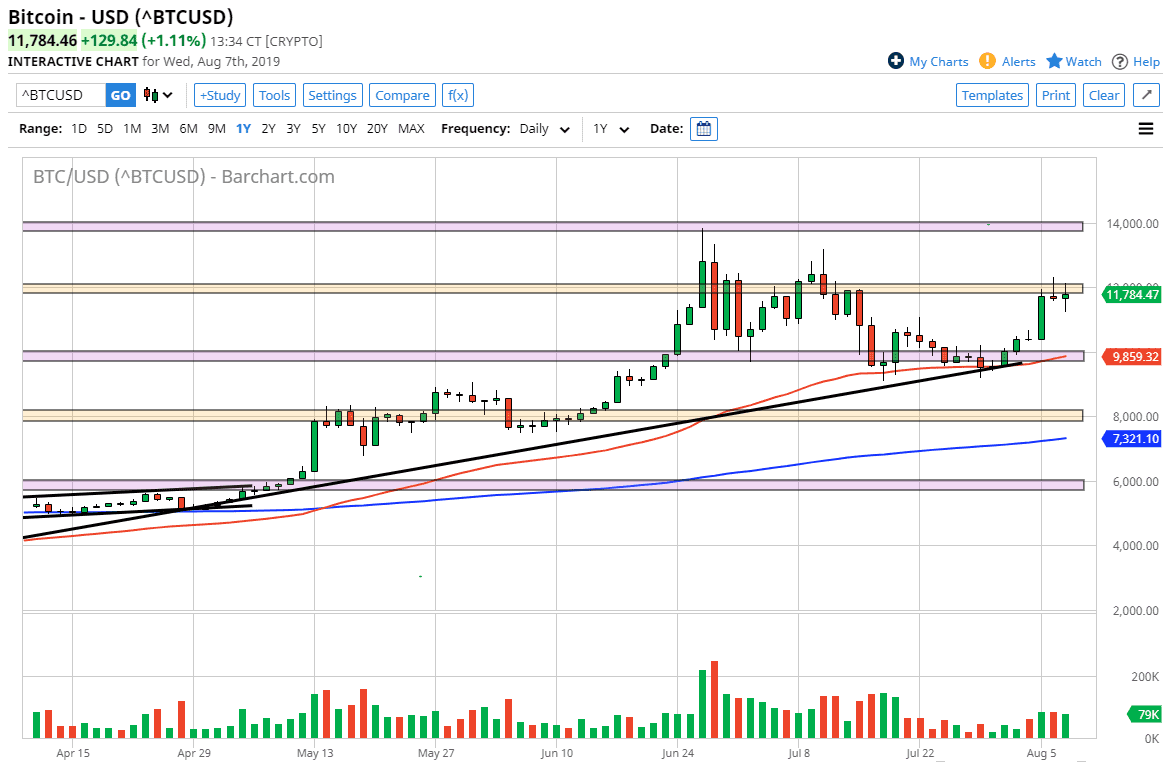

Bitcoin markets went back and forth during the trading session on Wednesday, as we continue to test a major level. The $12,000 level of course is an area that will attract a lot of attention considering that the market does tend to go back and forth every $2000 or so. I think that this market is extraordinarily bullish, so it makes sense that eventually the buyers will return. However, that doesn’t necessarily mean that we are going to go straight up in the air.

Central banks continue to cut interest rates, as the central banks from New Zealand, India, and Thailand all cut interest rates overnight. At this point, the market is acting a bit like gold, as the correlation between gold and Bitcoin is essentially a perfect one. In other words, the market moves right along with the gold market, which of course has been very bullish for quite some time. Ultimately, when central banks continue to cut rates it drives money out of various fiat currencies around the world which of course helps cryptocurrencies. Beyond that though, there is also the technical analysis when it comes to this chart.

Speaking of that technical analysis, there is a massive uptrend line underneath, and I think that should continue to be a major driver of where the market goes later. Beyond that, the 50 day EMA is sitting right around the uptrend line, where we should see a bit of a “floor” in the market. The $10,000 level of course is a large, round, psychologically significant figure. If we were to break down below there, it would obviously be a breakdown of support but I think at this point we are starting to build up enough momentum to try to go much higher, perhaps breaking above the shooting star from the previous session and reaching towards the $1300 level.

As long as central banks around the world are going to continue to cut interest rates, that will have money flooding the not only the crypto markets, but the Gold markets. At this point in time, it’s very likely that we continue to find plenty of reasons to go higher. At this point, the $14,000 level above is the target but we will probably see a lot of choppiness but obviously an upward proclivity overall. I believe we continue to buy Bitcoin, at least for a while.