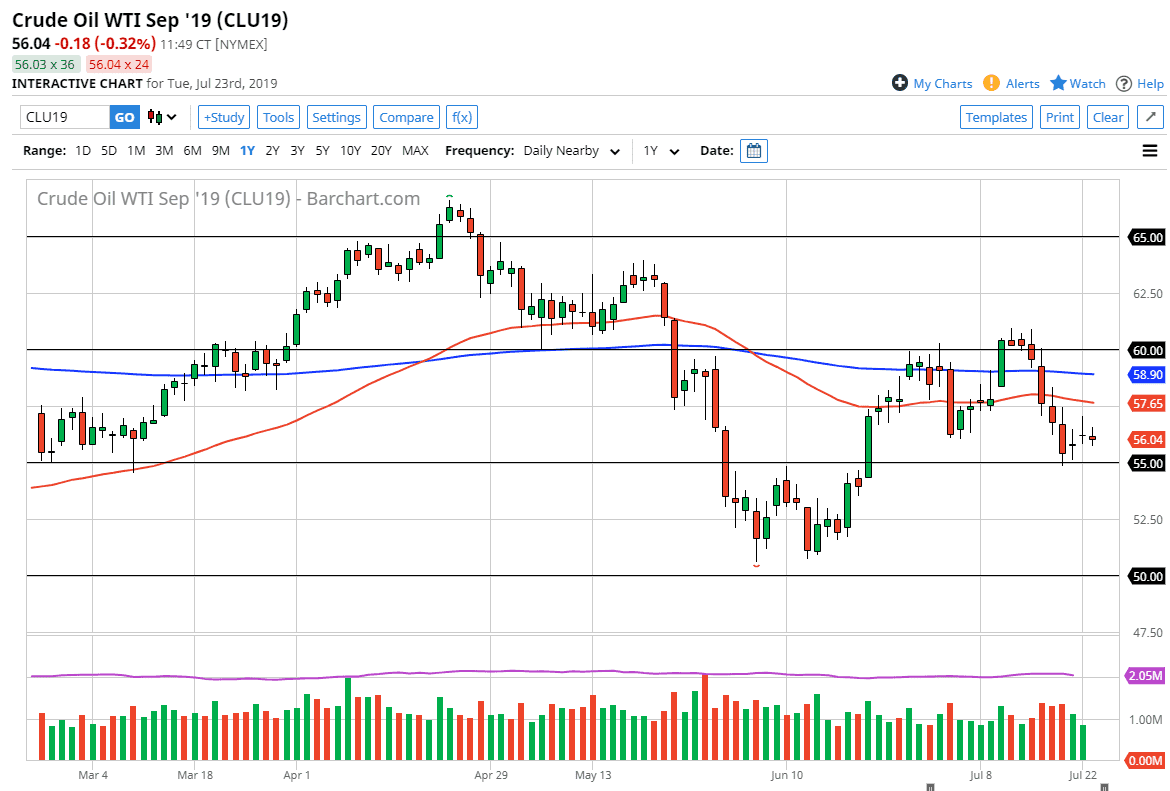

The WTI Crude Oil market went back and forth during the trading session on Tuesday, showing signs of neutrality as we can’t make a decision in one direction or another. The last couple of trading sessions have formed a neutral candle’s, and now Tuesday is simply a continuation of that. The $55 level underneath is massive support, and of course psychologically important. I think it’s probably going to take a lot of momentum to finally slice through there in order to go lower. I believe that rallies are to be sold, especially considering that the technical set up looks so bearish.

The 50 day EMA should offer resistance just above the $57.50 level as it is a significant technical indicator for trend. It’s also interesting that considering the Americans and Iranians are going out of their way to ratchet up attention to the Straits area of Hormuz, the reality is the markets don’t seem to care much. This is mainly due to the fact that global demand is going to be an issue, as the economies around the world seem to be slowing. Beyond that, and other major bearish factor is that Americans are producing massive amounts of crude oil every month. In fact, the United States is on track to produce 13 million barrels each month, which of course works against the value of oil as the oversupply continues to be a real threat. Furthermore, the little bit of crude oil that is imported into United States typically comes from Canada.

Rallies at this point will continue to be faded, because if we can’t get a rally based upon geopolitical conflict with the Iranians and potential military attacks, then what exactly is going to lift this market? However, if we were to break above the 50 day EMA, it’s likely that we could go to the $60 handle next. Obviously, that’s going to have to take a significant change in attitude, something that simply doesn’t look very likely to happen. To the downside, if we were to break down below the $55 level it will more than likely send this market looking for the $52.50 level, and then possibly even $51 after that. This is a market that is bearish and should be traded as such. Regardless though, this is a market that will be noisy so keep that in mind and make sure your position size is a bit smaller than usual.