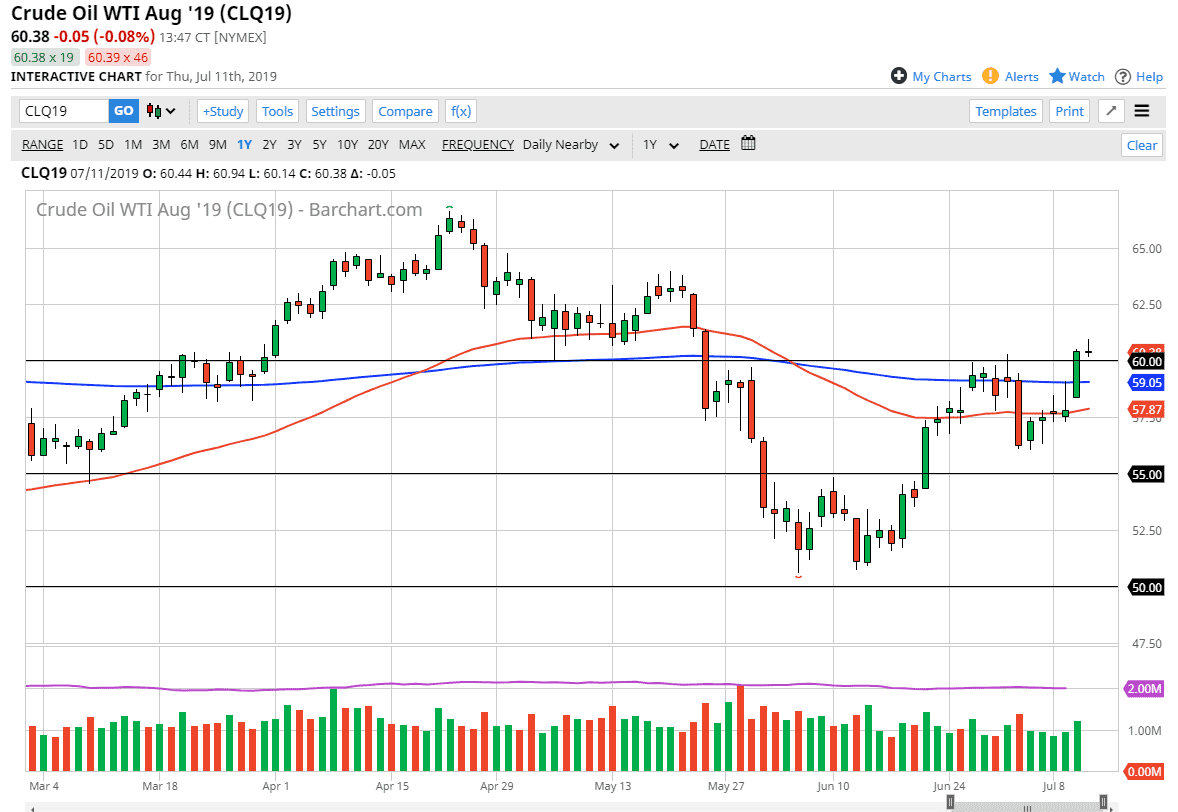

The WTI Crude Oil market has gone back and forth during the trading session on Friday, sitting just above the psychologically important $60 level. Beyond that, the market is looking at signs of exhaustion, as the Thursday candle stick also show signs of exhaustion as well. It is a shooting star, so that of course is a major negative sign. However, if we were to turn around and break above the shooting star, it’s likely that the market will probably go looking towards the $64 level above which was previous resistance.

Looking at the chart, I also recognize that the 50 day EMA is trying to cross back above the 200 day EMA, which is the “golden cross.” Looking at this chart, I do think that the 200 day EMA will also offer support so in general this is a market that I think will offer buying opportunities on dips, especially considering that there is a tropical storm heading into one of the areas of the United States that tends to have a lot of oil production and distribution.

I have no interest in shorting this market, it is quite too strong over the last couple of weeks. These pullbacks to offer buying opportunities, and we may get one here but I do recognize that a break below the 50 day EMA, pictured in red on this chart, could be a very negative sign. At that point I would anticipate that the move will probably be down to the $56 level, possibly even the $55 level after that. Ultimately, this is a market that is trying to make a move, but I think that choppy days are ahead of us as we have a lot of different moving pieces.

The United States and Iran continue to have tensions, and of course there are a lot of concerns when it comes down to the global growth situation. If global growth stops, then it’s very likely that we will continue to see crude oil struggle. In other words, we have pressure in both directions. All things being equal, I believe the one thing you can probably count on is choppiness in this market. I do favor the upside given enough time, but I also recognize that we will get the sudden pullbacks occasionally that cause significant issues. To the upside, there are a lot of sellers waiting so take your profits quickly.