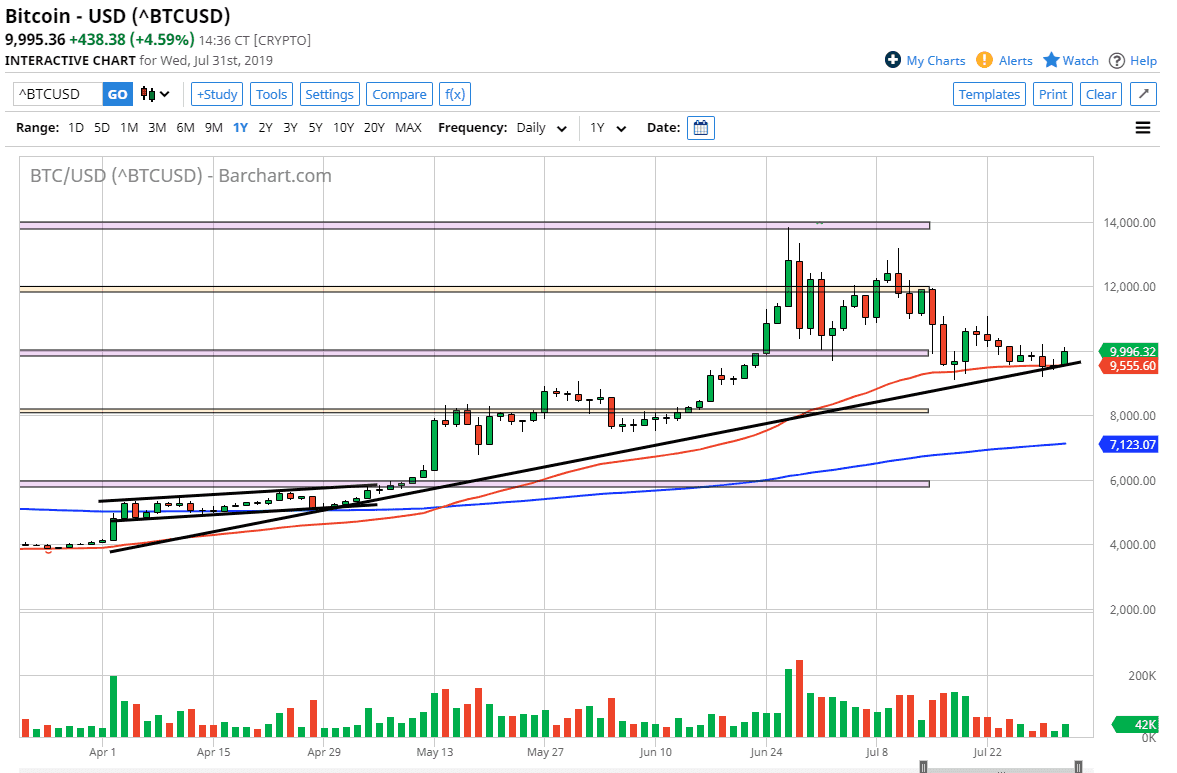

Bitcoin markets rallied during the trading session on Wednesday, showing signs of support at the uptrend line just below. Beyond that, we have also broken above the inverted hammer like candle stick for the trading session on Tuesday, which by itself is a very bullish sign.

By looking at this chart, you can see there is an uptrend line, the $10,000 level which we are trying to break above, and the 50 day EMA all of the same area. It looks as if we are going to continue to go to the upside, so therefore I do like Bitcoin I think we are forming that base that we needed to do so in order to continue the uptrend overall. Based upon what we have seen over the last couple of days, it looks as if we have finally started to calm down and build a bit of confidence in the uptrend it had been such a huge part of this market.

Beyond all of that, the Federal Reserve has cut interest rates and that should work against the value of the US dollar. However, they may not have been as dovish as people had hoped, so the US dollar hasn’t exactly broken apart against a bunch of other currencies. The one thing that Jerome Powell did talk about though is that there is concern about global slowdown issues, and therefore I think part of what traders are coming into this market to try to protect some wealth, especially in smaller countries that are struggling in general.

However, if we were to break down below the Monday candle stick, it’s likely that we could go reaching towards the $8000 level which is the next major support level. At this juncture, it’s obvious that every $2000 seems to attract a lot of attention, and therefore it’s very likely that this area will continue to be a place that people will pay quite a bit of attention to. Bitcoin of course has enjoyed a nice run to the upside and therefore it looks likely that this pullback has been necessary in order to build up the necessary momentum to go to the upside. After all, you can’t go straight up in the air, regardless of what you may have seen a couple of years ago. Remember, one thing that I do like about Bitcoin these days is that we are starting to show signs of stability. That is something that we desperately need in this market to make it more viable.