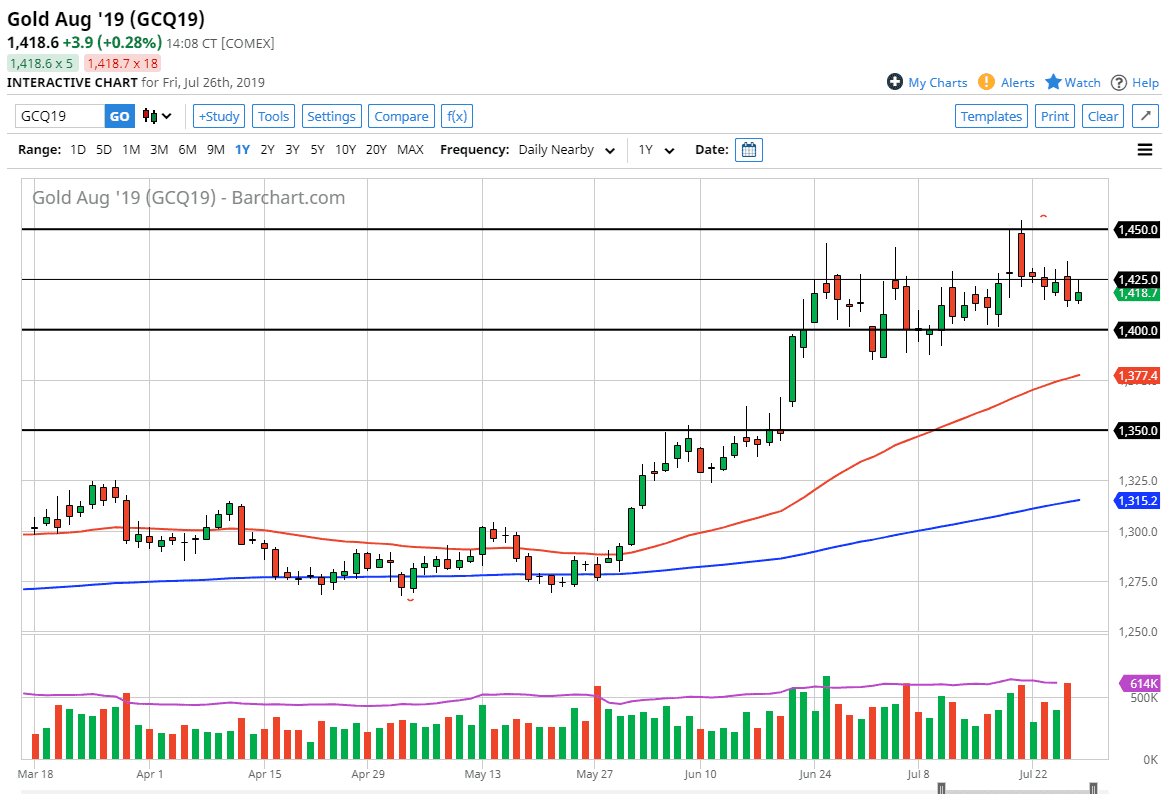

Gold markets initially tried to rally during the trading session on Friday but ran into a lot of trouble at the $1425 level. In fact, we reached towards that level and then turned around to form a less than attractive candle stick. At this point, the market seems to be getting a bit exhausted, which makes sense considering how bullish we had been. All things being equal though, there is a lot of noise underneath and that typically means support.

Central banks around the world continue to be very loose, and that of course will continue to put a bit of a bid into the precious metals markets as traders are looking for “hard money.” Ultimately, this is a market that will continue to find reasons go higher, not necessarily just because of the central bank policy, which should favor the Federal Reserve cutting rates, and perhaps even becoming ultra dovish.

At this point, I believe that the $1400 level underneath is massive support that extends down to the $1390 level, which is an area that’s worth paying attention to. Based upon the candlestick on Friday it would not surprise me at all to see this market head toward that level, and then find buyers in that region. I would look for some type of supportive candle or a bounce from that level to get involved to the upside, or there is also the alternate scenario that could throw traders back into this market as well.

The alternate scenario of course is that we break above the $1425 level and close above there on a daily candle stick. If we do, then that means we probably go looking towards the $1450 level again. Above there, the market more than likely will finally go looking towards the $1500 level, an area that I do think we try to get to eventually.

That support underneath should be rather stringent though, not only based upon the recent action that we have seen in that area, but the fact that the 50 day EMA is starting to reach towards the same region as well. That should continue to offer yet another reason why buyers will probably get involved and push the gold market to the upside. Quite frankly, unless the Federal Reserve doesn’t cut interest rates, I can’t imagine a scenario where gold breaks down significantly anytime soon.