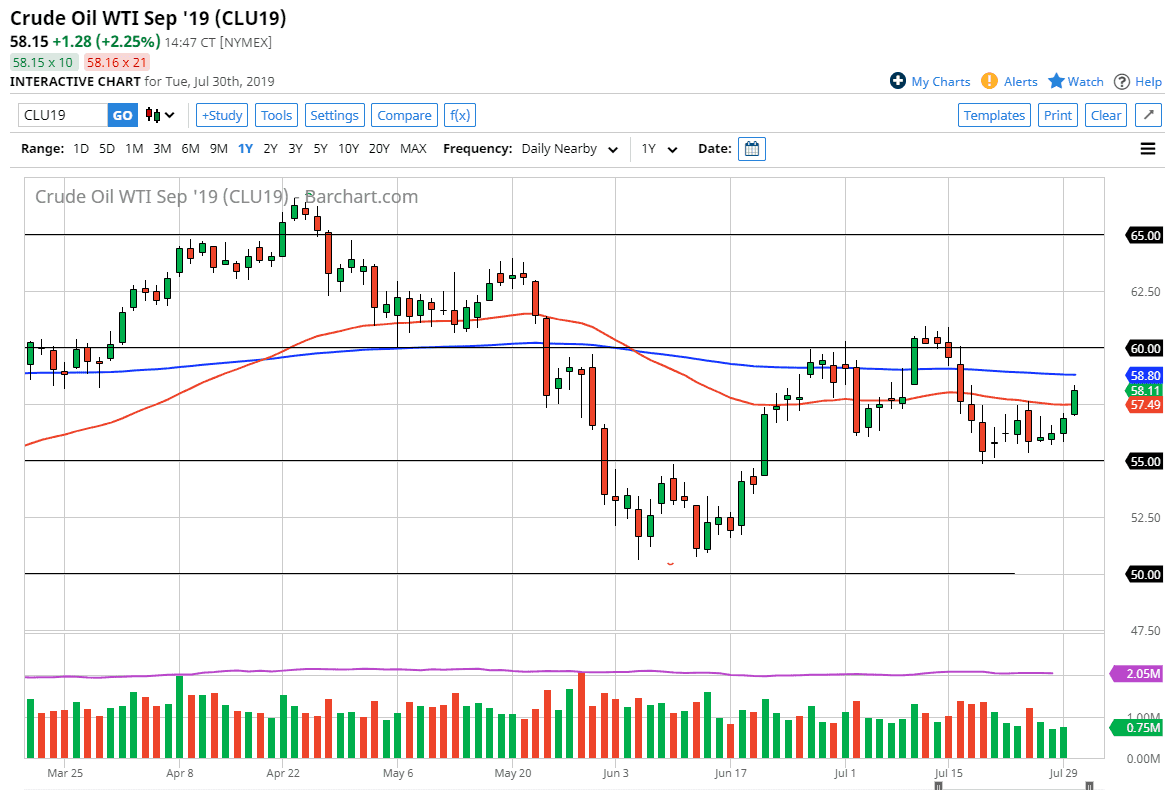

The WTI Crude Oil market has rallied significantly late in the day on Tuesday, breaking above the psychologically important $57.50 level, as well as the 50 day EMA. That’s a good sign, so therefore it’s likely that we are looking at the market as one that’s ready to test the 200 day EMA above, which is the blue EMA that I have marked on the chart.

Looking at this chart, you can also see that we have broken out of a short-term range of $2.50, so I think at this point it’s very likely that the market could make a move towards the $60.00 level as it would be a measured move higher. However, we have the Federal Reserve interest rate announcement and statement after the announcement. If we get an extremely dovish statement, and perhaps signs that the Federal Reserve is willing to continue to cut rates after this one, could send the US dollar lower, perhaps driving this market higher.

All things being equal if we do break down below the $57.50 level, we will probably reenter the previous consolidation area. Overall though, I think that this market will continue to try to go higher, at least in the short term. I believe that we are trying to trade between the $55 level on the bottom and the $60 level on the top. We are in the dead of summer, and that means we have very little in the way of volatility. We did almost nothing for a couple of weeks and that’s probably more common than not this time of year.

If we were to break above the $60 level, that would be a very bullish sign and could send this market higher. However, if we were to break down below the $55 level we could then go down towards the $52.50 level and then the $50 level. I suspect that trying to trade ahead of the Federal Reserve is going to be a bit difficult but when I look at the commodities markets around the world, it certainly looks as if people are expecting an extraordinarily dovish fed to boost commodity prices in general, and I think that’s part of what we are starting to see late in the day on Tuesday. We are essentially in the middle of the larger consolidation, but it does look like we favor the upside short term.