The Bitcoin market went back and forth in a rather quiet trading during the trading session on Monday, which is probably a good thing considering everything else that we had seen around the financial world. While the rest of the world went back and forth it’s likely that we continue to see buyers underneath as it has been so well supported recently.

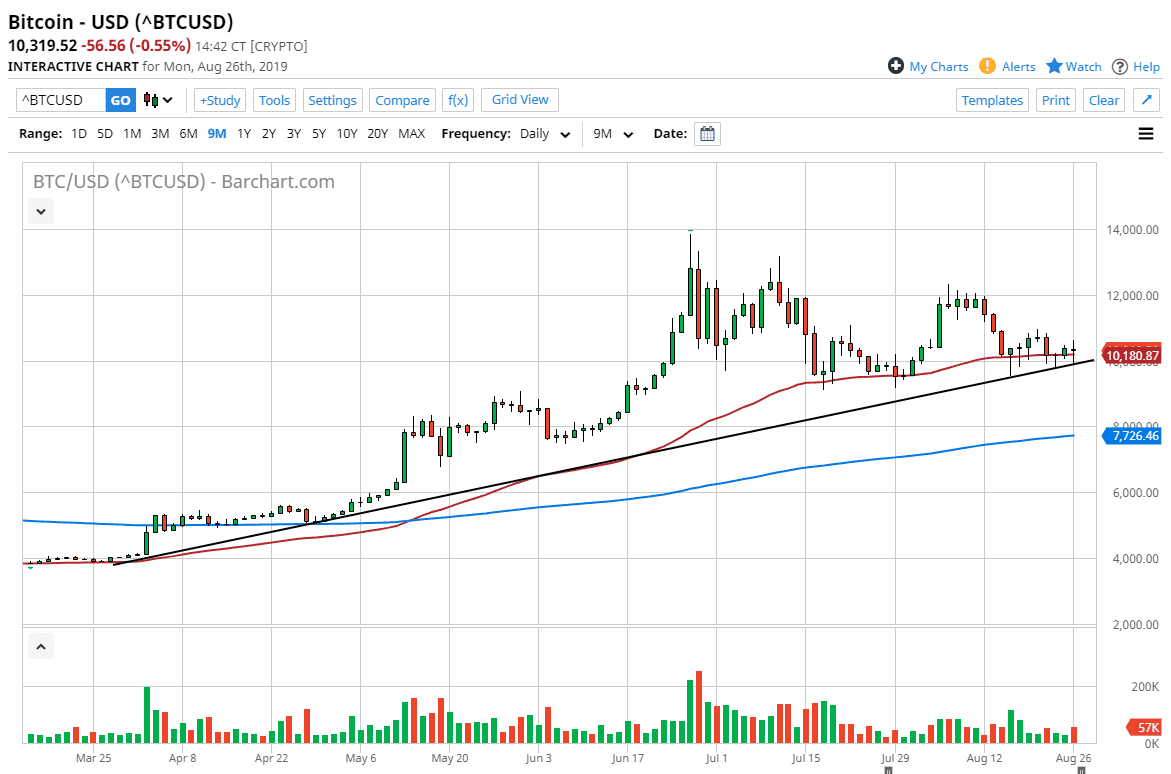

There are whole plethora of reasons why I believe Bitcoin continues to find buyers. Not the least of which will be the hammers that continue to form right around this area, which by the way of course is right at the psychologically and structurally important $10,000 level. That’s an area that will of course attract a lot of attention from the psychological aspect and as you can see during the month of July we had found a lot of buying in that area.

Beyond that we also have the nice trend line that has not been violated yet, which continues to offer buying opportunities as well. The 50 day EMA is in the same neighborhood as well, so there are a multitude of reasons to think that we continue to go higher. Ultimately, this is a market that I think continues to grind towards the $12,000 level but you may have to take a very patient attitude when it comes to trading Bitcoin. Remember, this market is a bit of a haven away from the fiat currency world, which is a bit crazy at the moment. The question now is whether or not we can attract more buyers?

All of that being said, if we did break down below the $9500 level, then we could break down towards the $8000 level which is where the 200 day EMA is found. Ultimately, I think that the level would essentially act as the “floor” in the market. If we were to break down below there then Bitcoin could find itself in relatively serious trouble. That being said though, the trend line seems beholden zone anyway, so I am much more comfortable buying Bitcoin at this point than anything else. I believe that the uptrend should continue, mainly because we see so much concern out there with so many other currencies, although the US dollar certainly isn’t one of them. In fact, if you have the ability to trade Bitcoin against something like the Euro or the British pound, you may find even more value over there.