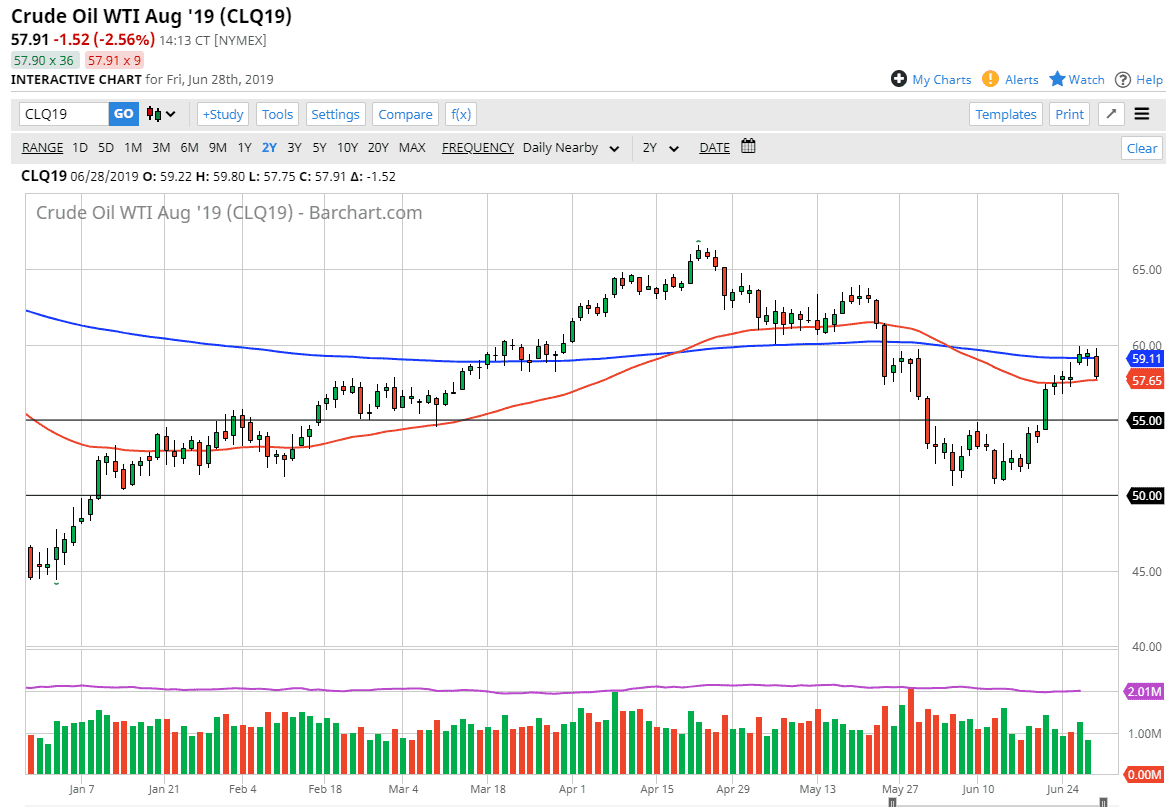

WTI Crude Oil

The WTI Crude Oil market fell hard later in the day, filling the gap that was marked on the daily chart and finding buyers near the 50 day EMA. Ultimately, this is a market that looks like it is trying to find buyers, based upon shorter-term charts. That being said, we are going into the weekend so it’s difficult to imagine a scenario where a lot of people willing to hang onto a huge position. That being said though, we obviously have a lot of tensions between the Americans and the Iranians that could flare prices to the upside. If we can break above the $60 level, this market is likely to go much higher as it would be a breach of serious resistance. To the downside, if we break down below the $57 level, the market probably goes down to the $55 level next. In that area, I would expect quite a bit of support.

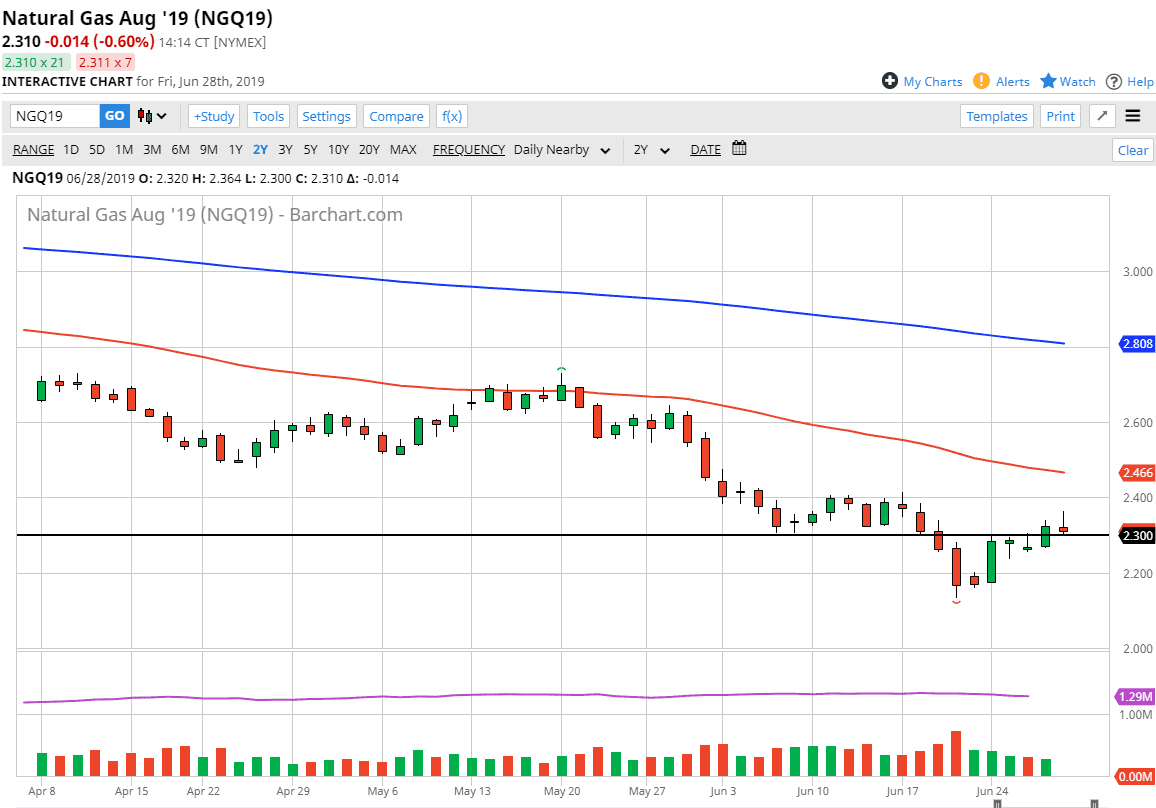

Natural Gas

Natural gas markets initially tried to rally during the trading session on Friday but gave back quite a bit of the gains to form a bit of a shooting star. Ultimately, I think that the $2.40 level will continue to cause issues, as we are most certainly in a downtrend. If we can break down below the bottom of the candle stick, it’s likely that we go down to the $2.20 level underneath. Longer-term, I believe that we are going to go towards the $2.00 level but obviously that’s not somewhere where we are going to be tomorrow. All things being equal I like the idea of selling rallies on signs of exhaustion, as this market has been so negative for so long. I do not have any interest in trying to buy natural gas at this time a year and believe that there is a lot of resistance all the way to at least the $2.40 level.