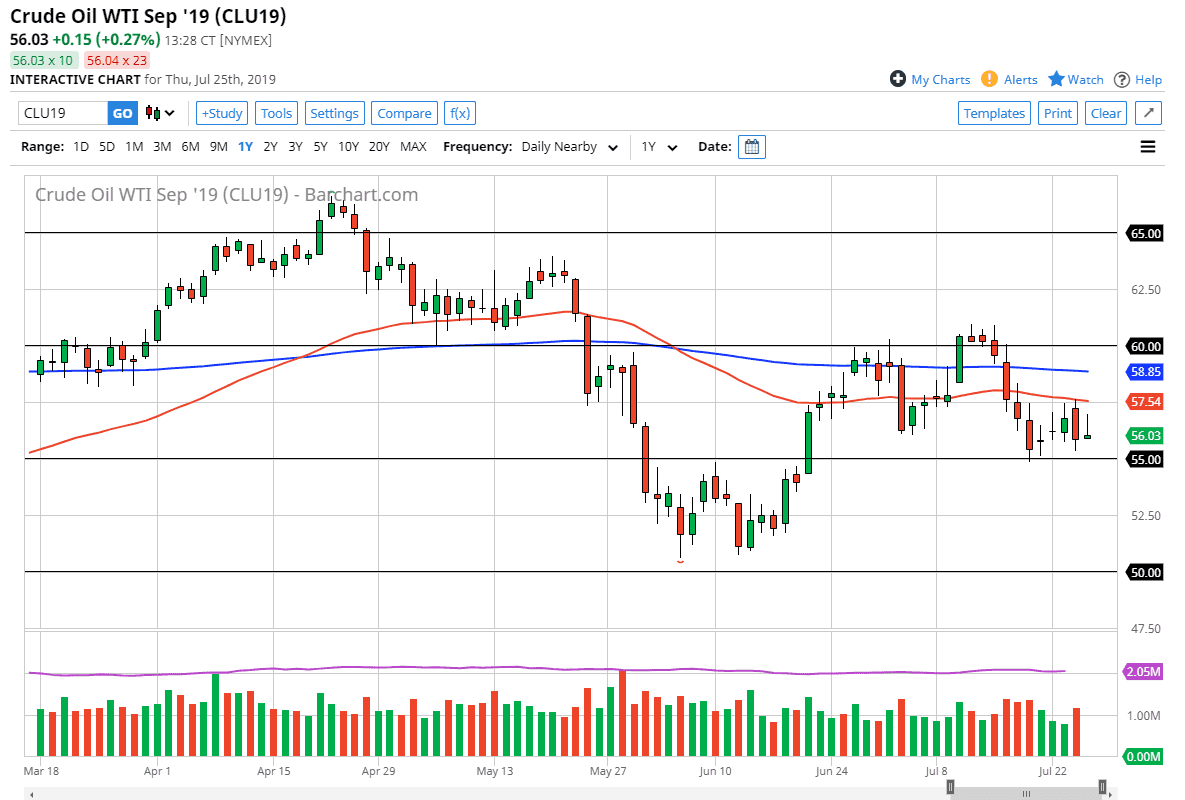

The WTI Crude Oil market struggled a bit during the trading session on Thursday after initially trying to rally. As you can see the 50 day EMA has caused a significant amount of resistance as we pulled back significantly from there. The candle stick is very poor, and it looks as if we are going to try to make a move underneath the important $55 level. If we break down below that level, it’s likely that the market probably goes down to the $52.50 level. The way I trade this market is to simply short rallies that show signs of exhaustion, as it would make sense to see traders come in and punish this market.

The US/Iran tensions continue to be front and center, and quite frankly if they can’t lift the value of crude oil, this is a very bad sign in this market because quite frankly 10 years ago that would have skyrocketed this commodity. However, the United States provide 75% of its own crude oil, export some of it, and gets the rest for places like Canada, places that aren’t necessarily going to be an issue. Unless we suddenly see Canadian troops amassing at the North Dakota border, I suspect that the flow of crude oil in North America continues.

Overall, I like the idea of fading rallies and believe that the market is paying close attention to the 50 day EMA, but if we were to break above there it’s likely that the next target would be the 200 day EMA which is in blue. A break down below the $55 level opens up the market to much more significant losses, perhaps not only to the $52.50 level, but even the $50.00 level. I don’t have any interest in buying, because quite frankly the market is telling me otherwise.