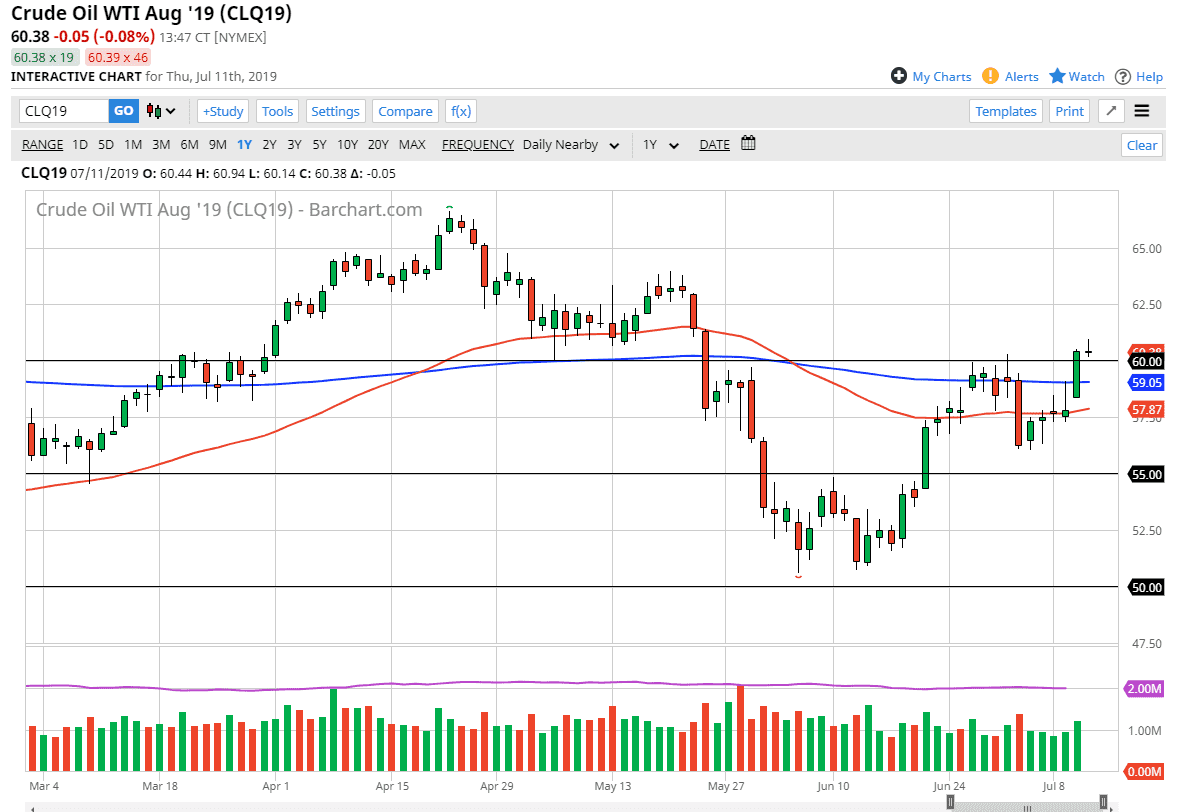

The WTI Crude Oil market clear the $60 level during the trading session on Thursday but did stall above there as we couldn’t quite keep up the massive momentum. That being said, we gave back quite a bit of the gains and have formed a long way to the upside. If we can break above that level though, it’s very likely that this market will break out to the upside and continue to go much higher. With that being the case, I like buying short-term dips, and will use a couple of technical levels underneath to keep an eye on the uptrend.

I believe that the 200 day EMA underneath which is pictured in blue on the chart should offer support. I also recognize that the $60 level should as well, but I think that’s a little less significant. The 50 day EMA which is in red looks as if it is ready to reach towards the 200 day EMA, and perhaps cross above it. That would be a “golden cross” which a lot of long-term traders really like. If that’s going to be the case I suspect it’s only a matter time before fresh money comes back into the market.

To the upside I anticipate that the $62.50 level could be the target, as it has been resistance previously. Crude oil markets will continue to have a lot of volatility built into it due to the Iranian tensions, and of course the US dollar being worked against by the Federal Reserve. If we get a lot of interest rate cuts, that should weigh upon the US dollar which should help crude oil in general.

That being said, we do have a problem with over supply of crude longer-term, and I do think that it’s only a matter of time before we sell off again. However, I do think that we have a destination at the $62.50 level that we are trying to get to, so in the short term I think there is still some room to play with. Short-term dips offer buying opportunities, unless of course we were to break down below the 50 day red EMA, which is a major support barrier. A breakdown below that level then starts to cause significant problems in this market, and perhaps even threaten the overall uptrend that we have seen for several weeks.