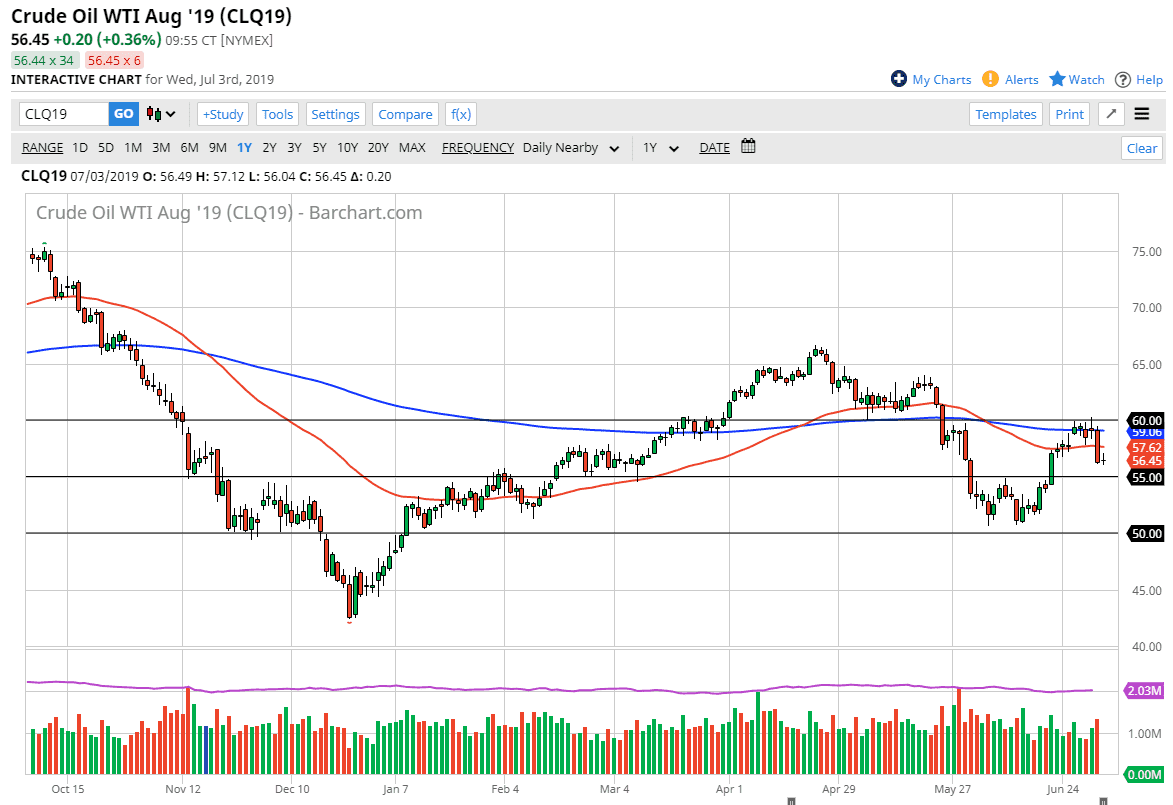

The WTI Crude Oil market had a relatively flat trading session during the day on Wednesday, initially trying to rally but then giving back the gains. This is a pretty negative sign as we had such a bearish move during Tuesday. On Tuesday, we lost roughly 5%, which of course is a significant statement. Not only did we fall, but we also broke down through the gap and the 50 day EMA. As we are below those couple of supportive levels, it makes sense that we will continue to go lower.

OPEC is powerless to do anything about a lack of demand. Even though they are fresh off of extending the production cuts with Russia, that does nothing to do with the United States or Canada, both of which you are throwing tons of oil into the marketplace. At this point it looks like short-term rally should be faded, and that the 50 day EMA should offer a lot of resistance.

Thursday is going to be thin as it is Independence Day in the United States so there will be limited electronic trading later in the day, so quite frankly you would be forgiven to simply step away from the market. However, the Tuesday candle stick was impulsive enough to suggest that perhaps we are in fact going to go lower. The $55 level underneath will be supported, but if we can break down below there we can go much lower, perhaps down to the $51 level. Ultimately, this is a market that will be reactive to the jobs figure on Friday, so we should be paying attention to that. If we get a relatively soft jobs number we could see this market drop as it could suggest there’s going to be even less demand.

Even above the 50 day EMA, we have the breakdown candle that sits right underneath the 200 day EMA at $59. Ultimately, it looks like there is a lot of resistance above, as the $60 level with simply far too much. The market has taken a significant turn in attitude, and the fact that the drawdown in inventory continues to be strong, I believe at this point it’s very likely that the market continues to have a lot of negativity built into it. That being said, if we get a strong jobs number it might be enough to turn things around, at least temporarily. Another thing to keep in the back of your mind is that the United States and Iran tensions could continue to move this market back and forth. If things calm down, it’s very likely that oil falls, and of course vice versa.