Bitcoin markets fell again during the trading session on Tuesday as we have seen a little bit of comfort come into the stock markets and risk appetite in general. Ironically, Bitcoin was once considered to be a “risky asset”, but we have seen a lot of people use Bitcoin as a safety play, as fiat currencies around the world will continue to struggle as central banks have been cutting interest rates. I believe it’s only a matter of time before people start to run away from fiat currency again.

Beyond that, the Chinese have induced capital controls again, and that has had a large amount of Chinese citizens trying to get money out of the country. As the Chinese yuan has been devaluing, it makes sense that the citizens have been trying to sneak money out of the country. Ultimately, that is only one of the drivers though, and it looks as if we are going to continue to see a lot of money struggling to find a safe haven.

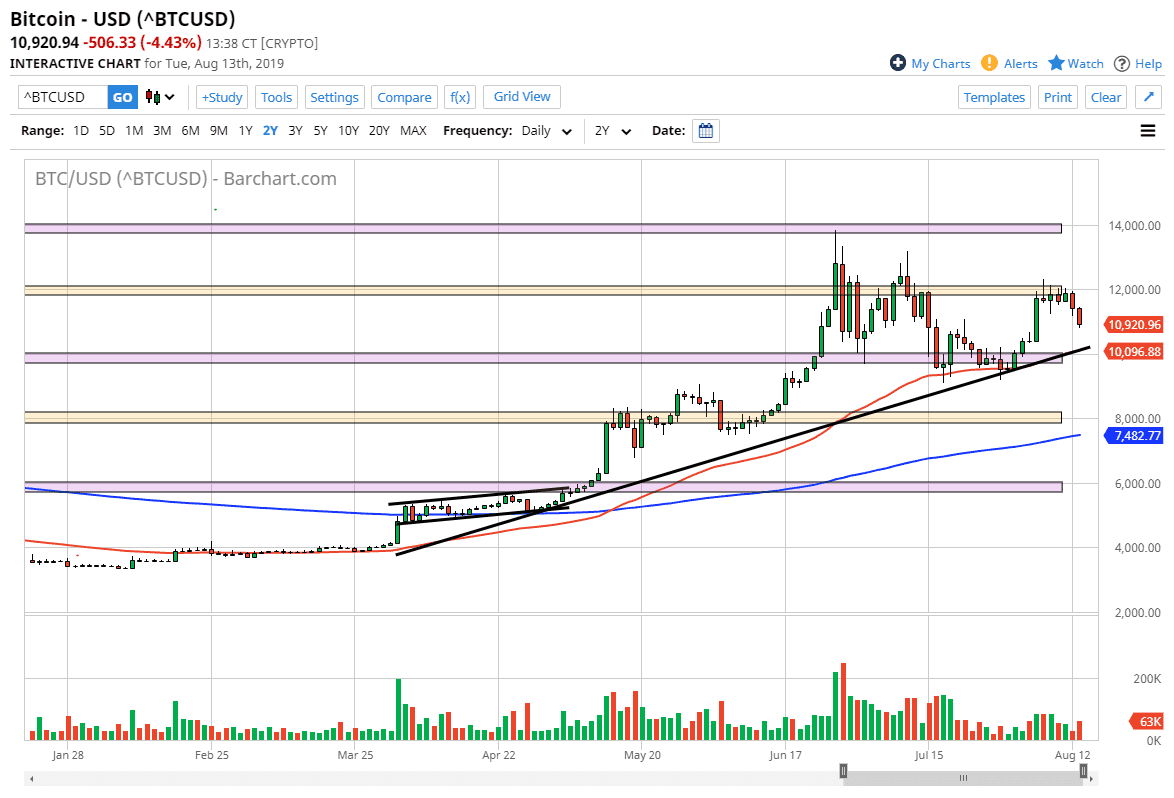

Looking at the technical analysis for this market, the $10,000 level course will offer support, not only because it is a large, round, psychologically significant figure, but it also coincides quite nicely with an uptrend line and the 50 day EMA. Both of those should attract a certain amount of attention. The Bitcoin market tends to move in $2000 increments, so it makes quite a bit of sense. Ultimately, I believe that there will be plenty of buyers down at that level, so unless we were to break down significantly below that area, I think that you should be looking for buying opportunities as the market continues to go to the upside as we continue to reach towards the $12,000 level, then the $13,000 level, followed by $14,000 which I see as a “ceiling” in the market. I think at this point short-term pullbacks are buying opportunities and that’s exactly what we are looking at right now. All things being equal, we are in and uptrend and even though we have pulled back nicely, it doesn’t mean that we are breaking down. It just simply means that value has reentered the Bitcoin market, offering an opportunity for those who have missed the ride higher. I remain bullish of Bitcoin, but I recognize that a bit of patience may be needed to take advantage of what we have seen.