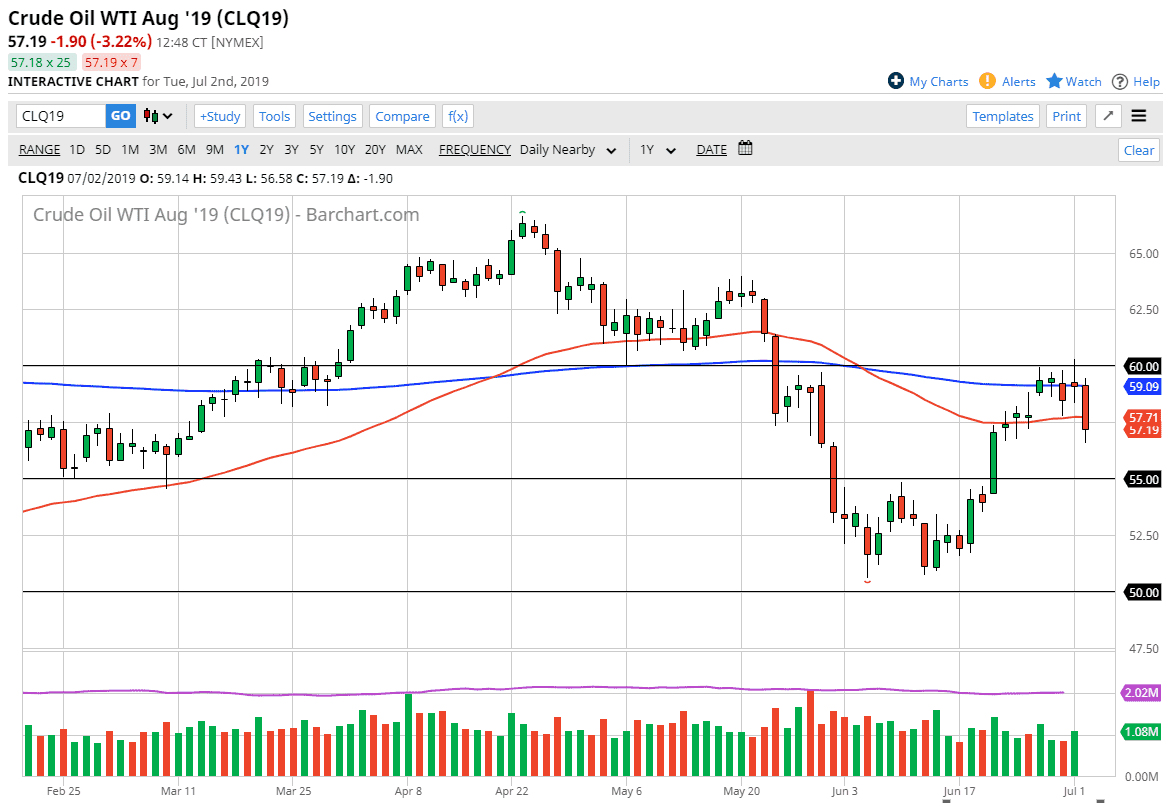

The WTI Crude Oil market broke down significantly during the trading session on Tuesday, slicing below the 50 day EMA. This is a very negative sign and a bit surprising considering that the market had been so bullish until this session. The OPEC deal to keep production down has been rolled over, but that doesn’t seem to be enough. With the Americans pumping out over 12 million barrels a day, there’s only so much that OPEC can do, especially considering that the global demand picture is starting to look less strong.

In this scenario, and of course with a reasonably strong US dollar, that’s a bit of a “one-two punch” for the crude oil market. However, there is a certain amount of support underneath at the $57 level, which is followed up by the $55 level. I don’t think that we are going to start crashing at this point, and I do believe that the buyers will come back into the marketplace. It’s very likely that we are trying to carve out a summer range, with the $55 level offering the “floor”, while the $60 could offer the “ceiling.”

If we were to break above the $60 level, then it is very likely that we could open the door to the $62.50 level. However, if we were to break down below the $55 level it’s very likely that the market could go down to the $51 level again where we had seen quite a bit of buying pressure. Looking at the chart, I think a choppy couple of weeks are on tap for the marketplace, especially considering that the Americans are going to be celebrating Independence Day, and of course we have the jobs number coming up on Friday. This week will probably be somewhat thin, and next week will give us a few more clues as to where were going longer-term. With that, we have a nice set up for a lot of choppiness, and of course it’s only a matter time before the US/China situation starts to have people wondering about global demand as well, so at this point I think it’s difficult to hang onto a longer-term position, and I’m simply looking at this market as one that is bouncing around in this five dollar range until proven otherwise. As we are in the middle of this range, I suspect that it’s probably a bit dangerous to be putting money to work right now.