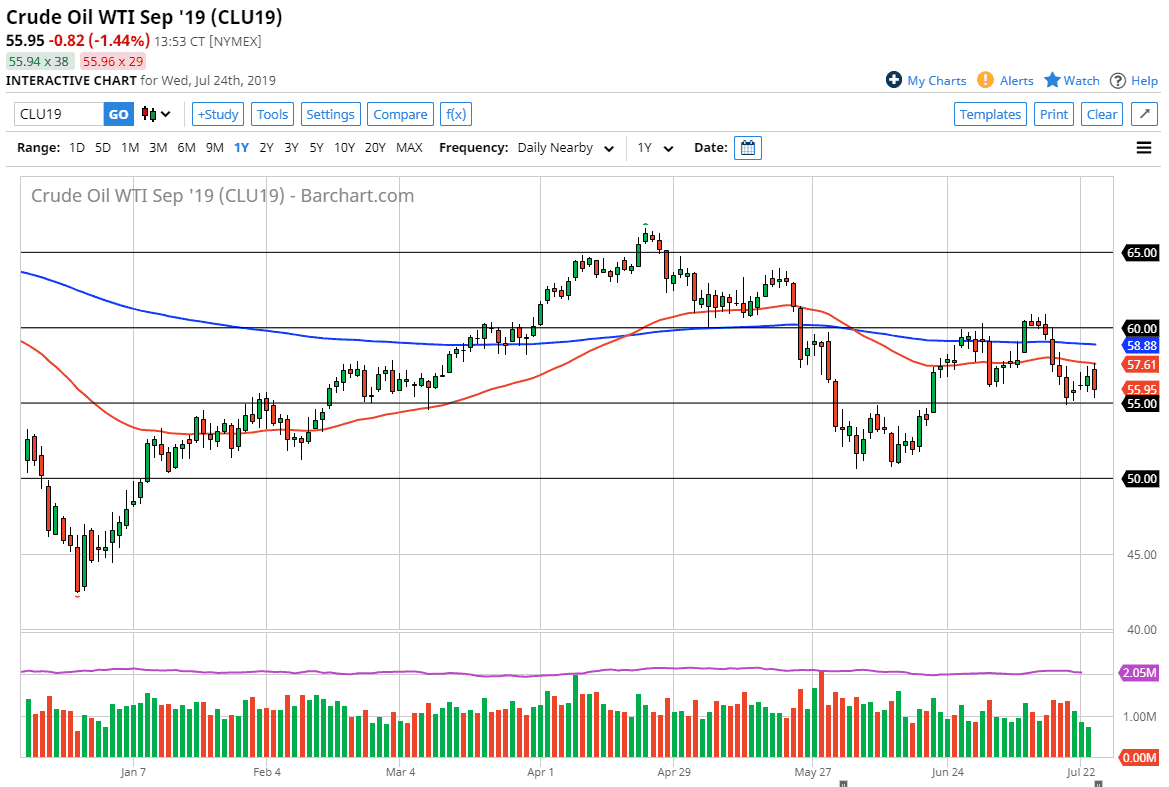

The WTI Crude Oil market tried to rally during the trading session on Wednesday, reaching towards the 50 day EMA which is on the chart. At this point, the market looks likely that we break down every time we reach that area, and if you read the analysis that we did during the previous session, I suggested that the 50 day EMA could cause a lot of problems. It has now, so it’s likely that we are going to continue to roll over from here.

The $55 level underneath was a target, and we did reach towards that area before bouncing slightly. At this being the case, if we can break down below the $55 level it would send the market much lower. This is a large, round, psychologically significant figure, and should give me an opportunity to start selling again. It is a major support level due to the round figure in the psychology involved, but also the previous resistance.

If we can get below there, the market then goes down to the $51 level, looking for support as the market would see a bit of a “zone of support” down to the $50.00 level. Ultimately I do think that we break down given enough time, as we can’t keep the bullish picture going forward. After all, the Iranian tensions can’t even pick up the oil markets, and of course the fact that we know the Federal Reserve is cutting rates can’t help from the currency side, it’s just going to be difficult to find any reason to get bullish at this point.

Adding further fuel to the fire is the fact that the global demand for crude oil seems to be slipping. The global economy seems to be slowing down, and that of course is going to suggest that there will be a lot less demand. After all, if factories are cranking out at full tilt, they need less energy. It also has a bit of a ripple effect considering the trucking won’t need petroleum either. At this point, I think it’s easy to fade rallies on short-term charts that show signs of exhaustion, as this market simply cannot get out of its own way. Overall, it’s not until we get a daily close above the 50 day EMA that I would be even remotely pressed to go long, and even then I think it would take a long look at the market.