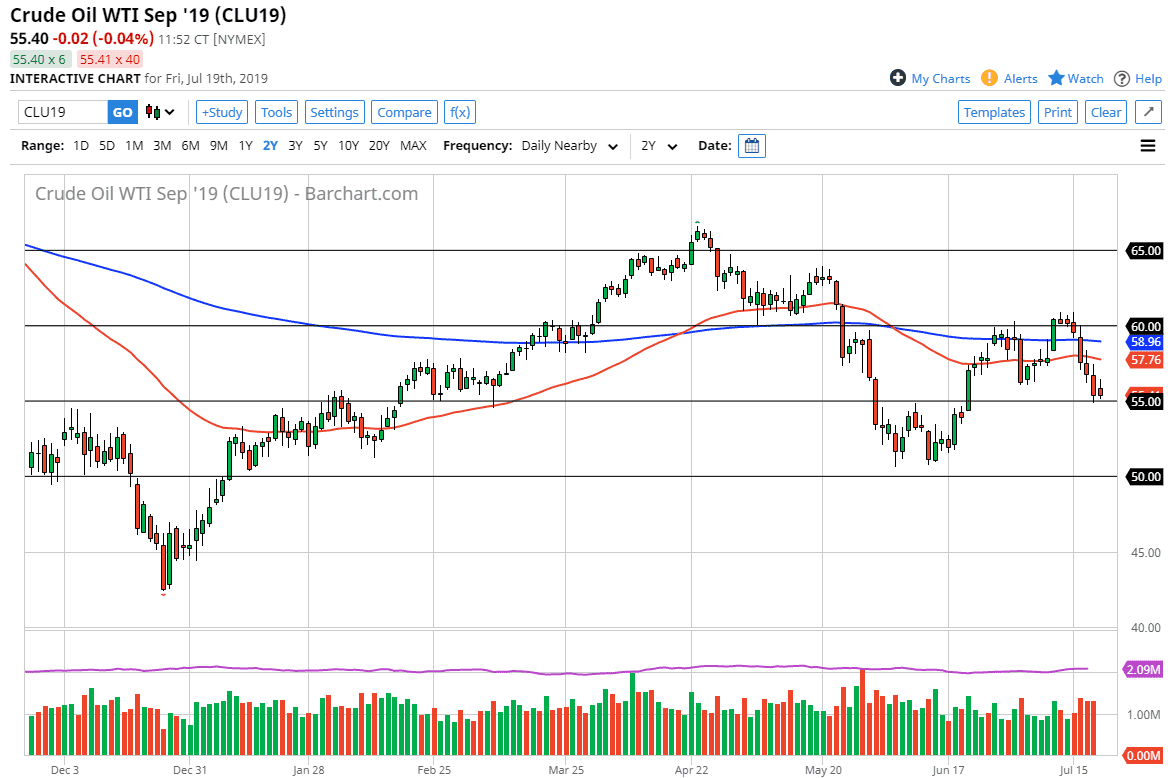

The WTI Crude Oil market initially tried to rally during the trading session on Friday, but then rolled over to show signs of exhaustion again, reaching down to the $55 level. That’s an area that was previous resistance, and it should now be supported. At this point, you should also recognize the fact that it is a large, round, psychologically significant figure, so that of course is something to pay attention to as well.

Looking at this candlestick, it suggests that we are going to go lower, but ultimately if we were to break above the top of the candle stick, that would show a certain amount of resiliency, and then I think we could probably continue to find resistance above, especially near the 50 day EMA, or perhaps even the blue 200 day EMA.

This being the case, I suspect that we are more than likely going to continue to see sellers come into the market at the first signs of exhaustion. If we break down below the $55 level on a daily close, then the market probably drops down to the $51 level. That is an area that extends down to the $50 level as well, so I think it’s only a matter of time before we reach down to that area. After all, the global economy seems to be slowing down, and that will more than likely bring down demand for energy, which of course WTI will be sensitive to.

With a slower global economy, quite often you will see a run towards safety. That being the case the US dollar has strengthened in the bond market, but ultimately I think what we are really looking at here is in fact, but rather a simple observation that the tensions between the Americans and the Iranians are dying down, at least somewhat, and if central banks around the world are starting to cut interest rates the first question that you need to ask is “how strong can the economy be?” If it’s not strong, then why would we need any significant amount of crude oil? This being the case, the market will probably continue to show bearish pressure. All things being equal, this is a market that continues to show bearish pressure and therefore you should not be fighting it, rather joining in and you get the opportunity. This market will continue to be volatile, but I think it’s starting to show its true colors.