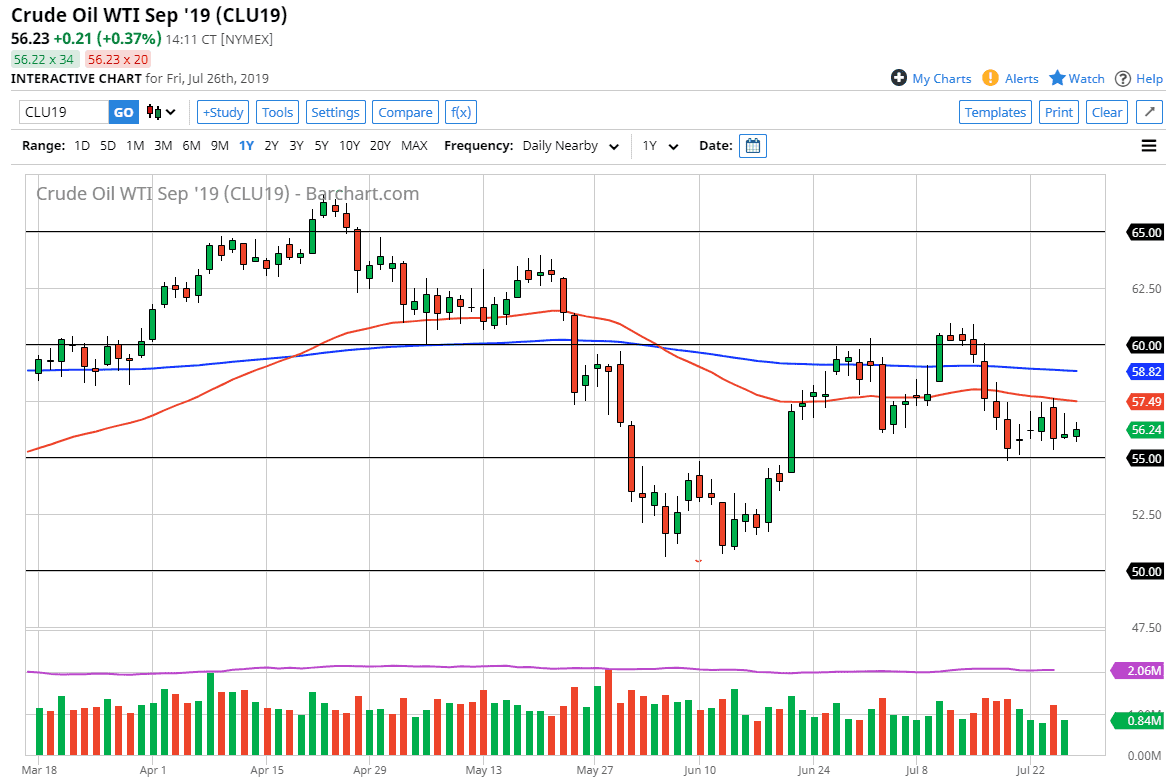

The West Texas Intermediate crude oil market continues to be very choppy, as the entire week has been stuck between the $55 level underneath, and the $57.50 level above. All things being equal, this is a market that seems like it has nowhere to go, as we have a lot of conflicting issues out there pushing oil around.

One of the more bullish situations is that the United States, Great Britain, and the Iranians are all bickering about the Straits of Hormuz. Ultimately, this is a market that is going to continue to be very difficult because of that scenario, which could of course caused a bit of reaction. However, the market seems to be stuck in a range, and this tells me that there isn’t enough fear when it comes to the Iranian situation to keep this market to the upside. However, it’s obvious that there is a lot of support at the $55.00 level. That being the case, I think we don’t really have anywhere to go.

If we rally from here, then the $57.50 level could cause a bit of trouble as well, just as the $60.00 level is as well. This is a market that will continue to be very choppy and difficult, so I think at this point you are probably best to trade this market on short time frames, in $2.50 increments. Looking at the chart, I think day traders will continue to push this market around, as we just don’t have enough fundamental pressure in one direction or the other to take control of this market. That being said though, we are also in a very quiet time of year typically as a lot of the larger traders are away at holiday. With that, I think that we will eventually get a significant amount of movement eventually, but right now we are looking at the rest of the world for some time of reason to hang onto a position.

The demand for crude oil will continue to be an issue if global markets recognize that we are slowing down economically. We are around the world, although the United States seems to be doing “reasonably well.” With that, it does help the oil market but the lack of demand and many other parts of the world will continue to be a drag upon price. At this point, the range bound short-term trading system is probably best.