Bitcoin rallied significantly during the trading session on Monday to kick off the week, gaining over 10%. This was an explosive move to the upside and I believe that a lot of this money was probably coming out of China. The reason I say this is that the Chinese yuan broke the 7.0 level against the US dollar, an area that had been a major barrier. Now that we have broken through that area, it seems as if the floodgates have opened.

The main reason I believe money is leaving China is that we have so much uncertainty in Hong Kong right now. It is not lost on me that the Chinese yuan and the Bitcoin market moved in opposite directions during the same candlestick. As long as there is uncertainty in China, and of course a weakness move in the Chinese yuan, it makes sense that Bitcoin will get a bit of a bid.

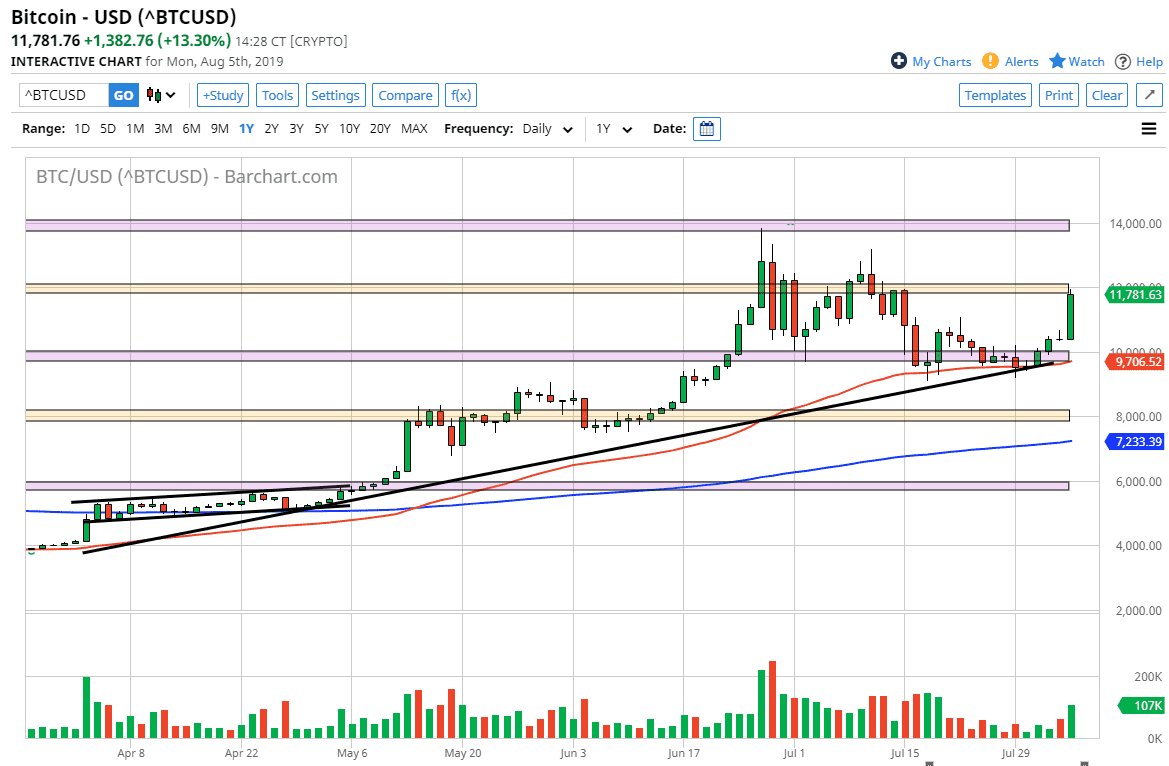

Looking at the chart, the $12,000 level should be significant resistance, as the market tends to move in $2000 increments. This is an area that should cause a lot of noise, but I do think that breaking above there should send this market towards the $13,000 level, and then eventually the $14,000 level. As the Hong Kong situation heats up, I believe that we will continue to see Bitcoin get a bit of a bid. Beyond that, we also have the US/China trade situation which is going to cause havoc with the Chinese yuan as we continue to see retaliatory acts being thrown at each other.

From a technical standpoint, I see the $10,000 level underneath as being crucial, as it is a large, round, psychologically significant figure. Beyond that we have the 50 day EMA and the uptrend line that I have marked on the chart. Another thing that works in the favor of the buyers is the fact that we broke through a shooting star from the Sunday session on Monday, which is generally a very bullish sign.

That being said, it’s very likely that we have a bit of a pullback in the short term coming, because this is such a major resistance barrier. By pulling back the way we could, that should attract plenty of value hunters. Right now, I have no interest in shorting this market, and I believe that there is an absolute ton of support down at the $10,000 region.