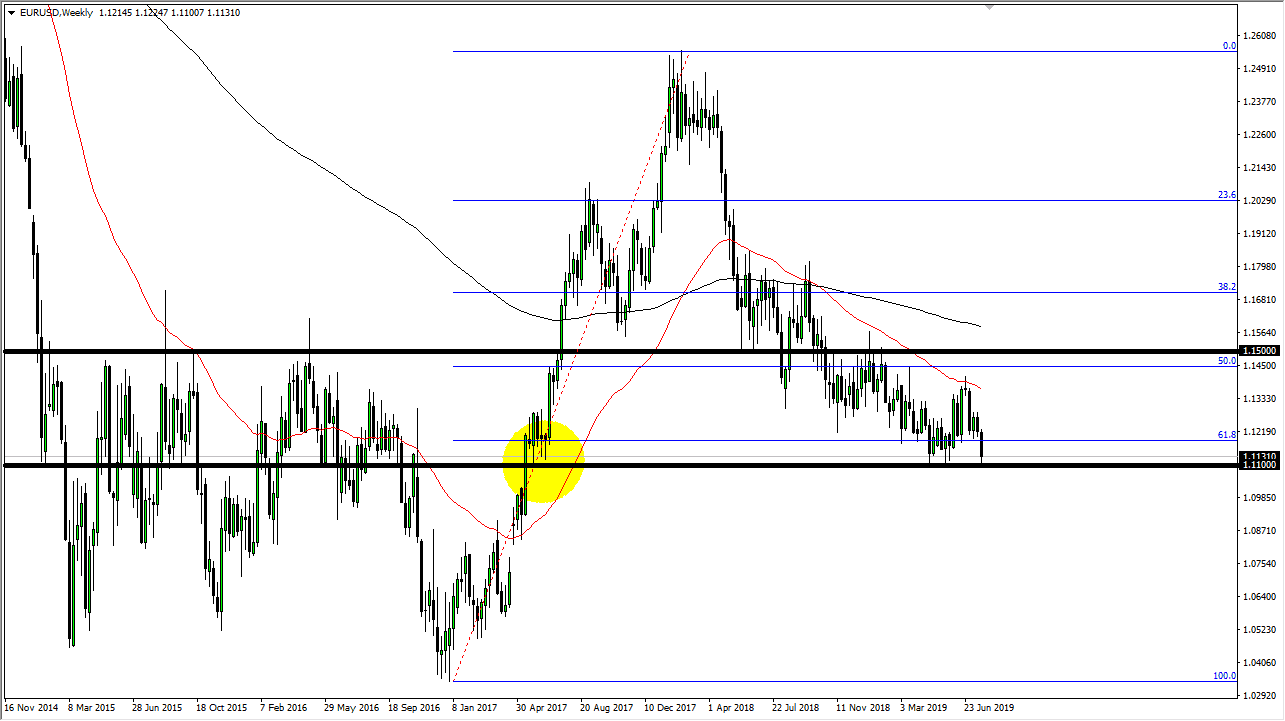

EUR/USD

The Euro broke down during the course of the week, reaching down towards the 1.11 level. This was mainly due to the ECB meeting, and of course the statement after the rate decision. The 1.11 level has been massive support as of late, and I think that there is support extending down to the 1.10 level. At this point, I think it’s going to be all about the Federal Reserve meeting coming up, so while it is short-term bearish I do think that we are going to turn right back around as the 61.8% Fibonacci retracement level will be supportive.

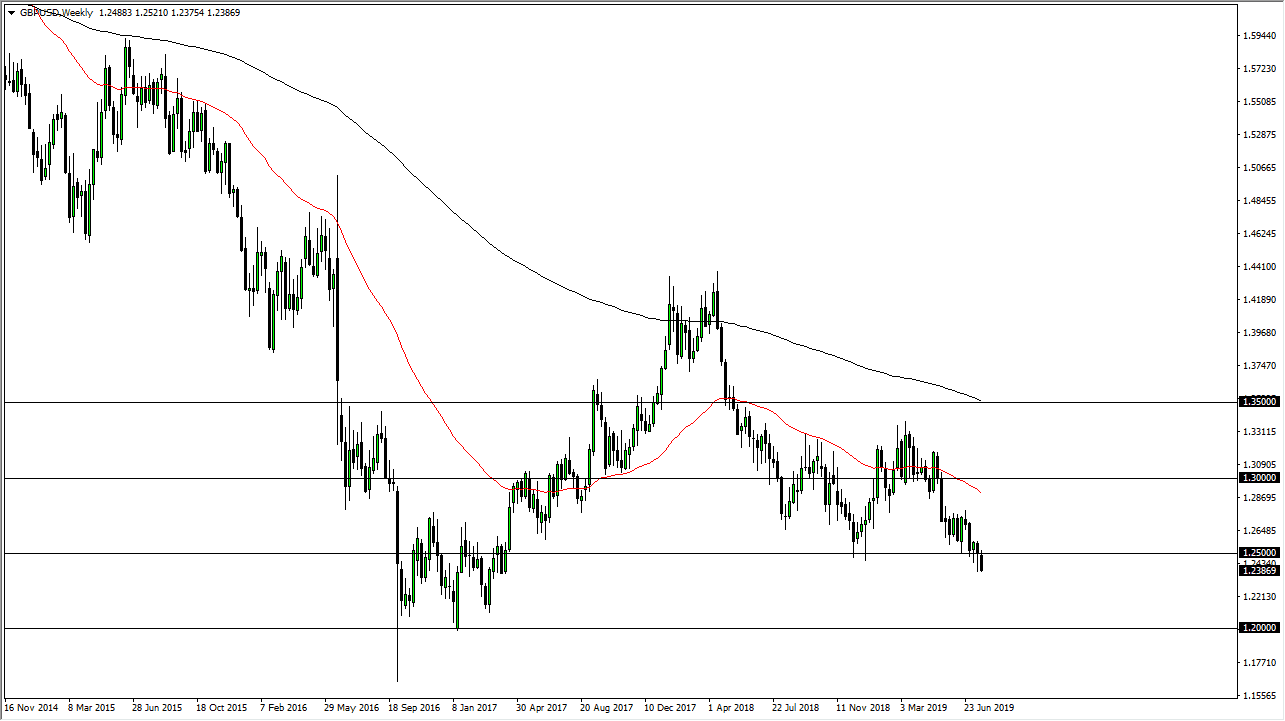

GBP/USD

The British pound has continued to show weakness, and I think that is going to be the way this market moves forward. Short-term rallies are selling opportunities, as the 1.25 level is massive resistance. That resistance extends to the 1.26 level above. At this point, I think any rally towards the 1.25 level is an invitation to start selling. The 1.2250 level underneath is a potential target, just as the 1.20 level after that. Ultimately, I do like the idea of shorting this market.

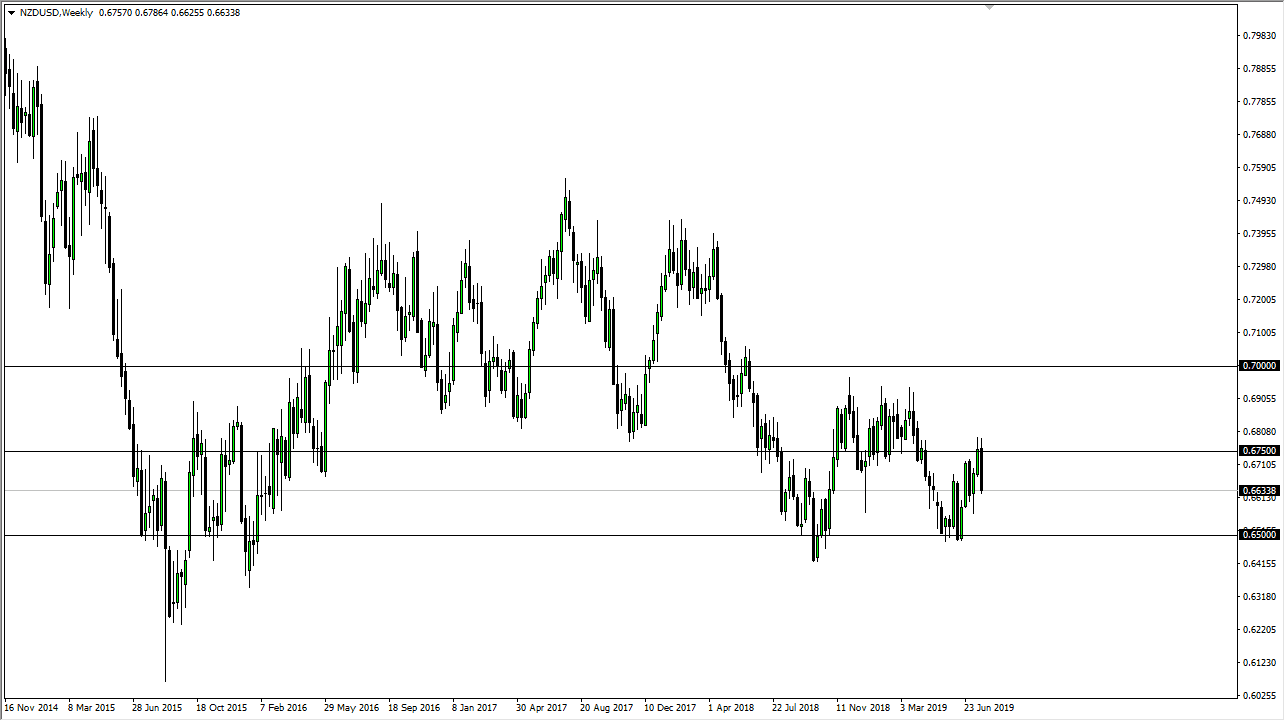

NZD/USD

The New Zealand dollar has broken down significantly during the week, as we have seen a lot of resistance at the 0.6750 level. I think at this point it’s likely that the market probably reaches a bit lower, perhaps reaching down towards the 0.65 level next. That’s an area that has been massive support in the past so I think it’s only a matter of time before buyers would return to the market if we reach that area. In the short term though, it looks like we may try to make that move.

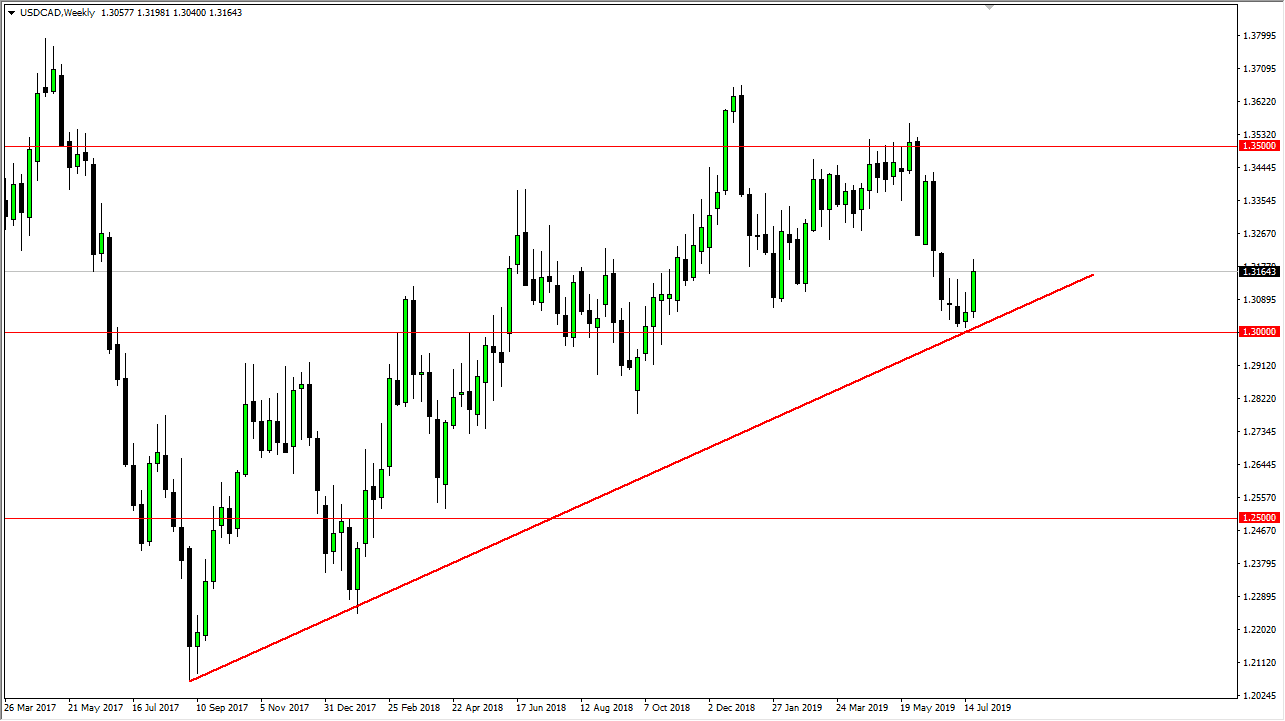

USD/CAD

The US dollar rallied during most of the week, breaking above the top of a couple of inverted hammers, bouncing from a trend line. This is a very bullish sign and I do think that eventually the US dollar continues to climb much higher. I think at this point the market probably goes looking towards 1.34 level. The trend line underneath should continue to offer support so as long as we can stay above there I have no interest in trying to short this market. All things being equal, we are in an uptrend and it looks like we have just saved that uptrend over the last couple of weeks. Breaking the top of two inverted hammers is in fact a very strong move.