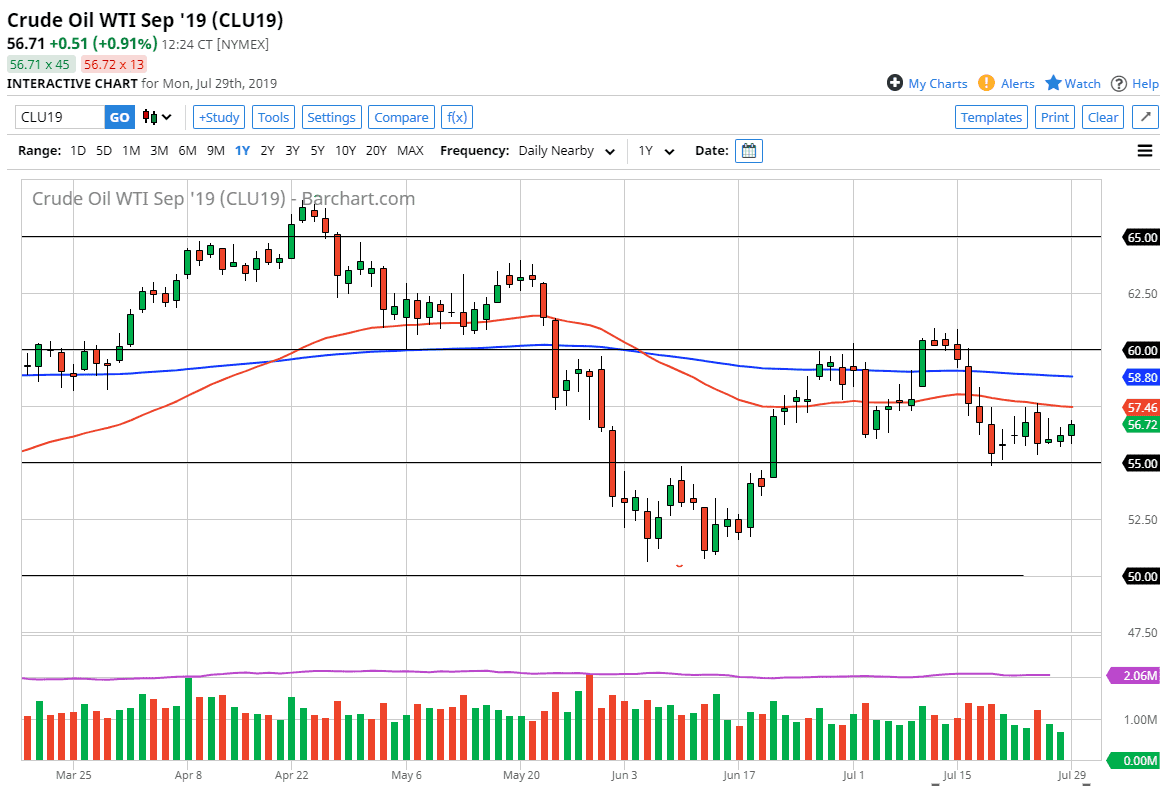

The WTI market has done very little again during the trading session on Monday, as we continue to go back and forth, and therefore it’s likely that we will continue to see choppiness and a general lack of interest in the market. The $57.50 level above has offered resistance, just as the $55.00 level on support. At this point in time, it’s very likely that the market will continue to trade in this $2.50 level, and I think it’s very likely that we are simply going to bounce around in this area without any clear directionality.

We have a whole slew of issues out there driving the crude oil markets, and therefore the dynamics are pushing things in both directions. We have the Iranian tensions which should in theory be bullish for crude oil, but we have a bigger issue at play, the fact that there isn’t as much global demand as you would expect. Beyond that, the United States produces plenty of crude oil now, and therefore that puts a lot of supply into the marketplace as they are good for over 12 million barrels a day.

The 50 day EMA is just above, near the $57.50 level. That’s an area that has been resistive and now that the 50 day EMA is sitting right on it, that should be massive resistance. To the downside, the $55.00 level has been very supportive recently as well as being significant resistance back in June. You’ll notice that on the chart I have a five dollar increments marked off with lines, as the Gold markets do tend to be very technically driven.

Because of this, I think we are simply going to continue to bounce around in this $2.50 level, as volatility has dropped. Under normal circumstances, I would have more of a five dollars range to trading, but right now it looks as if the markets are lulling themselves to sleep. Ultimately, this is a market that continues to be very technically driven, but of course also has all of those geopolitical issues attached to it. With a global slowdown, I think that is clearly a bigger issue than anything else right now. Granted, 10 years ago that problem with Iran would have added $15 to the price of oil, but things have changed and that’s the one thing you should keep in mind. With the Federal Reserve meeting over the next couple of days, we could get FX headwinds or help as well.