The WTI Crude Oil market did very little during the trading session on Thursday as you would expect, as it was the Independence Day holiday in the United States. Ultimately, this is a market that simply is waiting for the jobs number like many of the other markets out there. This recent action has been underwhelming to say the least, but as it is a holiday week followed by a jobs number announcement, volume has been a bit of an issue.

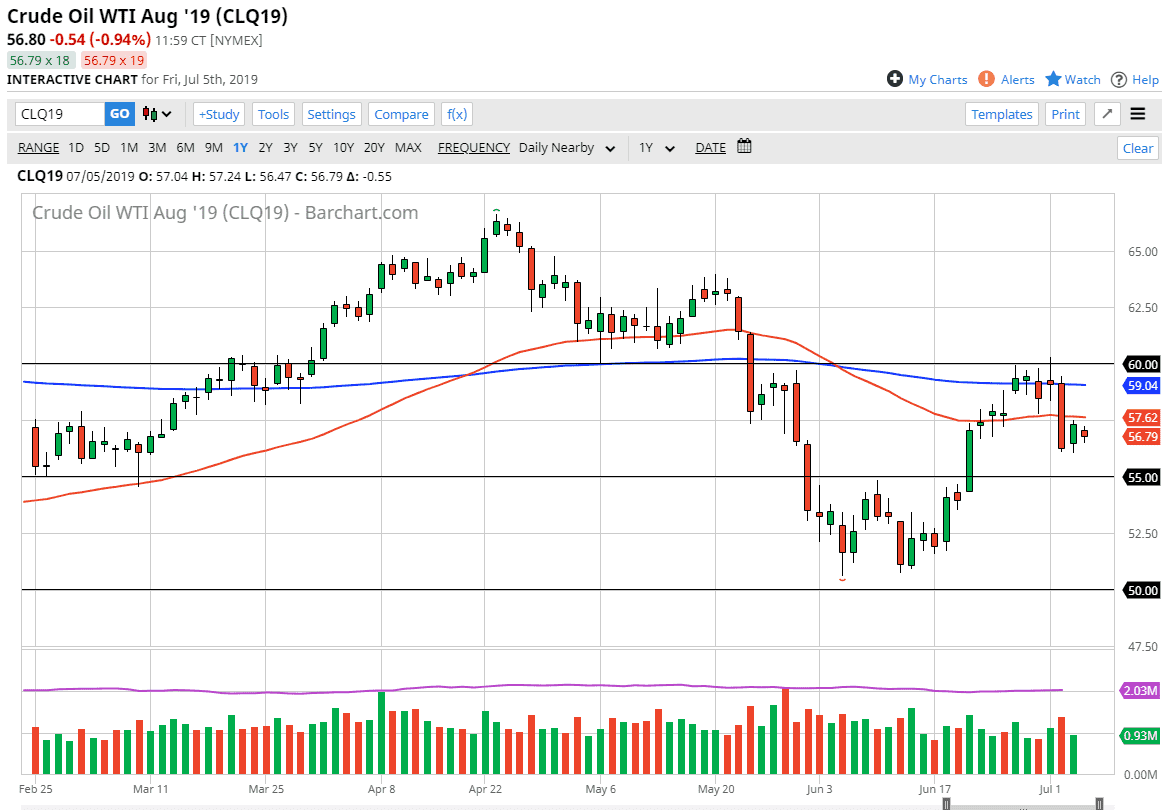

The one candlestick for the week that sticks out is the Tuesday candle stick, as we have seen a 5% loss during that session. Breaking through the 50 day EMA of course is a very negative sign, so therefore I do think the sellers will probably continue to flock towards this market on short-term signs of rallies. Keep in mind that the Tuesday session was the same day that OPEC announced that they were extending production cuts, so it’s a sign of just how soft this market is becoming.

The tensions between the United States and Iran also drove prices higher, but at this point it looks like the market is starting to recognize that war isn’t going to break out. If that’s going to be the case, then it’s very likely that we are going to see less of a major catalyst to go higher. At this point, if central banks around the world are going to continue to cut interest rates, that shows just how weak the economy can be thought of around the world, and if the economy globally is going to soften, it’s very likely that demand for crude oil will also become a problem. As long as that’s going to be the case I suspect that rallies will be sold, at the first signs of exhaustion.

Above the 50 day EMA we also have the 200 day EMA, which is even more important. The fact that we gave up most of the bullish pressure at the 200 day EMA suggests that we are going to continue to see downward pressure. Obviously, the jobs number will have its effect on the markets, and that should transfer into a major directional move in the US dollar. That in and of itself could be reason enough for oil to move as it is priced in that same currency. Ultimately, the market probably won’t move until we get those figures at 830 in the morning, New York time on Friday.