

GBP/USD

The British pound had a very rough week, reaching down towards the 1.25 handle during the Friday session. At this point, it looks as if it’s relatively easy to determine where we go next in relation to the idea that the 1.25 level is crucial. As long as we stay above there, it’s likely that we could bounce towards the 1.27 handle. However, if we break down below the 1.25 level on a daily close, then the market probably drops a couple of hundred pips.

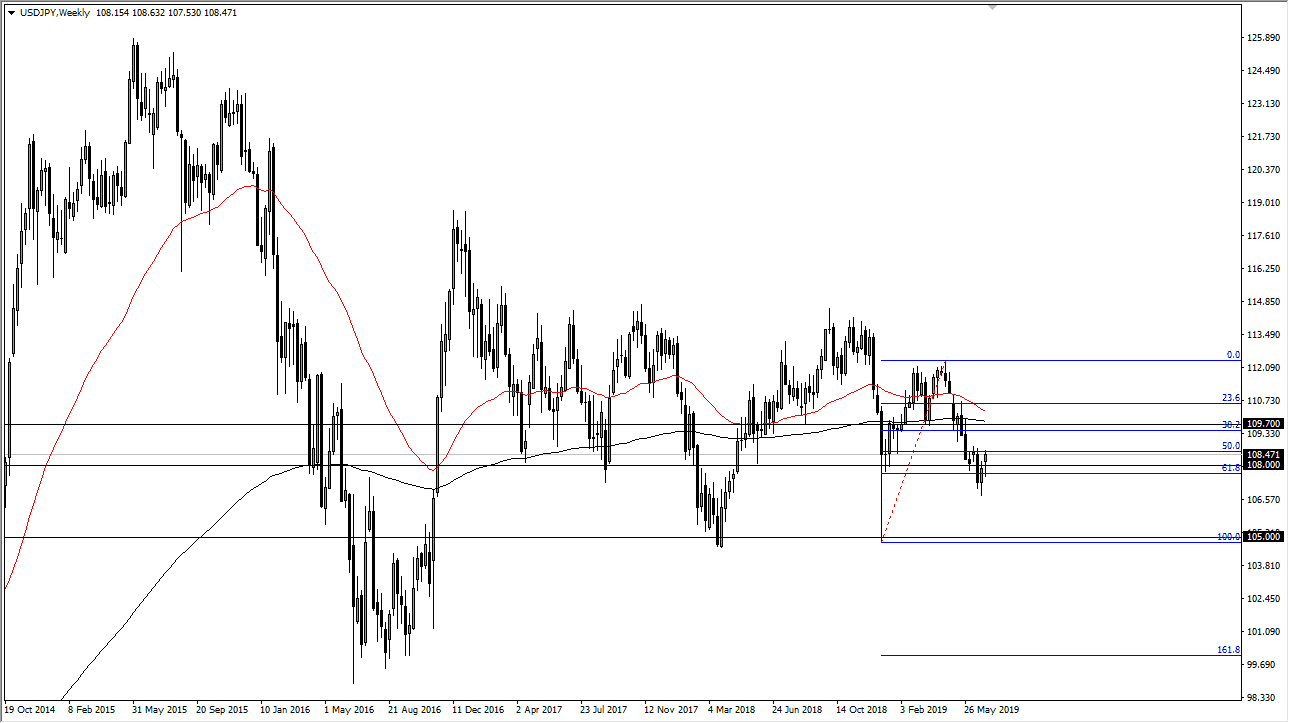

USD/JPY

The US dollar gapped higher during the open on Monday, but then pulled back significantly to find enough support to rally higher. At this point, it looks as if we are ready to continue going higher, and a break above the ¥108.60 level should open up the market towards the ¥109.70 level. Short-term pullbacks will more than likely find plenty of buyers underneath, as we continue to look healthy in the stock market, which should help this pair to go higher as well.

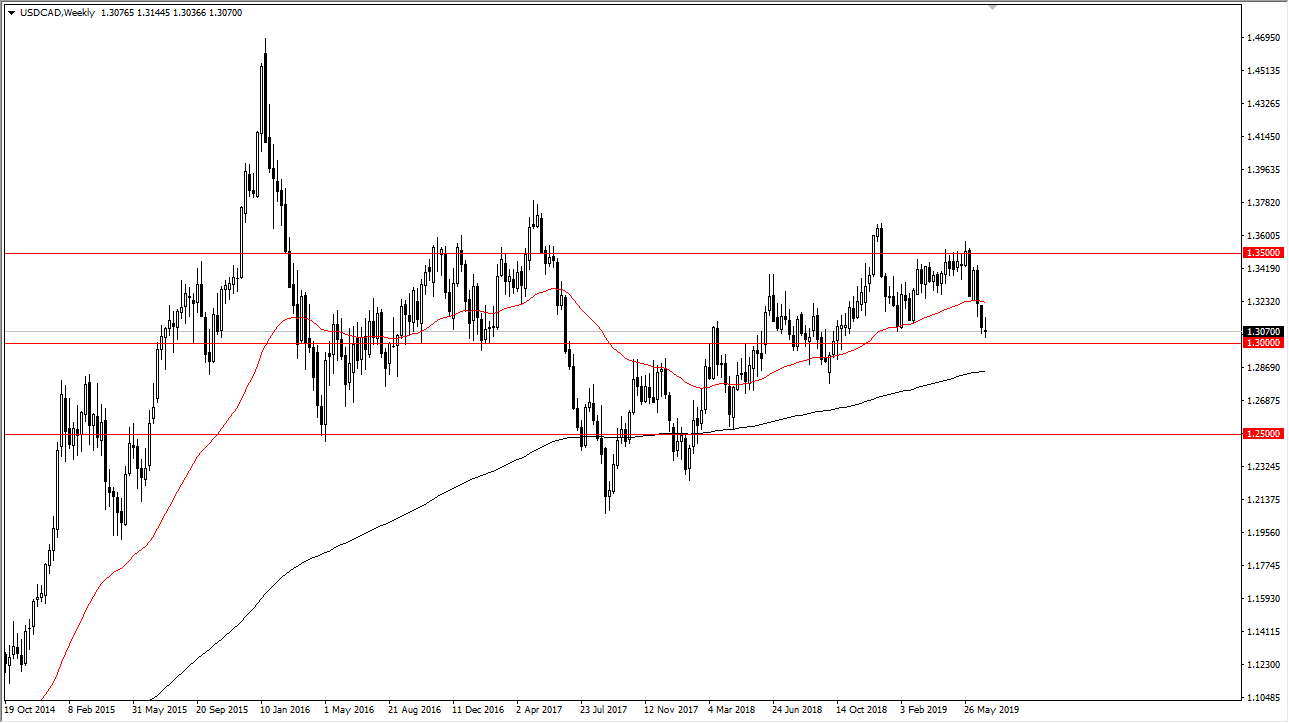

USD/CAD

The US dollar has gone back and forth against the Canadian dollar during the week, testing the 1.30 level as support. It has held so far, but if we break down below the 1.30 level, the market is very likely to go down to the 1.2850 level. A breakdown below that level opens up the door to much lower pricing. Alternately, if we break above the top of the candle stick for the week, then the market is probably going to go looking towards the 1.33 handle above.

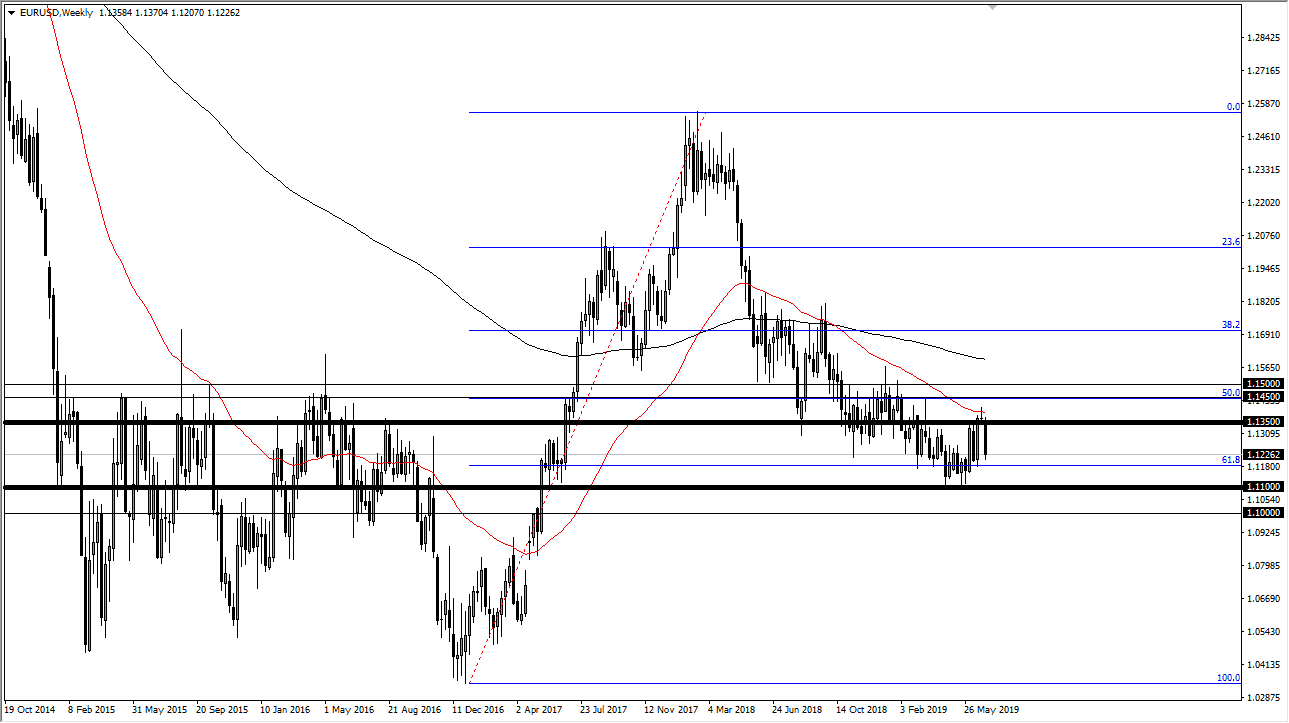

EUR/USD

The Euro fell hard during the week, breaking down towards the 1.12 handle on Friday as the jobs number with much stronger than anticipated. This long candle is pretty interesting, but it also shows that there is a lot of support underneath. The 1.11 level underneath is massive support as well, so ultimately some type of bounce from here is more than likely going to happen. That being said, it’s difficult to break above the 1.1350 level.