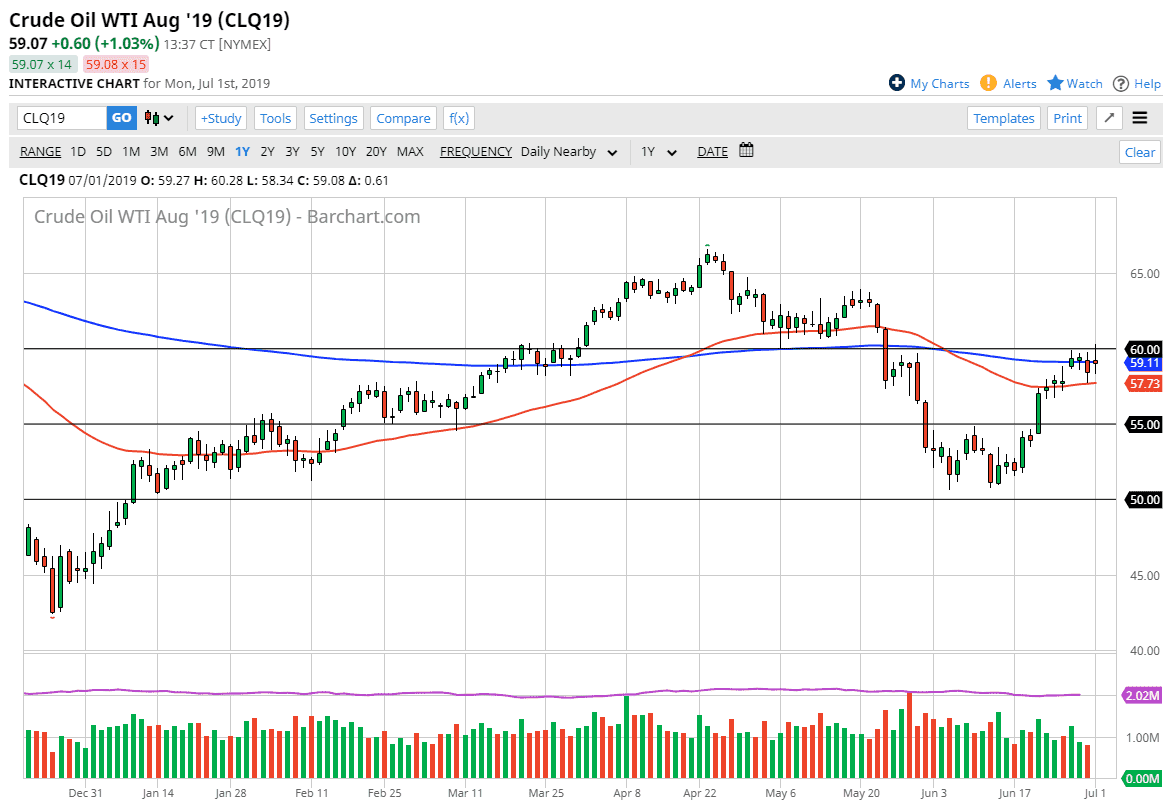

Oil markets were a bit tricky during the trading session on Monday as we came back to work. This would have been mainly due to the US/China trade talks progressing a bit, but the question is did it progress enough? Looking at the chart, I don’t know that the oil traders are completely convinced, as we had initially seen a very positive reaction to the idea of a loosening or at least a stagnation of trade sanctions and tariffs against the Chinese. However, we have since given that back and it looks as if we are going to form a shooting star for the end of the day. That is not a good look for the market, and it shows just how resistive we are above at the crucial $60 handle.

Looking at the chart, I think it’s obvious that if we can get a daily close above that $60 handle, the market could then go looking towards the $62.50 handle, the scene of the major breakdown that happened three months ago. Ultimately, that level will be the target if the buyers get their way, but we have to get some clarity for that to happen.

Looking at the chart, we have an obvious support and resistance area that continues to keep the market in check. That being said, I see a lot of support at the 50 day EMA just below, basically the $57.70 level. To the upside, the $60 level of course is resistive, so it’s not until we break out of this range that I think you have a clear shot as far as trading is concerned. Once we do get that move, then we can start to trade with a little bit more confidence but right now I think people are waiting on an official OPEC statement, as the Russians look likely to continue to cut production. However, the reality is that the United States alone is pumping out almost 13 million barrels a month, so OPEC is starting to lose some of its effectiveness. Marry that with the idea of a global slowdown and even though I think we are starting to get bullish pressure; I think this rally will probably be somewhat short-lived. In the meantime, we need to pay attention to the two areas that I have pointed out, as they will give us an idea as to where we are going to go next.