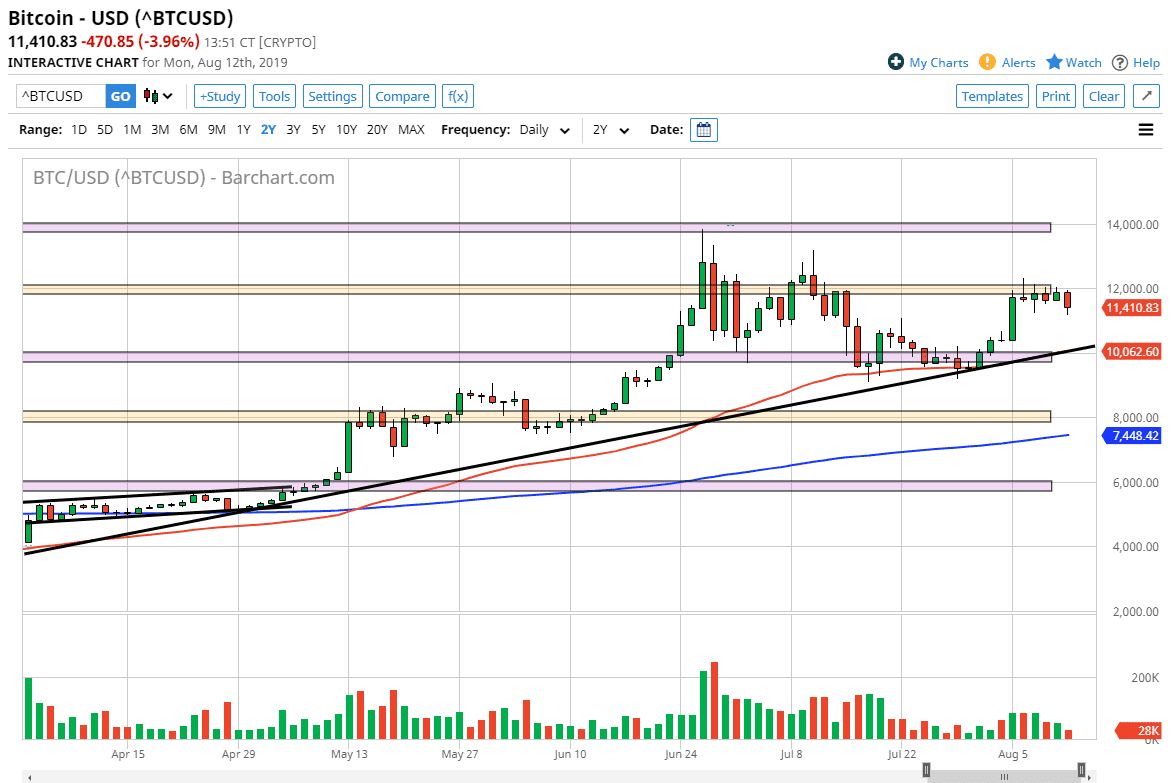

The Bitcoin market pulled back from the psychologically important $12,000 handle to kick off the week on Monday, showing just how important and how difficult the $12,000 level is going to be. We have seen quite a bit of action in this level, most of which has been bearish, so keep that in mind. However, we have not broken the uptrend, so at this point the question then remains whether or not it will continue, or are we getting ready to roll over?

At this point, you simply need to look at the trend line to see that we are still very much above it, even though we have seen quite a bit of selling pressure recently. Perhaps “selling pressure” isn’t quite the right term, rather more like “downward pressure.” What I mean by this is that we simply can’t break above the $12,000 level, but we should also notice that when we do pull back, there are buyers willing to pick this up again. I that is somewhat telling although it’s also obvious that the $12,000 level is a major battlefield.

Looking at the technical analysis, you can see that there is a nice uptrend line, and of course the 50 day EMA has been crawling right along with it. Beyond that, we also have the $10,000 level underneath that should offer psychological support. The $10,000 level will attract a lot of attention, so I think that the trend line, the 50 day EMA, and that level all combined at roughly the same point will continue to offer buying pressure.

The alternate scenario two pulling back to that level would be to finally break above the $12,000 level on a daily close. If we get that, then I think you should be looking at the $13,000 level, possibly the $14,000 level after that. Keep in mind that Bitcoin has been moving right along with gold, as traders are concerned about central banks around the world cutting interest rates, which of course works against the value of fiat currencies. The markets of course argues is a mechanism for a lot of people to protect wealth, so I think we will continue to see demand for crypto going forward. However, if we did break down below the $10,000 level I think that the next major support level is underneath at the 200 day EMA which is reaching towards the $8000 level.