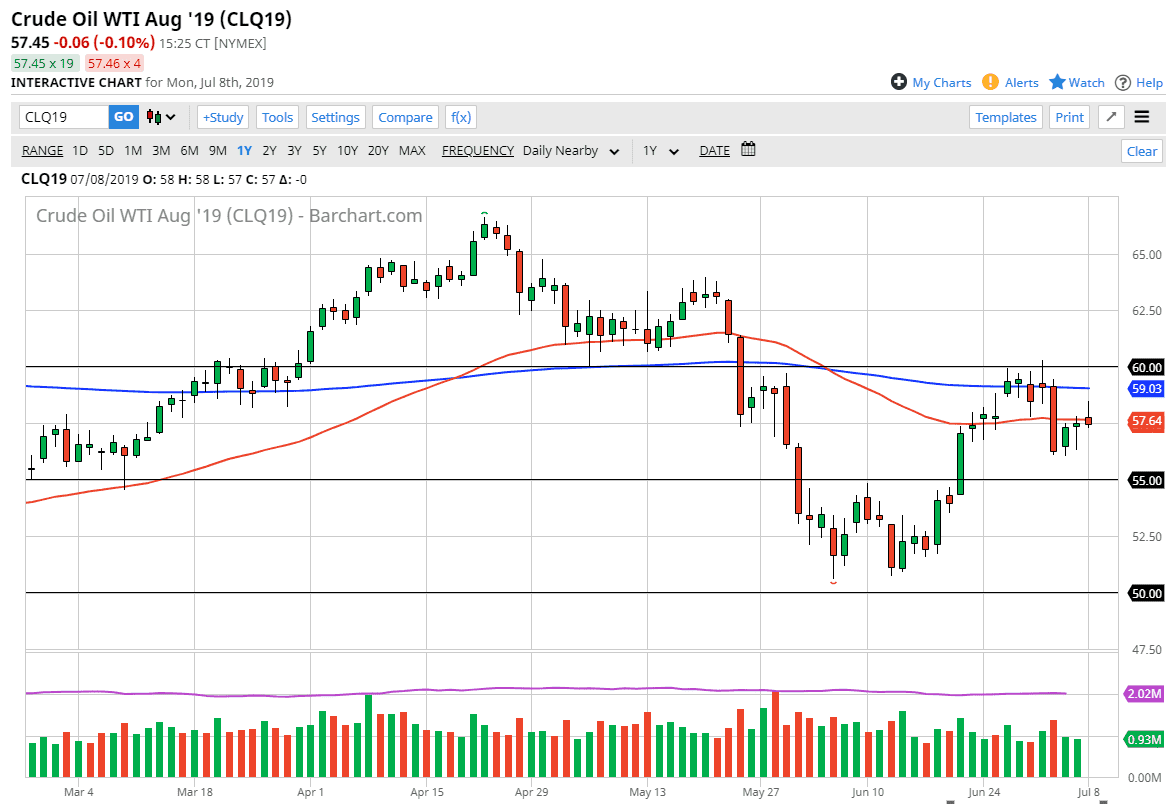

The WTI Crude Oil market rallied initially during the trading session on Monday but as you can see gave back quite a bit of the gains and ended up forming a bit of a shooting star. This was preceded by hammer so this tells me that the market is needless to say a bit confused. At this point, the market looks like it is probably going to remain rather tight, which makes quite a bit of sense considering that the situation for oil is so convoluted at the moment.

On one hand, you have the OPEC trying to cut production, and recently extending those cuts. However, global demand is light to say the least, especially considering that the economy seems to be slowing down. At this point, what makes things worse is that the Americans are pumping out almost 13 million barrels a day. No matter what OPEC does, they cannot reduce production out of places like North Dakota or even Canada. Oil is over supplied, and most of the rally that we had seen as of late had more to do with the geopolitical tension between the Iranians and the Americans. Now that that seems to be subsiding a bit, that has taken away a bit of the upward momentum. That being said, we have a very obvious range from which to work with.

The $55 level underneath offers a significant amount of support that extends to the $56 level. You should think of it as a “zone” in general, so therefore I think it will be difficult to break down below there. Ultimately though, the $60 level above is significant resistance, as it has the 200 day EMA floating just below at the $59 level. We have also seen the lot of resistance here previously, so it makes sense that we could continue to go back and forth in this five dollar range. I don’t have any interest in trying to play this market for anything involving significant length, as markets continue to show signs of confusion. Until we get a daily close outside of this five dollar range, I think you need to look at this as a scenario where we will probably continue to trade short-term charts on signs of exhaustion in both directions. There just isn’t enough conviction in one direction or another to place a lot of faith in any particular trade.